North America Could See Natural Gas Prices Following Global Trends – The Dreadful Taste of Struggling Developing Countries

On the back desk in my office is a small pile of color-coded maps that I don’t talk about much because they make me look like a madman. They are maps of Pennsylvania, capturing a semi-pathological and stubborn fascination with U.S. shale gas production.

A pile showing all of Pennsylvania’s counties; Counties are color-coded according to the number of productive or cumulative gas wells created since the start of the Appalachian shale revolution. The second, deeper level shows towns within counties, similarly coded.

Before this obsession, all I knew about Pennsylvania was that it was home to the Steelers and Penguins and Fallingwater and Trent Reznor, and that the place couldn’t be pastoral if Nine Inch Nails were a product.

These days, I know enough PA puzzles to annoy any average person very much. I know that the Town of Springville in Susquehanna County is 31 square miles and has produced 1.3 trillion cubic feet of natural gas. I also know that Colley Township in Sullivan County is 5 miles ESE from Springville, 59 square miles, and produces one-third of that natural gas.

I also know that Rush Township in Susquehanna County is about 3 miles NE from Springviille, is 39 square miles wide, and produces 30% of the gas Springville has, even though it’s only a mile away.

I know that 15 miles north of Springville Township in Silver Lake Township, Susquehanna County, has virtually no natural gas production, and literal zero has been produced 15 miles south in Town Davidson, Sullivan County.

Three of Pennsylvania’s 67 counties account for 83 of the top 100 wells.

The point of all these statistics isn’t just to bother, though. The problem is that the Appalachian natural gas field is huge, but it has amazing sweet spots, and those sweet spots aren’t huge.

Consider that Susquehanna County is the owner of Appalachian production, which has produced 13 TCF of gas. More than half of that gas comes from seven towns in the County’s Northwest region. These seven towns cover an area of 240 square miles – about 24 miles by 10 miles.

Still awake? Hopefully so, because here’s the fun part: modern horizontal shale wells are typically three miles long horizontally. How long does it take to chew through 240 square miles with 3 wells 3 miles side by side? Not for long, and these prolific regions have seen drilling activity for a decade. On top of that, at current production rates, Appalachia produces 13 TCFs per year. In other words, the entire historical output of that potential sweet spot needs to be replaced every year. And there are very few sweet spots.

Technically savvy people will correctly point out that the Marcellus Formation still has plenty of gas outside of these sweet spots, and that’s true, and it’s also true when the marginal regions become economically subs. 7 dollars + gas.

But hardly. Furthermore, the Appalachian field produces about 36 bcf/d. It takes a few big wells to keep production running, and a large number of bad ones.

The sweet spots are slowly drying up and a significant amount of drilling is happening now in some pretty remote areas (even South Buffalo Town in Armstrong County – can you imagine? What the hell happened to these people?) The initial production rates for these marginal regions were a fraction of the prolific regions – and that is with modern, far-reaching wells. , each reservoir is growing for miles.

The big players’ IR presentations talk about thousands of locations, but when they got brave enough to show a map of said locations, the picture was one of wells per square foot of owned land. their. It looks silly. They’re not necessarily wrong, but are missing an important metric: Some sites will be drilled for $3 gas, some at $5, and some will have to wait for $10+ gas. And they won’t add much to the total output.

It is the total output that is very important. Consider that the lower 48 states of the US produce about 95 bcf/day. Three fields – Appalachian, Permian and Haynesville – account for 70 of those bcf, or 74% of the lower 48 (in case you were wondering about the other two, Alaska produces substantial natural gas but is refills most of it; Hawaii’s gas production includes belts of volcanoes that would take some particles to get into the pipeline).

Extended horizontal wells often have significant decline rates, often exceeding 50% within the first year. But suppose that the overall shale gas depletion rate is 20%. That means these three sectors must produce 14 bcf/d new each year.

That’s equivalent to nearly all of Canada’s production, which needs to be replenished every year. Or, to put it another way, a new school the size of Haynesville needs to be added each year.

Until a year ago, North American producers reacted to the price cycle as they should – prices rose, cash flow increased and producers drilled more until the market found equilibrium again. . Rich shale plays are easy, in fact so easy that the market is flooded for a long time.

This has been an unusually long period of overproduction, for a number of reasons: improved productivity, longer life, abundant capital, cheap debt, and a management incentive structure built on growth. production chief.

