Plug-in hybrid cars are almost out of the way

Everyone loves having options to choose from, or at least they think they do. That’s part of the reason some automakers bet a lot above Dip into the mixture tramor PHEV, giving consumers a way to sample the EV experience without having to jump in completely.

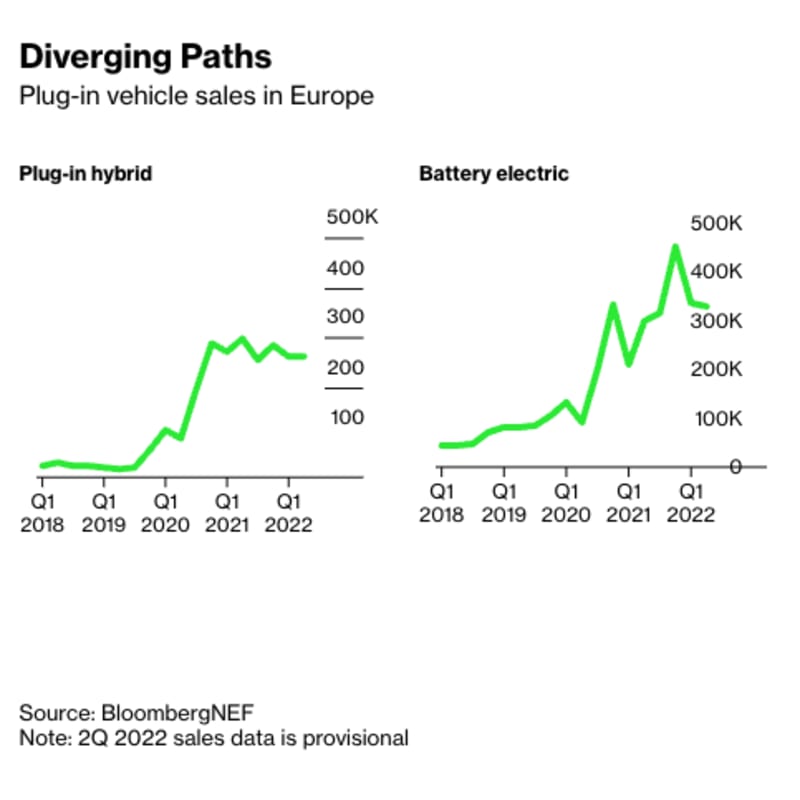

PHEV is often described as a transitional technology – a bridge to an all-electric future. However, sales of these models are faltering in Europe, which has been their most important market by far. Latest data shows two very different trajectories between the plug-in

crossbred and battery electric vehicles, or BEVs.

Country-level data paint an even clearer picture. PHEV sales in France fell 28% in June. In Germany – another old stronghold of technology – registrations are down 16%. In the UK, plug-in hybrids have become a classic with the most recent BEV in 2019. Now, two battery-powered cars are sold for every one PHEV.

Some of this is to be expected. In 2020 and 2021, automakers must meet the more stringent CO2 targets Because new vehicleand plug-in hybrids receive favorable treatment under the regulations. Many automakers don’t have their new BEV architecture ready yet. When faced with two choices – market an all-electric vehicle based on a modified internal combustion platform, or PHEV – many people choose the latter.

Europe’s vehicle CO2 regulations won’t tighten again until 2025. As more and more car manufacturers prepare fully electric platforms for the launch of vehicles model, BEV looks ready to continue moving up the sales rankings. Consumers are clearly ready, with a long wait next year For most electric models completely popular in Europe.

Many PHEV owners are satisfied with their vehicle. But from a policy perspective, there is a The elephant is in the room: motorists don’t usually charge these cars very often. One recent research of the International Council on Clean Transport’s 9,000 vehicles found that real-world fuel consumption from PHEVs is 2.5 to 5 times higher than what is estimated by key testing procedures. awake in the laboratory.

That gap between theory and practice is part of the reason national governments are cutting purchasing subsidies for PHEVs faster than for fully electric models. For example, the UK eliminated the plug-in hybrid car purchase subsidy in 2018, while Germany announced just this week that the PHEV subsidy will Last year.

An important difference here is that the percentage of electric kilometers running on the PHEV is highly dependent on who owns it. Among privately owned vehicles, ICCT research shows real-world electric driving rates are 45% to 49%. Not bad, though still falling short of what the official test cycles assume. For company cars, that number drops to 11% to 15%. Company car is a large part of the market in Europe, accounting for more than half of new car sales in many countries.

Upcoming policy changes could further erode the PHEV case. The European Commission is expected to introduce “utility elements“For PHEVs from 2027. These are values intended to reflect how often vehicles are driven in electric mode and, importantly, CO2 emissions the value to which they are specified.

The goal of the regulation is to use the real-world driving behavior of both private and company-owned vehicles to establish values, using in-vehicle displays. Unless there are significant changes in the next few years, this will make PHEVs a less attractive way for automakers to meet emissions regulations. Manufacturers will see this change coming and start allocating investments accordingly.

Relatively strong sales of plug-in hybrids in China currently keeping the global numbers afloat. Sales of PHEVs there more than doubled last year, led by offerings from BYD and Li Auto, though that still hasn’t been enough to keep up with BEV demand growth. China has more high-rise apartment dwellers with limited home charging options, but the government is taking action big boost to build public charging options and help keep the BEV market expanding rapidly. The municipal government in Shanghai is also set to phase out favorable treatment for PHEVs starting in 2023, and others may follow.

If the plug-in hybrid is a bridge, it starts off like a short.