Biden Lying About Oil and Gasoline Prices… Again – Watts Up With That?

Guest “A man who would never tell the truth when a lie would serve him just as well” by David Middleton

Every time that Biden flaps his gums (or his minions type Tweets on his behalf), this Douglas MacArthur quote comes to mind:

Well, apart from not being dead, the MacArthur quote fits Biden to a T.

Biden demands faster drop in gas prices as oil tumbles

By Matt Egan, CNN Business

Wed March 16, 2022

New York (CNN Business) President Joe Biden is using his bully pulpit to call out the tendency for gasoline prices to go up like a rocket when oil spikes, but only drop like a feather when crude crashes.

Biden fired off a tweet Wednesday morning highlighting the painfully slow decline in gasoline prices in a bid to draw scrutiny to a decades-long trend that critics say hurts consumers by failing to pass savings along to drivers.

“Oil prices are decreasing, gas prices should too,” Biden said on Twitter. “Last time oil was $96 a barrel, gas was $3.62 a gallon. Now it’s $4.31. Oil and gas companies shouldn’t pad their profits at the expense of hardworking Americans.”

[…]

Is Biden that stupid? Or is lying simply his default position? Rhetorical questions. What’s Matt Egan’s excuse?

President Joe Biden is using his bully pulpit to call out the tendency for gasoline prices to go up like a rocket when oil spikes, but only drop like a feather when crude crashes.

Matt Egan, 2007 BS in Journalism.

Did he research that bit of nonsense from the CNN archives? Another rhetorical question.

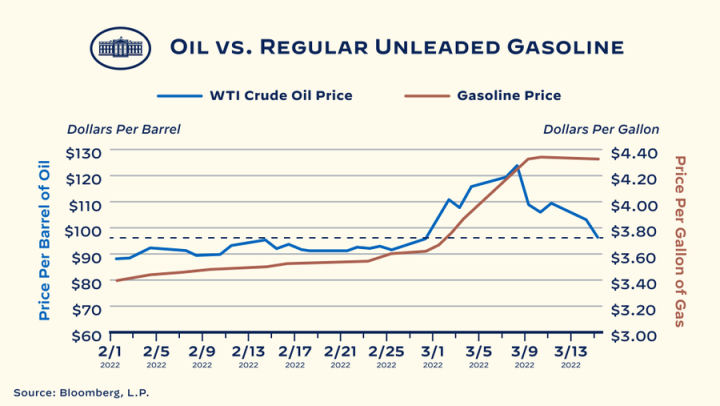

Biden’s Tweeting minions included this graph, allegedly sourced from Bloomberg:

Why not just use EIA data? The EIA is part of the Department of Energy… part of the Executive Branch… The only branch of government that reports to Biden.

Why do gasoline prices fluctuate?

Retail gasoline prices are mainly affected by crude oil prices and the level of gasoline supply relative to gasoline demand. Strong and increasing demand for gasoline and other petroleum products in the United States and the rest of the world can place intense pressure on available supplies.

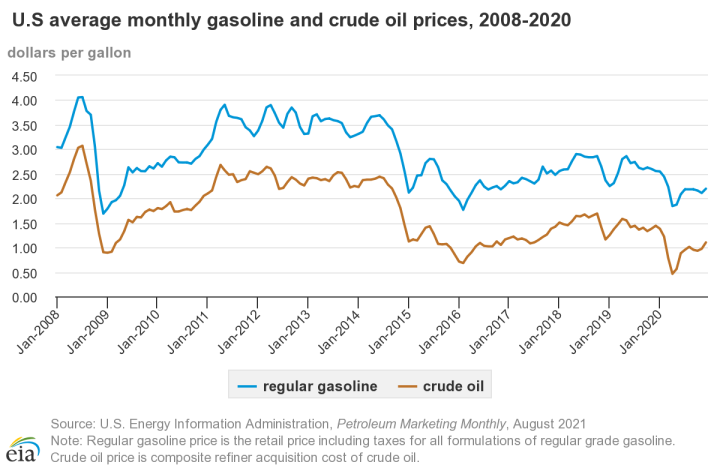

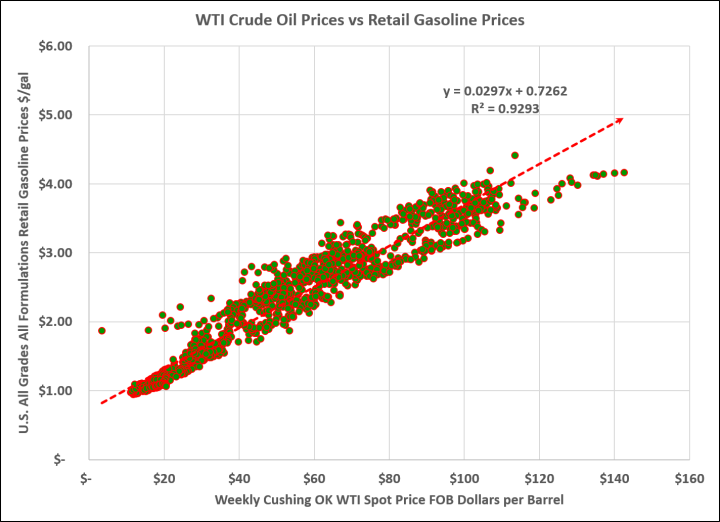

While crude oil and gasoline prices don’t move in lockstep on an hourly or daily basis, they do move in a more or less lockstep fashion on a weekly or longer term basis.