But recently most of those pillars have been wiped out. Yield is not as high as it used to be and may decline as the sweet spots are exhausted. Debt and equity markets aren’t helpful, and the investment community is in the exact opposite position of capital injection – they want capital out of producers. They want shareholder return – more dividends, share buybacks, debt pay off.

There is also a huge dark cloud that dominates the industry – the unrelenting hostility of policymakers and hydrocarbon opponents shows a moral imperative in damaging the supply base. . Their efforts are paying off. There is a huge sense of exhaustion in the industry; things are harder than before, there are not enough workers and public hostility to bear. That hatred is being instilled into the children, the elderly, and all those who are there paying more attention to the news flow than to the reality of energy.

The US and Canadian shale plays have done a miracle in North America – we enjoy the benefits of natural gas at a fraction of what the rest of the world does. must return. Until recently, North America remained an isolated natural gas market. Massive production growth over the past decade has gone nowhere, and has blasted the continent and kept prices down.

That appears to be changing with the advent of massive US LNG export capabilities and growing exports to Mexico. These developments have allowed any surplus to escape from the continent. But the North American gas market is still seeing prices well below the world average, with expectations unceasingly set that the massive rig count will return as soon as prices rise sufficiently. .

That doesn’t happen. U.S. gas prices have reached levels not seen since 2008, and for a variety of reasons, as outlined above, production has not been increasing at the right time. The market kept adding fuel to the fire and nothing.

Things went ominously the other day, or at least speculate on it. A report from a respected US investment firm surmises that natural gas production has never been so concentrated in such a number of sectors, and the rate of production growth in these sectors is imminent. significantly slowed down. They point to similar peaks and plateaus in the Barnett and Fayetteville Texas shale systems.

Regardless of whether the mighty Appalachian field is geologically peaking or not, we know that it is physically peaking, due to the inability to build more pipelines to bring gas out of the area. The last major project on the books, the Mountain Valley Pipeline, is almost completed, but activists have been trying to halt completion for several years. Cost estimates have doubled, and there is serious doubt that the project will ever be completed.

Activists even killed an LNG liquefaction project and shipped it by truck from Pennsylvania to New England. While all of these export projects slow or die, the pace continues and the sweet spots are drilled deeper and deeper.

So there’s a very real possibility that US gas prices could be linked to global prices, and you don’t even want to think about what that might mean. US and Canadian gas prices are currently in the range of $7-8 USD/mmbtu. Global gas prices are four times higher, with the LNG bidding war raging on a global scale.

If you think that things are hard right now, it would be unthinkable if gas prices in North America were even half of the global level. At $15/mmbtu or GJ, businesses start to close. Heating costs become crippling. These fuel costs are not “optional” in the sense that if the price of gas went up too high, we wouldn’t make a 6-hour trip.

Review comments in the BOE Report the other day from the head of the trade group the Western Appliance Dealers Association, said that “last winter’s heating bills were unsustainable”. Oops, who will tell him. Last winter, Henry Hub prices averaged $4.56 US/mmbtu. The futures price for next winter is $7.83. The cost squeeze will be unbearable for many businesses.

With natural gas, whether for industrial or residential purposes, shrinking back has serious consequences, either for industrial output or the temperature of your home.

Global fuel shortages are not always evident in the lines at gas stations. They can appear more quietly and dangerously in the form of shuttered businesses, unsustainable utility bills, and skyrocketing inflation for anything that depends on natural gas as a source of energy. input materials. The potential problems are severe in North America, and simply unthinkable in the developing world.

The fossil fuel divestment campaign is yielding appalling results. There will be nowhere to hide.

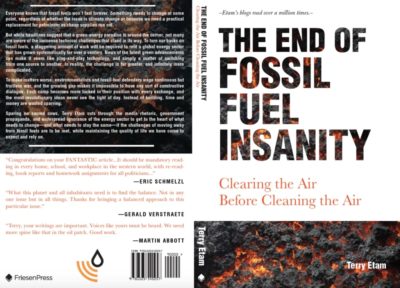

Come on Ukrainians! Find out how the world fell into such a disastrous energy state, and how to get out – catch the “Fossil Fuel Madness” at Amazon.ca, Indigo.caor Amazon.com. Thanks for the support.

Read more insightful analysis from Terry Etam this, or email Terry this. PS: Dear email reporters, the email process is welcome, but I’m having tracking issues. Apologies if comments/questions go unanswered; they are not ignored.