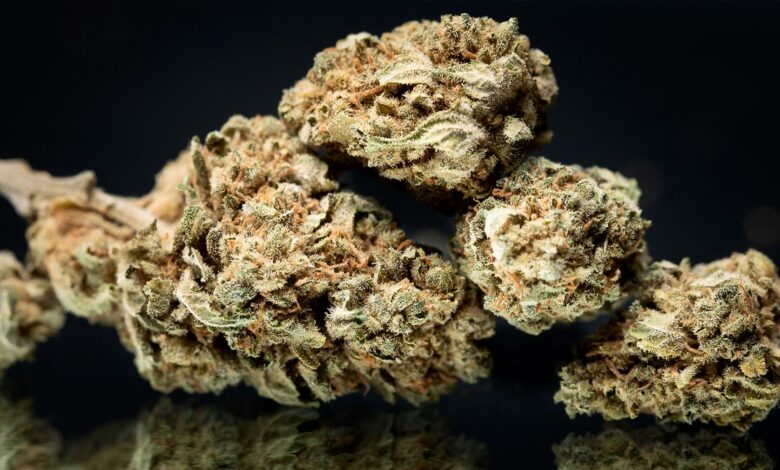

Cannabis banking startups Want to easily buy weed

Physical safety is also a concern that fintech startups are trying to address. The more banks go online and enter the space, the safer the industry participants will be. With Mastercard and Visa out of the game, newer software startups have joined in to ensure that cannabis retailers large and small are transparent at every step. Simply moving customers from paper to a digital trading platform will help the distribution agency document their work and remain compliant with the federal government.

Design familiarization and set the tone

Breaking into the gray areas of cannabis banking requires these startups to assemble a mixed team of professionals familiar with both traditional cash payments and digital ecosystems. , in addition to those who have tested innovative payment solutions. Everyone involved needs to be aware of exactly how different a beast is cannabis.

“We want to bring in the product, technical, and partnership resources that are already experienced in large-scale organizations and progressive fintech. They can take that knowledge and apply it to an underserved industry. Ryan Himmel, Head of Strategic Partnerships at LeafLink, a wholesale technology B2B platform for the cannabis industry. For LeafLink, their approach to the problem grew out of a practice called bill financing.

Invoice financing is when LeafLink provides prepaid payments to vendors through ACH, the same way a bank processes payslips, while then assigning invoices to retailers at the endpoint. In facilitating the movement of digital currency, the startup makes it easier for these vendors to scale. Credit unions in particular have taken the lead in regulating fintech, compared to national banks, because of their smaller size and ability to cater to local communities.

Similarly, there are many factors that a customer-oriented retailer must meet. “For a cannabis retailer, your point of sale cannot be the same as a restaurant or a hotel. You have state regulations, you have tax reporting and ID verification for your consumers. So the POS software has to be able to fulfill all those attributes,” said Jessika Wood, head of strategic payments partnerships at Dutchie, a trading platform with point of sale, e-commerce, payment and insurance in the cannabis industry. No longer simply an in-person experience, the Covid-19 pandemic forces distribution stations and suppliers to grow and go online to survive. With that, the buyer experience has become digital and set the standard.

“We are setting the tone in terms of what ‘compliance’ means. As the market matures and everything exists in space and you don’t see the sky falling, more and more banks are getting in,” said Jennifer Yager, Senior Vice President of Anti-Money Laundering Compliance at Valley Bank. Working with cannabis operators in multiple states, Valley Bank had to help customers find banks, wallet providers and even cash delivery companies willing to touch cash. marijuana.

Automation will reduce the amount of resources devoted to compliance, allowing smaller distribution points to enter the market at a disadvantage. For these fintech startups, in addition to the business opportunity, integrating social justice is also part of their master plan. Many partners with The Last Prisoner Project to help redistribute some of their cannabis revenue to people who have been disproportionately incarcerated as a result of past marijuana bans. Setting standards of compliance also means setting standards and expectations for social equality for this lucrative yet historic industry.