5 things to know before the stock market opens Monday, August 28

Here are the most important news items that investors need to start their trading day:

1. New week, new data

Stock futures were slightly higher on Monday to kick off the last week of August. Dow Jones Industrial Average futures were up 83 points, or about 0.2%, while S&P 500 futures and Nasdaq-100 futures rose 0.2% and 0.3%, respectively. Stocks are coming off a winning session, as the major indexes rose Friday following Fed Chair Jerome Powell’s speech in Jackson Hole, Wyoming. In his remarks, Powell said the central bank had seen signs of progress, but warned that inflation remains “too high” and that the Fed is “prepared to raise rates further if appropriate.” This week, investors will be looking ahead to more economic data that could give an indication of the Fed’s next move, with the monthly jobs report set to be released on Friday. Follow live market updates.

2. Earnings ahead

A Salesforce corporate logo sign hangs outside their office building in New York City.

Gary Hershorn | Corbis News | Getty Images

3. Going public

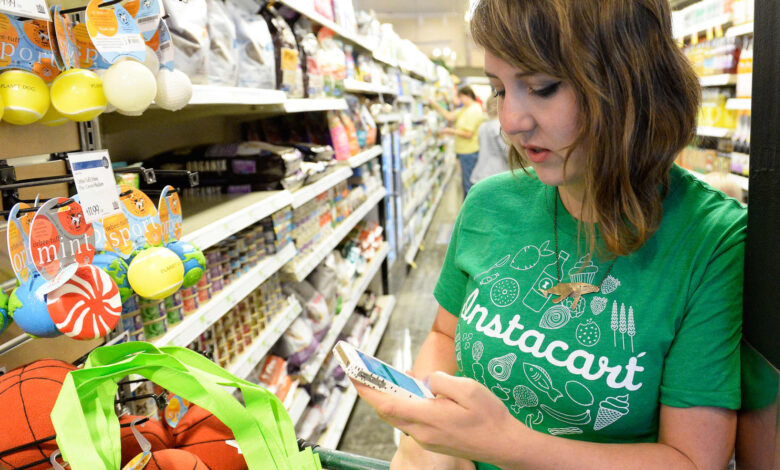

A shopper for Instacart studies her smart phone as she shops for a customer at Whole Foods in Denver.

Cyrus McCrimmon | Denver Post | Getty Images

Tech investors rejoice: The IPO freeze is over. The last major initial public offering for a venture-backed tech company came 20 months ago, leaving many to wonder which buzzy name would be the first to leap into the public markets. An answer finally came Friday, when grocery delivery startup Instacart and data and marketing automation company Klaviyo filed for stock market debuts. Earlier last week, Arm, the chip designer owned by Japan’s SoftBank, filed for a Nasdaq listing. CNBC’s Ari Levy reports that the three IPOs will be a test to see how investors feel. If they’re successful launches, they could inspire more companies to go public.

4. Not so grand

The Evergrande Group headquarters building in Shenzhen is pictured on January 11, 2022 in Shenzhen, Guangdong Province of China.

Liang Xiashun | Visual China Group | Getty Images

5. The meme goes on

A customer walks up to a closed Bed Bath and Beyond store on February 08, 2023 in Larkspur, California.

Justin Sullivan | Getty Images

Meme stocks are gonna meme. In this case, it’s popular meme stock Bed Bath & Beyond which saw its shares trade at large volumes even as the stock is likely weeks away from being declared worthless. The home goods retailer filed for Chapter 11 bankruptcy in late April and has been closing its brick-and-mortar stores. Its intellectual property was acquired at auction by Overstock, but the company warned in an SEC filing that trading its stock during the ongoing Chapter 11 cases was “highly speculative and poses substantial risks.” In other words, stockholders aren’t likely to see much, if any, gain. Without recovery, the company’s market cap of $152.25 million essentially boils down to nothing for common shareholders. Several tiers of bondholders come first in the reimbursement food chain and shareholders do not get a vote on the plan.

— CNBC’s Samantha Subin, Jeff Cox, Robert Hum, Ari Levy, Lim Hui Jie and Elliot Smith contributed to this report.

— Follow broader market action like a pro on CNBC Pro.