New Zealand-based customer due diligence platform First AML gets $21M Series B – TechCrunch

Extra of the world’s economic system is shifting on-line, and that’s underscored by the lengthy record of current fundings and acquisitions within the digital ID authentication and anti-money laundering (AML) house, together with Okta’s $6.5 billion acquisition of Auth0. At present, one other startup introduced it has raised capital: end-to-end due diligence platform First AML.

Blackbird Ventures (which can also be one in all First AML’s customers) and Headline led a $21 million (about $29.2 million NZD) Collection B within the New Zealand-based firm, with participation from returning buyers Bedrock Capital, Icehouse Ventures and Pushpay founder Eliot Crowther. This brings First AML’s whole raised to about $30.1 million USD (about $42 million USD).

Based in 2017, First AML entered Australia this 12 months and can use a part of its Collection B to develop into worldwide markets, beginning with the UK. It’s also taking a look at Singapore and the USA. The corporate additionally plans to double its worker rely from 90 to 180.

One of many most important methods First AML is totally different from different digital ID authentication startups (like Jumio, Onfido or ForgeRock, to call just a few) is that as a substitute of particular person finish customers, it focuses on advanced entities and transactions, which can imply performing due diligence on a number of organizations and folks at a time. Not like many different authentication and KYC (know your buyer) startups, its most important shoppers aren’t banks. Its shoppers embrace different varieties of monetary service suppliers, accountants, legislation companies and actual property businesses.

“We haven’t targeted on working with banks as a result of there are quite a lot of medium-sized enterprises within the economic system that additionally have to adjust to AML guidelines,” co-founder and chief govt officer Milan Cooper instructed TechCrunch. “Many individuals give attention to banks as a result of these are the large guys, however the smaller legislation companies and funding companies, they should comply as nicely. What we’ve discovered is that they don’t have the sources to spend money on inner groups to arrange a extremely refined compliance course of.”

First AML’s founding staff, which additionally consists of Bion Behdin and Chris Caigou, needed to launch the startup as a result of two of them (Cooper and Caigou) had been former company bankers and “noticed the ache of AML onboarding firsthand context and the way it could decelerate transactions,” Cooper mentioned.

For instance, compliance groups wanted to contact a number of stakeholders for documentation, and infrequently needed to observe up as a result of the incorrect paperwork was despatched. “The KYC course of is so cumbersome and it was not a great buyer expertise attempting to onboard, so we noticed a possibility to streamline it and take away friction.”