The WTI points occur three days prior to the gasoline points.

Since the beginning of 2021, crude oil prices have actually risen significantly faster than retail gasoline prices.

Oil slope = 0.0862

- Crude Oil $113/$48 = 2.35

- Gasoline $4.41/$2.34 = 1.88

- 2.35/1.88 = 1.25 M’kay?

While it is true that retail gasoline prices tend to rise faster than they fall, this has nothing to do with oil & gas companies padding their profits. The owners of gas stations tend to raise pump prices based on what it’s costing them to buy gasoline. They tend to lower the pump prices only when their competitors do so. And… most gas stations aren’t even owned by oil companies.

Do the major oil companies own all the service stations in this country?

No. According to the latest information, the refiners own less than 5% of the 150,000 retail stations. When a station bears a particular refiner’s brand, it does not mean that the refiner owns or operates the station. The vast majority of branded stations are owned and operated by independent retailers licensed to represent that brand. According to the National Association of Convenience Stores (NACS), more than 60% of the retail stations in the US are owned by an individual or family that owns a single store. Through various branding agreements, approximately 36% of the retail stations in the US sell fuel under API members’ brands. See U.S. Service Station Outlets Summary.

Moreover, most gas stations barely make a profit on fuel sales, often losing money…

Why most gas stations don’t make money from selling gas

With gas prices climbing up, you may think station owners are getting greedy. But the economics behind the pump tell a different story.Zachary Crockett

September 12, 2021[…]

With average gas prices at a 6-year high, you might think station owners are rolling in the dough.

But the business model of gas stations is a bit counterintuitive.

Most gas stations barely turn a profit on their core product, and when the price of oil goes up they may even take a loss on it.

[…]

Most major oil companies have backed out of the retail business because selling gas generally isn’t very profitable.

According to IBISWorld, gas stations make an average net margin of just 1.4% on their fuel.

[…]

The real money is made inside the store

Today, 80% of all gas stations have a convenience store on site.

According to a study conducted by the National Association of Convenience Stores, 44% of gas station customers go inside. And among them, 1 in 3 ends up indulging in some kind of treat.

The goods inside these stores — Doritos, sunglasses, lotto tickets, energy drinks — only account for ~30% of the average gas station’s revenue, yet bring in 70% of the profit.

[…]

This bald-faced lie is particularly flatulent and pernicious:

Oil and gas companies shouldn’t pad their profits at the expense of hardworking Americans.

Profits are reported on a quarterly basis. No oil company has reported Q1 2022 earnings yet. Q1 2022 ends on March 31, 2022. It takes time to work up corporate income statements. No one will know how profitable oil companies were in Q1 2022 until their earnings statements are released, Most companies will release Q1 2022 earnings in April, so Biden can’t even make a bogus claim about oil companies padding their profits.

Furthermore, oil companies weren’t padding their profits in Q4 2021, much less padding their profits on a crude oil/gasoline price differential. In the most recent quarter, Q4 2021, oil prices (WTI) averaged $77/bbl. Here are the Q4 2021 profit margins of 10 large US oil companies compared to 2 tech giants:

The two tech giants had net earnings more than double the sum of ten large US oil companies. with three times the profit margin. The least profitable oil companies (Valero, Marathon and Phillips 66) would have benefited the most from gasoline prices remaining high, while crude oil prices plunged. They are mostly midstream and downstream players. The most profitable companies (Devon and Chesapeake) are strictly upstream players. They don’t benefit at all from gasoline prices remaining high, while crude oil prices plunge. Such a scenario would hurt their bottom lines. It’s also important to note that most, if not all, of these companies lost money in 2020 when oil prices were low.

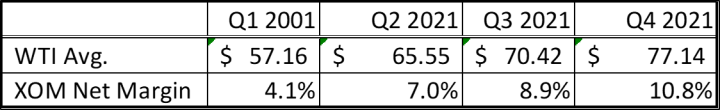

It is true that oil companies generate better profit margins with higher product prices. Their cost to find and produce oil doesn’t change quickly. Every $/bbl that oil rises above their breakeven cost has an out-sized effect on profit margins. We’ll use ExxonMobil (XOM) as an example.

