Is it possible to have too many points? TPG recommends readers how to exchange 35 million miles

You might consider one Welcome bonus 100,000 points on a new credit card will be a hefty sum, but not all points balances are created equal.

Business owners with significant monthly business expenses may find that they earn points even faster than they can redeem suitable credit card.

We’ve seen some impressive balance scores from readers in the past (and even… TPG staff), but this might be the biggest.

Here’s how you can spend millions of credit card points.

Can you have too many travel rewards?

TPG reader Larry M. reached out to us looking for some advice on how to use his points. He is collecting Member reward points through him American Express for over 13 years and would like to book a cruise using them.

Larry currently has a staggering 27 million Membership Rewards points, as well as 3.8 million Hilton Honors points, 1.8 million Marriott Bonvoy points, and 2.8 million American Airlines AAdvantage miles.

He earned most of that money on American Express Business Platinum® Card. He usually redeems about 1 to 1.5 million points for travel each year.

He specifically asked how many points it would take to pay for a $10,000 cruise with Amex Business Platinum versus Reserve Chase Sapphire® or other card that TPG recommends.

How to Maximize Millions in Credit Card Rewards

Founder of The Points Guy, Brian Kelly, shared his advice in his article. recent weekly newsletter:

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

You’ll get the best value for those Amex points when you use them for airfare — whether transferring to an airline partner or through Pay with Points with your Amex Business Platinum card for 35% off on certain flights.

That said, Amex points are not good when redeemed for cruises. Through Amex Travel, you only get about 0.7 cents per point.

There are no good travel credit cards, so forget that. What you really need is a solid cashback card — ideally one without a preset spending limit or a large credit line (because you spend so much). Many cards offer 2% cash back on all purchases without having to worry about any bonus categories.

Let’s do the math on this – for every $1 million you spend, you’ll get $20,000 in cash back. You can use that refund to buy cruises, car rentals, you name it. In contrast, 1 million Amex points you redeem for a cruise would be worth $7,000. So you’ll get almost three times the value by spending on a 2% cashback card.

I think it’s time to stop spending on Amex and start making money again. The thing about cash back versus points is that you can invest the cash and that amount can grow over time. Your Amex points balance does not increase in value over time.

So use your stash of Amex points for flights and hotel points for hotels, and use your cashback for everything else.

Let’s break down some of Brian’s advice:

- American Express Business Platinum Card endow Pay with American Express Travel points This feature, allows you to get 35% off when you use points for first and business class flights on any economy flight and airline on airline you have chosen. The 35% discount is limited to 1 million points per calendar year. If Larry is looking for an easy way to redeem points, perhaps join one cruise departing from Europe or Asia, he can easily redeem his Membership Rewards points for 1.54 cents each without having to worry about transfer partners or the ability to claim awards.

- While Larry can Book travel with his Amex pointsthis is not a great way to use them as he will only get 0.7 coins per point of value.

- Instead of earning millions of points that he may not be able to easily use, Larry might consider a business credit card that can earn great cash back that he can use to pay for anything. any trip he wants. While it may not be as attractive as the Business Platinum Card, Larry might consider it Capital One Spark Cash Plusoffers a sign-up bonus of $1,200 after you spend $30,000 in the first three months of card membership for an annual fee of just $150 (see exchange rates and fees) — waived when you spend $150,000 on the card in a year. Plus, he’ll get unlimited 2% cash back on every purchase, everywhere — no limits or category restrictions. One million dollars spent on this card each year would net Larry $20,000 in cash back (plus a $1,200 welcome bonus), enough to pay for two luxury cruises per year.

Related: Best business credit cards of 2024

Other redemption options

If Larry switches to one Cash back credit card, he still has some incredible membership bonus points he can use. While his focus is cruises, he has so many spots that he could easily consider some other cruises.

Here are some recommendations:

- Fly a family of four round-trip business class to Europe to earn 400,000 Membership Rewards points by transferring them to Air France-KLM’s Green flight program and use Look for flexible schedules to find vacancies throughout the year.

- Larry can transfer Membership Rewards Singapore Airlines KrisFlyer program flying a family of four to and from Singapore in business class above longest flight in the world, pre-order Advantage awards are more available for 287,000 points per person (that’s just over 1 million Amex points). That might even be cheaper if he can find economy-level prizes – although these tend to be quite scarce on this route.

- With so many Amex points, Larry will probably never need to fly economy class again. However, the transfer of his Membership Rewards to British Airways Executive Club will let him book flights to Hawaii for just 16,000 Membership Rewards each way on American and Alaska Airlines from the West Coast. First class domestic flights cost more than 42,000 Avios each way, but if he finds space this could still be a great redemption option.

Larry also has nearly 3 million US miles, and with the switch to the AAdvantage program dynamic pricing on flights operated by AA, Larry’s balance can quickly be swallowed up. Just a few long family trips will do the trick, as it’s not uncommon to see 400,000 AAdvantage miles per flight in premium cabins.

