Goldman Sachs and Nomura both cut China GDP outlook, again

People cross the street during hot weather on August 15, 2022 in Guangzhou, China. The country is suffering its worst heatwave in decades, straining its electricity supply.

Anadolu Agency | beautiful pictures

Goldman Sachs and Nomura lowered their growth forecasts for China, citing weaker demand, uncertainties stemming from zero-Covid policy and the energy crisis.

Goldman Sachs lowered its full-year forecast for 2022 to 3.0% from 3.3%, while Nomura lowered its full-year forecast to 2.8% from 3.3%.

The cuts reflect investment banks’ continued pessimism about Beijing’s growth target of around 5.5%. In July, Chinese officials pointed out that the country may miss its GDP target been a year.

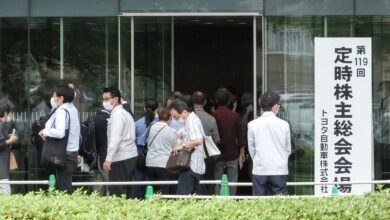

Goldman economists quoted the latest information Economic data for July as well as short-term energy constraints due to unusually hot dry summers. China is suffering from one of the worst heat waves in decadesstrain an already stressed power supply and lead to production cuts in some parts of the country.

Economists for both banks also noted an increase in Covid cases across the country as well as a contraction in property investment in July that dragged total investment down.

Nomura, which continues to maintain one of the lowest estimates for China’s growth, said it still believes Beijing will maintain its zero-Covid policy until March 2023. It said this stance has will remain a major drag for the real estate sector. In May, UBS cut its forecast to 3%the lowest of the estimates tracked by CNBC at the time.

Unexpected interest rate reduction

The forecast reduction comes after the People’s Bank of China surprises two rate cuts on Monday – medium-term policy loans and a short-term liquidity instrument – the second this year.

Nomura and Goldman both note that Beijing’s stimulus response could be quite limited.

“Contrary to some people’s concerns about too much policy stimulus in H2, the real risk is that Beijing’s policy support may be too little, too late, and too ineffective,” Nomura said.

Goldman Sachs said an unexpected rate cut does not necessarily signal the start of more aggressive easing, adding that policymakers not only face economic constraints but also political constraints.

“Their current focus may be on preventing further downside risks and ensuring jobs and social stability ahead of the 20th Party Congress,” it said.