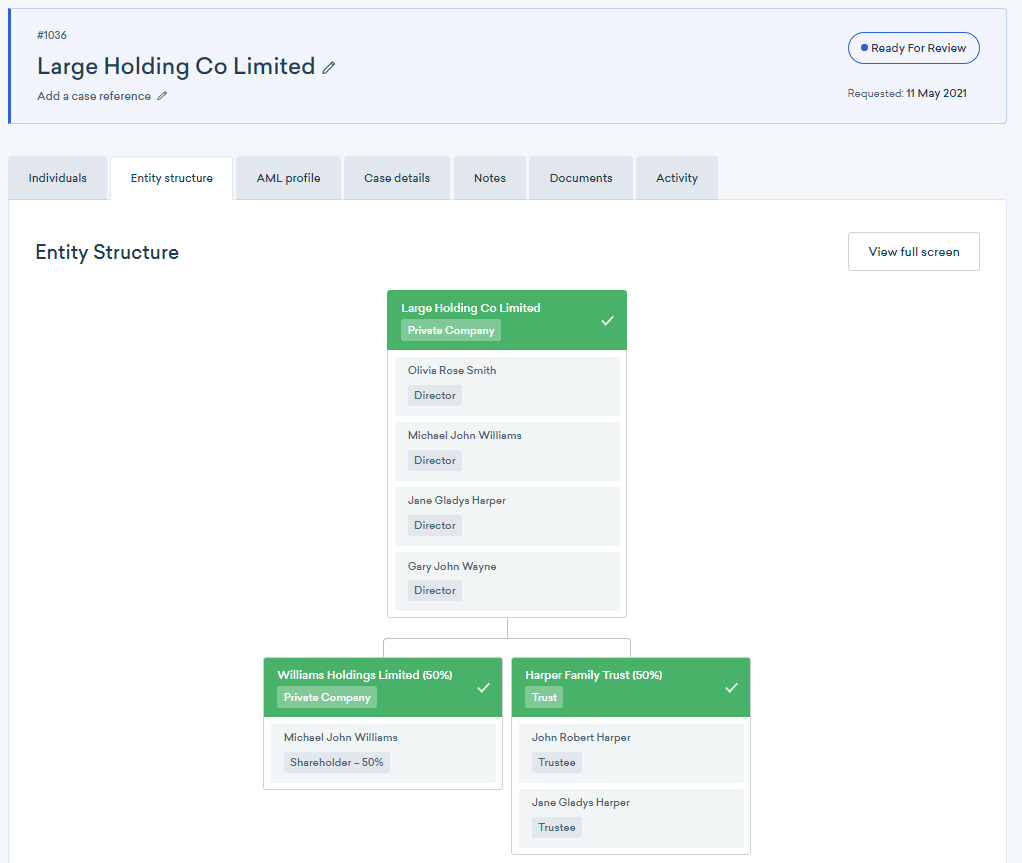

The corporate’s proprietary platform seeks to automate as a lot of the compliance course of as doable, corresponding to ID verification (together with biometric identification for distant verifications) and visible instruments that assist shoppers perceive firm possession constructions.

An instance of First AML’s consumer interface

“We tackle the total KYC course of finish to finish, and importantly, we do it for advanced buyer entities like corporations and trusts. That is the place lots of our opponents don’t supply a full end-to-end answer,” mentioned Cooper. “They may supply an answer for identification verification of a single particular person, whereas we’re taking that complete course of off their palms, which incorporates digging by the layers of a posh entity to grasp who the helpful homeowners are and coordinating the info assortment course of from a number of helpful homeowners.”

For instance, legislation companies that have to adjust to AML laws use First AML to conduct KYC on potential shoppers, which can embrace corporations with a number of shareholders, administrators and subsidiaries, that every one have to be checked. In the meantime, funding companies flip to the platform to onboard new buyers, together with belief constructions and different varieties of advanced entities.

Lots of First AML’s shoppers beforehand relied on guide e mail and paper-based processes that always required folks to ship notarized copies of paperwork like passports or utility payments. First AML’s platform begins by analyzing an entity’s construction. Then it pulls knowledge from public sources and obtains info from private sources.

“Primarily we determine what’s happening in these advanced entity constructions, that are very prevalent in monetary and different sectors, after which the platform facilitates knowledge assortment from a number of stakeholders inside that advanced entity, together with biometric ID verification, and uploaded paperwork,” Cooper defined.

First AML can also be constructing database, which presently has greater than 350,000 verified entities. If an entity onboards by its platform and is concerned in different compliance procedures, First AML can get their consent to retrieve their earlier verifications. This implies they don’t have to undergo the total AML course of each time they do a transaction. “It’s a key differentiator for us and a key aggressive benefit that may actually pace up the best way KYC occurs sooner or later,” Cooper mentioned.

Cooper mentioned the current publication of the Pandora Papers, an investigative report that exposed the hidden offshore accounts of 35 former and present world leaders, has elevated issues about AML compliance.

“Our take is that there’s nonetheless quite a lot of shady transactions happening within the world economic system and the Pandora Papers have revealed that there’s some huge cash going round and tax evasion occurring. For us, it is a sign to governments that AML legal guidelines are wanted in lots of international locations,” he mentioned. “Australia remains to be behind a few of the remainder of the world when it comes to introducing AML guidelines into new sectors like authorized accounting and actual property. The U.S. is one other instance the place it’s the monetary sector that’s captured, however non-financial sectors aren’t. It places extra stress on lawmakers to clamp down on these unlawful actions.”

In a press release in regards to the funding, Blackbird Ventures companion Samantha Wong mentioned, “We closely depend on First AML. That is what’s particular about this deal—how intimately linked we’re to the client ache level, our love for the product roadmap and the community results that emerge as their enterprise mannequin goes world.”