New Shipping ESG Rules Could Starve Millions – Raised by That?

AUGUST 4, 2022

By Paul Homewood

A transport expert gives his views on the latest climate regulations for international shipping:

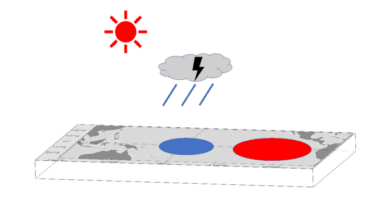

A new report shows that more than 75% of ships will fail to meet International Maritime Organization standards (IMO) new Environmental, Social and Corporate Governance (ESG) index that aims to decarbonize the industry. This means many ship owners will be forced to slow down their ships to reduce emissions but doing so could cause global dish and energy crisis by reducing existing vessel capacity.

A global security analyst told gCaptain: “The IMO decarbonization targets will slow ships, delay food shipments and people will starve. “How many people will die as a result of IMO’s ESG efforts is unknown at this time. I don’t think most ship owners even understand the severity of the EEXI threat but it could be millions of lives.”

IMO EEXI ESG INDEX

“Prior to any efficiency amendment, more than 75% of the fleet – including cargo ships, tankers and container ships – will not be compliant with the Existing Energy Efficiency Index (EEXI) will go into effect next year,” commodity analyst Joey Daly said in VesselsValue report.

The challenge of decarbonization will extend to all shipping sectors, and EEXI alone will present a multitude of challenges for owners, operators and financiers. Simon Hodgkinson, head of loss prevention at West P&I, has suggestions that the new rule could be one of the most important new shipping regulations in years. He believes it has the potential to change the entire industry.

The The International Maritime Organization’s Current Energy Efficiency Index is a voluntary, incentive-based system that incentivizes ships to improve energy efficiency. The index uses the ship’s speed, cargo capacity and other factors to calculate the score. The higher the score, the more energy efficient the train is. More specifically EEXI (Energy Efficient Ships Index) is a measure of a ship’s CO2 emissions per shipping job. It is similar to the Energy Efficiency Design Index (EEDI), which has been in effect since 2013, but applies to existing ships rather than new ships.

The index is designed to motivate shipowners and operators to invest in energy efficiency measures to reduce fuel consumption and greenhouse gas emissions.

Train must reach EEXI approval once in a lifetime, no later than the first periodic survey in 2023.

Slow steaming

Shipowners can achieve their goals by building new environmentally friendly ships, investing in new decarbonization technologies, and upgrading existing ships to burn cleaner fuels such as LNG, or by slow steaming.

Slow steaming is a technique used by shippers to reduce fuel consumption and emissions by slowing ships. This process involves sailing at a slower speed, usually around 50% of the ship’s maximum speed. This can be done by reducing the revolutions per minute (RPM) of the propellers.

While older ships can be retrofitted with equipment to reduce emissions and meet EEXI requirements, analysts say the fix most shipowners will take is just to go. slower, with a 10% reduction in cruising speed, a nearly 30% reduction in fuel usage, according to Danish maritime sector lender Ship Finance.

“They were basically asked to improve the ship or slow it down,” Jan Dieleman sayspresident of Cargill Ocean Transportation, the freight division of the cargo trader Cargill, which charters more than 600 vessels to transport mainly food and energy products around the world.

This strategy also reduces the amount of wear and tear on the ship, which can help prolong the life of the vessel. But there is a side effect: potentially significantly reducing fleet capacity.

Full story here.

As I understand it, the new regulations are voluntary, so will likely be ignored by many countries. However, shipping lines that ignore diktat can be punished by banks and insurance companies for operating under strict ESG rules:

“As IMO prepares to rate the energy performance of ships on the EEXI scale from A to E, shipping companies will be under increasing pressure to meet these targets not only from regulatory agencies reason but also also from banks.

In 2019, a group of banks pledged to cut carbon emissions when lending to transport companies. This group of banks established the Poseidon Principles, a global framework that aligns with IMO policies on an environmental basis. As of today, 28 banks have signed on The Poseidon Principle.

The The Poseidon Principle relatively new but already having a major impact on finance and insurance, as banks and other lending institutions are starting to take into account a company’s carbon footprint when making lending decisions.

What this means for shipowners is that even if they seek to comply with IMO ESG regulations, steaming at normal speeds could increase their carbon score and have a negative impact on financial options and stock prices”

This amnesiac obsession with decarbonization presents a painful dilemma:

Slow absorption means reduced global shipping capacity, leading to potential supply bottlenecks. As the article explains:

“Is capacity reduction really a problem? Right.

No one is calculating the cost of a good ESG score in terms of human life,” said a global security analyst who wished to remain anonymous. “The question is no longer IIf people would starve to IMO decarbonization goals. The question is how many? “

The most disturbing fact from our conversations with global security analysts is that millions of people could die before the famine hits. “

And longer transit times mean higher cruise costs that, despite the fuel economy, add to the cost of everything we import.

Of course, the simple alternative is to build more ships to bring the carrying capacity back to equilibrium. Of course, building these ships would carry a huge carbon footprint, eliminating any potential savings from fuel economy for years to come.

And China?

Any discussion of international shipping must take into account the role of China, believe controls the world’s second largest shipping fleet by gross ton and was built on one-third of the world’s ships in 2019.

Do they follow these rules?

One of the reasons for their global dominance in shipping lies in a complex and unclear formal and informal system. state support it is unparalleled in size and scope, and includes subsidized financing from state-owned banks who are unlikely to care about ESG.

While China may be paying for these new regulations, given their complete disregard for ESG in other industries, I strongly doubt that they will continue to build up their shipping industry, taking advantage of weakness of the West.

And the West’s economic dependence on China will be more dangerous than ever.