Heavily VC-backed salad chain Sweetgreen heads toward public markets – TechCrunch

Hire the Runway is predicted to cost its IPO later right this moment and commerce tomorrow morning, supplied that each one issues go as deliberate. Udemy is also on the way to the public markets. Allbirds, too.

And this week, Sweetgreen threw its hat into the ring.

Sweetgreen is a meals chain greatest identified for salads which might be in style with the office-lunching crew. I can safely say that as a longtime member of that cohort again after I labored in an workplace in a significant metropolis.

Why are we speaking a few fast-casual restaurant chain right here on TechCrunch? As a result of Sweetgreen raised hundreds of millions of dollars throughout its life as a personal firm, together with myriad enterprise capital rounds — via a Sequence I in 2019 — together with capital from different traders.

It’s an extremely well-backed unicorn, in different phrases. It simply occurs to make salads as a substitute of, say, enterprise software program.

So, let’s take a dive into its IPO submitting, working to each perceive the corporate’s enterprise and its outcomes. We’ll shut with notes on how we don’t know find out how to worth the corporate, an identical problem that we had with Hire the Runway.

The next days and weeks are going to show illustrative by way of the worth of tech-enabled companies, particularly in distinction to extra digital and hard-tech efforts. Yet again.

The fast-casual meals sport

Sweetgreen operates its 140 meals spots in 13 U.S. states and Washington, D.C., with some 1.35 million prospects inserting not less than one order within the 90 days concluding September 26, 2021. And for a expertise angle, some 68% of Sweetgreen income was generated from digital orders for its fiscal yr thus far, which ended September 26.

As famous above, workplace tradition has proved to be no small a part of Sweetgreen’s development. Per the corporate’s S-1 submitting, observe the way it discusses the impression of COVID-19 — which disrupted going to workplaces, interval — on its enterprise (emphasis: TechCrunch):

We skilled a decline in our In-Retailer Channel as a result of COVID-19 pandemic in fiscal yr 2020, significantly in central enterprise districts, which was partially offset by robust gross sales in our suburban places and powerful off-premises digital gross sales throughout all markets. For our fiscal yr thus far via September 26, 2021, we skilled constructive momentum throughout all of our channels, as COVID-19 vaccines grew to become broadly accessible and prospects began to return to workplaces.

Sweetgreen has persistently expanded throughout its life, noting in the identical submitting that it had “119 eating places as of the tip of fiscal yr 2020,” and 140 as of the tip of September of this yr. That development has not been cheap, with Sweetgreen “focusing on” an “common funding of roughly $1.2 million per new restaurant” sooner or later.

Powering Sweetgreen within the background are a couple of tendencies that the corporate views as accretive, together with a shopper shift towards extra plant-based consuming and “speedy adoption of digital and supply,” key channels for the meals chain’s income development.

No matter how you are feeling about Sweetgreen the model, the corporate’s total marketing strategy seems sound on paper. Persons are consuming more healthy and ordering extra by way of supply. Salads transport properly — they aren’t soup — and are as plant-based as you’d like. And since it’s potential to generate income promoting meals, why not Sweetgreen?

So, how has the corporate managed in enterprise phrases throughout its previous few years of development? Let’s have a look.

Does Sweetgreen’s enterprise generate candy quantities of inexperienced?

No, it doesn’t.

The truth is, Sweetgreen is moderately unprofitable and doesn’t look like on the cusp of a speedy march towards profitability. Not that shedding cash is a sin, per se; many venture-backed corporations run stiff deficits whereas they scale. That’s the level of elevating personal capital, to take a position it at the price of near-term profitability and money move.

However Sweetgreen isn’t any company little one. It was based in 2007, per Crunchbase knowledge, making it almost sufficiently old to safe a learner’s allow to drive in america. If a human can get to the purpose of nigh-maturity in a time-frame, absolutely firms made up of adults and backed by mountains of personal capital can handle the identical?

Right here’s the information:

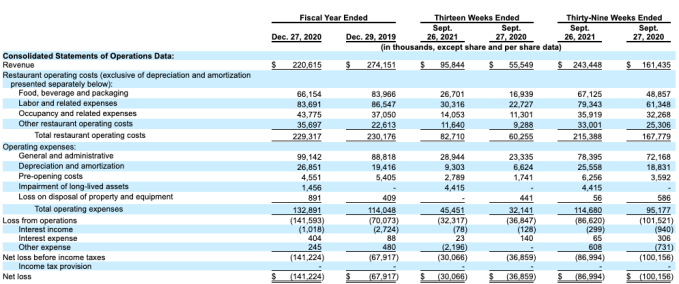

Picture Credit: Sweetgreen S-1

Be aware that point flows east to west on this specific desk, so the corporate’s most up-to-date full fiscal yr is on the far left.

As we will see from the 2 most up-to-date fiscal years, 2020 was a fairly laborious time for Sweetgreen, which noticed its revenues decline from $274.2 million to $220.6 million, and its web losses double from $67.9 million to $141.2 million over the identical time-frame.