Lithium-ion battery pack prices increase for the first time since 2010 – could make electric vehicles more expensive

Lithium-ion battery pack prices rose for the first time since 2010 due to rising costs of raw materials and battery components. This is according to a BloombergNEF (BNEF) reportstarted tracking the battery market 12 years ago.

In 2022, the volume-weighted average price for lithium-ion battery packs across all sectors rose to $151/kWh (RM665/kWh), up 7% year-over-year. This number represents an average across a variety of battery end uses, including different types of electric vehicles, buses, and permanent storage projects.

BNEF says the upward cost pressure on batteries outweighs the greater adoption of lower-cost and alternative chemistries such as lithium iron phosphate (LFP). It added that prices are expected to remain at a similar level through 2023, which will continue to defy historical trends.

Between 2013 and 2021, the average price by volume for lithium-ion battery packs has fallen from $732/kWh (RM3,226/kWh) to $141/kWh (621 RM/kWh), with 2022 assessed marks for the first time in over a year. decade in which an increase occurred.

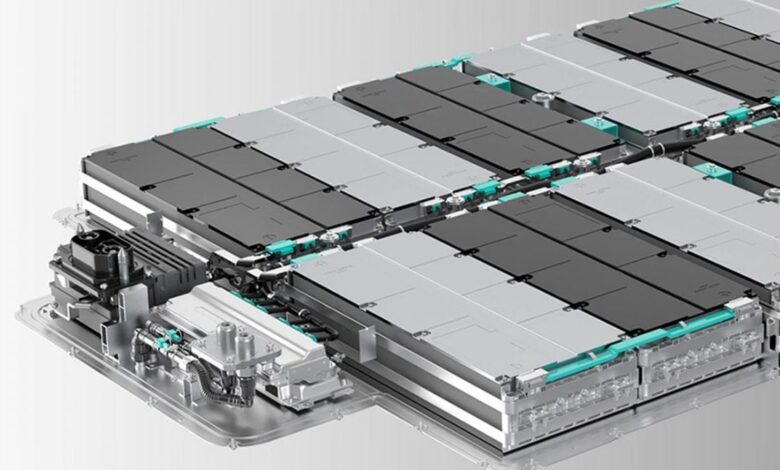

For EV battery packs in particular, the price is $138/kWh (RM608/kWh) on a volume-weighted average for this year. Meanwhile, at the cellular level, the average price stands at $115/kWh (RM506/kWh), which suggests that cells account for 83% of the total package price.

This is different from three years ago when the cell-to-package cost ratio typically hovered around a 70:30 division ratio. One reason for this is changes to packaging design, with manufacturers adopting a new umbrella-to-package approach that reduces costs.

On a regional basis, China has the lowest battery pack price at $127/kWh (RM559/kWh), while packs made in the US and Europe are 24% and 33% higher, respectively. . The report said higher prices in those regions reflect the relative immaturity of those markets, higher production costs, diverse application ranges and battery imports. It also notes that low volume and private orders have pushed prices higher, especially in the higher-end segment.

While the 7% increase is notable, BNEF says prices could have increased even more in 2022 had it not been for increased adoption of low-cost LFP chemicals and continued reductions in the more expensive cobalt in the base cathode. nickel.

The numbers show that LFP cells are 20% cheaper than lithium nickel cobalt oxide (NMC) cells this year. Even so, LFP battery prices are influenced by lithium carbonate prices, and when looked at independently, LFP battery packs are up 27% in 2022 compared to 2021.

“Increasing prices of raw materials and components is the biggest driver of the higher battery prices observed in 2022. Against the backdrop of such rising battery metal prices, battery manufacturers and umbrella manufacturers alike Large autos have turned to more aggressive strategies to hedge against volatility, including direct investment in mining and refining projects,” said Evelina Stoikou, energy storage associate at BNEF .

In 2023, BNEF predicts average battery pack prices will continue to rise at $152/kWh (RM669/kWh) although prices for key battery materials such as lithium, nickel and cobalt have been slightly revised in recent months .

With batteries making up such a large part of electric vehicle prices, it’s not too far-fetched to assume that electric vehicle manufacturers will raise the prices of their vehicles. This is already happening in the United States, with VinFast announcing in September that both the VF8 and VF9 will cost more due to rising material costs. The VF8 was originally priced at $40,700 USD (RM17,243) but has since been adjusted to $42,200 (RM185,849).

This is not all and gloom since then, as BNEF predicts battery prices will start to fall again in 2024, when lithium prices are expected to fall as more mining and refining capacity becomes available. The average package price is expected to fall below $100/kWh (RM440/kWh) by 2026, two years later than previously expected.

This could have negative consequences for automakers making and selling affordable and mass-market electric vehicles in markets that don’t offer subsidies or other forms of EVs. Other financial assistance for car buyers. Higher battery prices can also affect the economics of energy storage projects.

“Despite the setback due to falling prices, demand for batteries is still hitting new records every year. Demand will hit 603 GWh in 2022, almost double 2021. Scaling supply at that growth rate is a real challenge for the industry, but investment in the sector is also growing. fast and technological innovation is not slowing down,” commented Yayoi Sekine, head of energy storage at BNEF.

“Lithium prices remain high due to continued supply chain constraints and slow growth of new production capacity. Additional lithium supplies could ease pressure on prices in 2024, while geopolitical and trade tensions remain the biggest uncertainties for other key battery metal prices in the short term. Resolving these tensions could help calm prices in 2023 and beyond,” added Kwasi Ampofo, head of mining and metals at BloombergNEF.