SoftBank’s Arm registers for a blockbuster IPO in the US

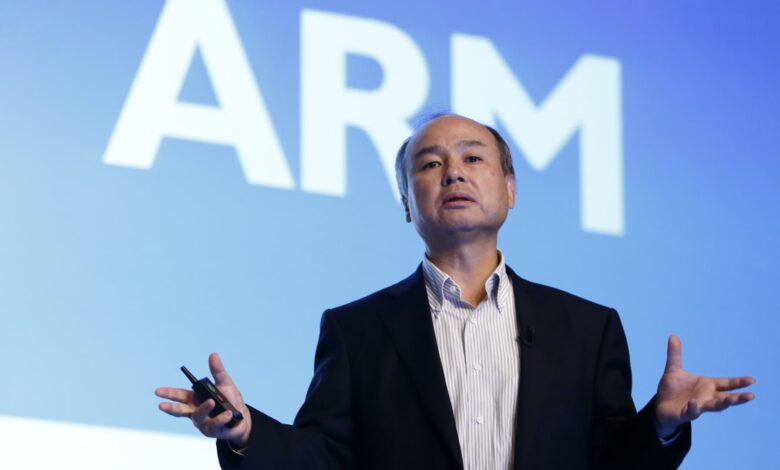

Billionaire Masayoshi Son, chairman and chief executive officer of SoftBank Group Corp., speaks in front of a screen displaying the ARM Holdings logo during a news conference in Tokyo on July 28, 2016.

Tomohiro Ohsumi | Bloomberg | beautiful pictures

SoftBank Corporation Chipmaker Arm has secretly filed with regulators for a listing on the U.S. stock market, Arm said on Saturday, setting the stage for a major initial public offering. most this year.

The IPO registration shows SoftBank is pushing for a blockbuster offering despite adverse market conditions, after saying in March that it plans to list Arm on the US stock exchange.

According to Dealogic, US IPOs, which do not include special-purpose acquisitions listings, have fallen about 22% to a total of just $2.35 billion so far. , as stock market volatility and economic uncertainty snuffed out many IPO hopes.

Arm plans to sell its stake on Nasdaq later this year, seeking to raise between $8 billion and $10 billion, people familiar with the matter said. In a statement confirming earlier Reuters reports about the IPO plans, Arm said the size and price range for the offering has yet to be determined.

The sources cautioned that the exact timing and size of the IPO depends on market conditions and requirements are not determined as it is a matter of confidentiality.

SoftBank and Arm declined to comment.

There are signs that the IPO market is starting to thaw. Johnson & Johnson is preparing to list its consumer healthcare business Kenvue in New York next week, hoping to raise about $3.5 billion.

SoftBank has been targeting listings for Arm since the deal to sell the chip designer to Nvidia for $40 billion collapsed last year because of opposition from US and European antitrust regulators.

Since then, Arm’s business has outperformed the chip industry as a whole thanks to its focus on data center servers and personal computers that generate higher royalty payments. . The company said sales jumped 28% in the most recent quarter.

Arm’s IPO is expected to boost the fortunes of SoftBank, which is struggling to turn around its massive Vision Fund, which has suffered losses due to the valuation of many of its holdings in startups. technology industry declines.

Earlier this year, Arm rejected the UK government’s bid to list shares in London and said it would pursue listing on a US exchange.

Arm’s IPO preparations are being led by Goldman book, JPMorgan Chase & Co, Barclays And Mizuho Financial Corporation.