At $65.55/bbl in Q2 2021, XOM’s profit margin was comparable to the average publicly traded US corporation. For XOM’s profit margin to match that of the tech giants, crude oil prices would have to average over $130/bbl for an entire quarter, not just a few trading days.

The problem is that the costs of finding and producing oil eventually rise and fall with product prices. And those costs are already rising… On land…

Fourth Quarter | December 29, 2021

Oil and Gas Activity Continues Expanding; Cost Pressures IntensifyThe oil and gas sector continued growing in fourth quarter 2021, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—remained elevated at 42.6, essentially unchanged from its third-quarter reading.

Oil production increased at a faster pace, according to executives at exploration and production (E&P) firms. The oil production index moved up from 10.7 in the third quarter to 19.1 in the fourth quarter. Similarly, the natural gas production index advanced seven points to 26.1.

Costs rose sharply for a third straight quarter. Among oilfield services firms, the index for input costs increased from 60.8 to 69.8—a record high and suggestive of significant cost pressures. Only one of the 44 responding oilfield services firms reported lower input costs this quarter. Among E&P firms, the index for finding and development costs advanced from 33.0 in the third quarter to 44.9 in the fourth. Additionally, the index for lease operating expenses also increased, from 29.4 to 42.0. Both of these indexes reached their highest readings in the survey’s five-year history.

[…]

And at sea…

Transocean Rakes In Five New Deals. Four Rigs Heading To GOM

by Bojan Lepic | Rigzone Staff | Tuesday, February 15, 2022Offshore drilling contractor Transocean has won work for five offshore rigs, with four going to the U.S. Gulf of Mexico and one to the UK North Sea.

Transocean said in its latest fleet status report that the new contracts and extensions for its drilling rig fleet have an aggregate incremental backlog of around $87.7 million. Some of the rigs won deals with better day rates meaning the backlog rose to $6.5 billion.

[…]

The Deepwater Asgard drillship secured a two-well contract in the U.S. Gulf of Mexico at $395,000 per day. The operator was left undisclosed, but the deal will run from April until June 2022. The rig’s day rate has been significantly increased with this contract. Its previous deal was also in the Gulf of Mexico and again the operator was left unnamed. The rate though was $100,000 lower and stood at $295,000.

The next drillship with a new deal is the Deepwater Invictus. It won a one-well contract extension with BHP in the U.S. Gulf of Mexico at $305,000 per day. The deal will run from June until September 2022. The rig’s dayrate under the contract with BHP which stretches from October 2021 to March 2022 is $260,000. It will increase to $295,000 from March till June 2022 and then increase again under the latest extension.

The last drillship to get a new deal was the Discoverer Inspiration. Its one-well contract in the U.S. Gulf of Mexico at $290,000 per day was awarded by EnVen Energy along with two one-well options. The rig is currently working for Hess until August 2022 on a $215,000 dayrate after which it will start work for EnVen. The company’s optional periods are slated for September-November and November-December 2022 at dayrates of $300,000 and $310,000, respectively.

[…]

Conclusion

It appears that Biden’s ghost-written Tweet features a graph comparing daily oil price changes with weekly gasoline prices.

Oil prices are decreasing, gas prices should too.

Last time oil was $96 a barrel, gas was $3.62 a gallon. Now it’s $4.31.

Oil and gas companies shouldn’t pad their profits at the expense of hardworking Americans. pic.twitter.com/uLNGleWBly

— President Biden (@POTUS) March 16, 2022

Their graphic is a Disraeli-ism on steroids.

Here is the actual comparison of weekly oil & gasoline prices over the same time period.

- “Oil prices are decreasing, gas prices should too.” False.

- “Last time oil was $96 a barrel, gas was $3.62 a gallon. Now it’s $4.31.” Disraeli-ism.

- “Oil and gas companies shouldn’t pad their profits…” Bald-faced lie!!!

Biden, here’s what you need to do:

GET THE HELL OUT OF OUR WAY!!!

- You never had a real job in your entire miserable excuse for a life. You never worked in the private sector. Stop lying about industry and trying to tell us how to run our businesses!

- Resume holding and honoring the results of Federal oil & gas lease sales – as you are required by law to do.

- Stop babbling about shutting down permitting.

- Reverse the recent trend of slow-walking permits.

- Stop nominating Marxist academics who are hell-bent on defunding the oil & gas industry.

- Restore the ANWR leases that you lawlessly revoked.

- Fully open up ANWR & NPRA in Alaska and the entire Outer Continental Shelf (OCS) to exploration & production.

- Reverse your moronic decision to rescind the permits for the Keystone XL pipeline.

- Stop putting up roadblocks to new pipelines and LNG export facilities.

- Shut the frack up about climate emergencies, catastrophes and crises… At worst, it is a minor long-term problem that could easily be dealt with, if it was treated as such.

The rant above was borrowed from a comment I made in another post.