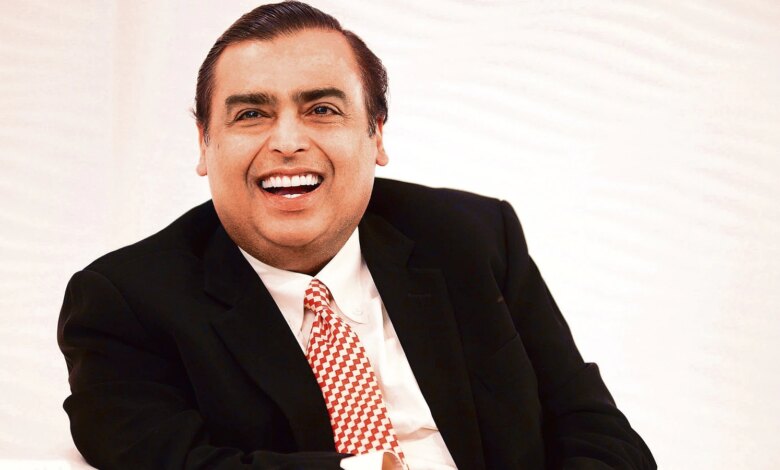

How Mukesh Ambani surpassed Jeff Bezos to lead Amazon in the $3.4 billion dispute

More Amazon.com Inc. to the list of companies that have been surpassed by the mugger of Mukesh Ambani.

More Amazon.com Inc. to the list of companies that have been surpassed by the mugger of Mukesh Ambani. Not only has he ousted the US giant in India’s battle for retail dominance, he now holds all the cards in a $3.4 billion dogfight to buy a retailer. local cash shortage.

Ambani’s Reliance Industries Ltd. in late February quietly began poaching employees and taking over the leases of hundreds of stores once operated by Future Retail Ltd. and Future Lifestyle Fashions Ltd., even as Amazon angrily tries to block official acquisitions through lawsuits and arbitration. India and Singapore. Ambani’s bloodless coup forced Amazon to seek to resolve a bitter dispute and warned Future investors and lenders to be wary of expropriation.

“We did not expect the Reliance Group to take such drastic action without discussing the matter with us,” Future Retail Chief Financial Officer Chandra Prakash Toshniwal wrote in a letter dated February 2. March for Reliance retailers. “Please confirm that there will not be any discount in the payable.”

Another letter, dated March 5 – Bloomberg has copies of both letters – sent by Future Lifestyle expressed “concern and shock” and asked Reliance not to take such actions “possibly subject to deemed serious by the Lenders, who have the company’s “liability of liquid and fixed assets”. Banks can cut Future’s lines of credit, crippling what is left of the company. one retailer was already short of cash, the letter read.

The Future Group, led by Kishore Biyani, has become embroiled in a scandal between two major corporations after Amazon objected to Reliance’s offer to acquire Future Retail stores and warehouses in August 2020 for 247, 1 billion rupees ($3.4 billion). The US e-commerce giant said the deal violated its 2019 agreement with another Future Group company because it eliminated Future Retail, which missed debt obligations and faced danger. bankruptcy chance.

Future Retail said in an exchange filing late Wednesday it received notices to terminate the sub-leases for 342 large stores and 493 small stores from Reliance group. These stores contribute up to 65% of sales but are not currently operating to reconcile inventory and inventory. Separately, Future Lifestyle has received termination notices for 112 sublease properties from Reliance units that are delivering a similar percentage of revenue.

Future Group was running India’s largest retail grocery chain before the pandemic hit, making it an attractive target for the world’s two richest men – Amazon’s Ambani and Jeff Bezos – as They vie for control of a consumer market of more than a billion people, the only foreign companies able to compete.

Representatives for Reliance, Amazon and Future Group did not immediately respond to emailed queries seeking comment on the letters.

The fate of Future Group’s investors, including Blackstone Inc. and L Catterton, and the lenders are now in balance as Reliance, Future and Amazon strike an out-of-court settlement by March 15, when they need to report progress to the Supreme Court of India.

According to Nirmal Gangwal, founder of Mumbai-based financial consulting firm Brescon & Allied Partners LLP, the tactical win makes Reliance the “key key”, giving it the strongest position on the table. negotiate.

Amazon is the latest player to see how the Reliance group grows and eventually dominates nearly every sector it enters – petrochemicals, crude oil refining, consumer retail, telecommunications, engineering services digital and more recently green energy.

Takeover of Tacit

Last week, Amazon sought to bury a nearly two-year-old legal loophole, five days after local media reported Reliance’s tacit takeover of stores by signing new leases with the owners. own Future’s store and send job offers to 30,000 workers from Future Group.

Amazon’s skepticism over the events unfolded during last week’s hearing. US electronics design firm Gopal Subramanium said Future Group had told them the deal with Reliance would take six months or more to close. “It’s been almost 48 hours and people are taking over the stores,” he said.

But the protracted litigation hurt Future Group the most. The two Futures companies owe a total of Rs 300 billion in debt, due to shrinking cash flow and operations.

Reliance will honor the last agreement they signed previously, said a person close to the development, who did not want to be identified as a private matter. It has also extended the closing period by six months to September 30.

Careful trampling

Another person familiar with the developments said Future Group is being cautious as they don’t want to offend Reliance right now.

That cautious tone, close to despair, is reflected in the letters sent by Future companies.

“We have always acted with full transparency and regard Reliance Group as a partner,” Future Retail said in the letter, adding that it hopes to close the transaction soon. “We will therefore ask you not to take any action against us.”