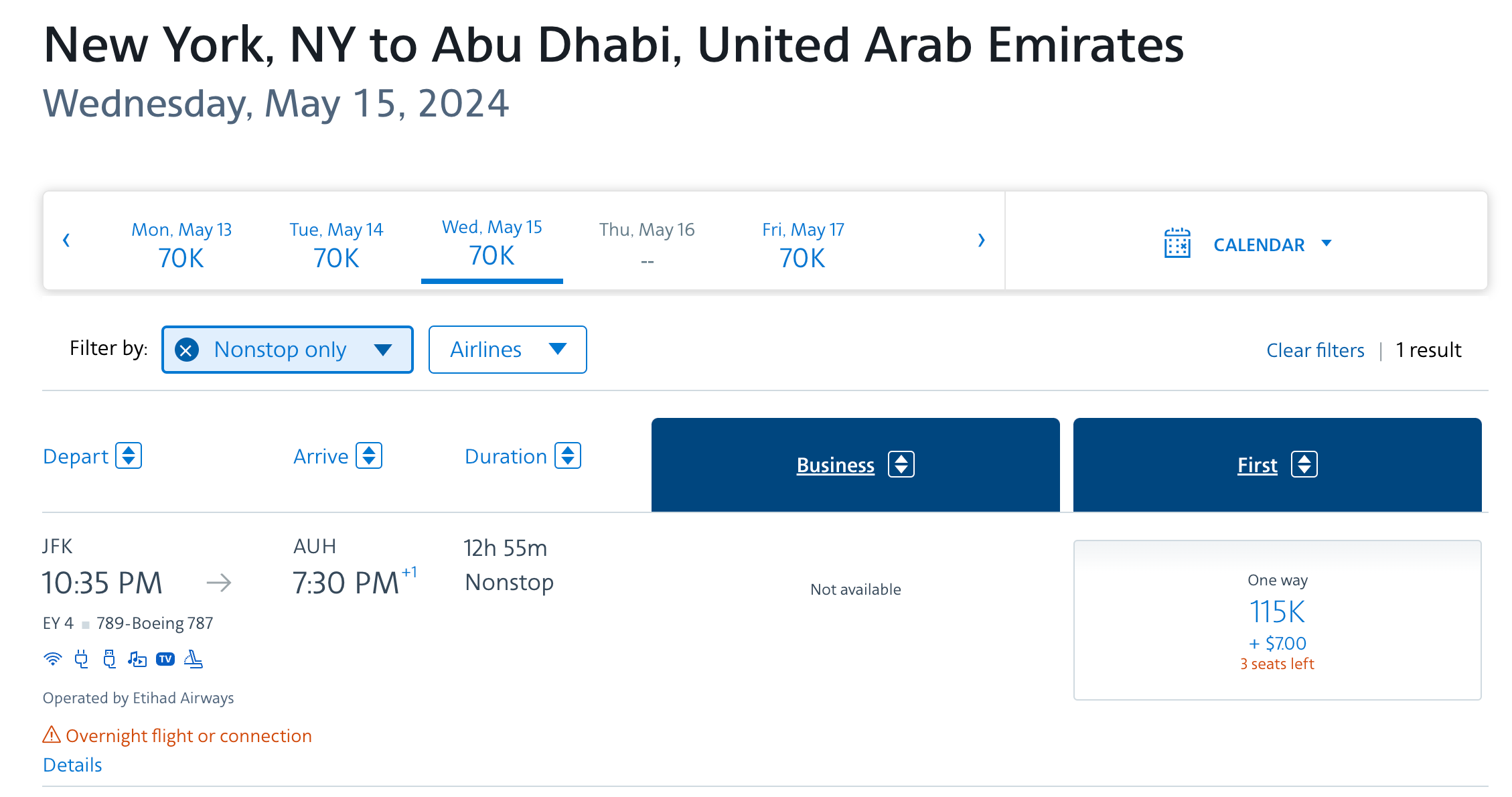

Fortunately, AA currently retains its award rankings flights operated by partner airlines. While British Airways should generally be avoided due to the airline’s high surcharges to Europe, there are still plenty of great deals to be found if Larry can book in advance or at the last minute on the airlines. such as Japan Airlines, Iberia, Etihad Airways and Qatar Airways.

Larry also has a seven-figure hotel points balance. Below are some of ours Favorite uses of Hilton Honors And Marriott Bonvoy Rewards Points.

Best travel credit cards to earn points and miles

While you won’t earn 35 million points from a single welcome bonus, you can easily earn plenty of valuable points and miles with the right travel credit card. Here are some of our favorites that are currently offering great welcome bonuses:

Any of these could allow Larry’s balance to increase further.

Bottom line

Larry’s grade problem is enviable. He already has Lifetime Membership bonus points, with at least a million added annually.

While he can get great value by using his existing Membership Rewards points to book flights to and from cruises he likes to take through the Pay with Points feature of Business Platinum, booking travel this way is not a great way to use eight- shape balance.

Instead, he might consider using a cash back card to earn 2% on every purchase. He can then use those rewards to book any cruise he likes.

As for redeeming his existing points for flights or hotel stays, the sky is the limit.