Why will electric cars cost more to insure than hybrid cars in 2024?

As more data becomes available from the insurance industry, an unfortunate trend persists for electric vehicles: Higher insurance costs.

And there are now enough of them in the fleet to highlight that it’s no longer a problem for insurers to insure themselves against the unknowns of a new vehicle.

Based on calendar year results examined by the insurance analytics team at LexisNexis Risk Solutions, electric vehicles now have 17% higher claim frequency and 34% higher claim severity than what the company considers its “traditional segment.”

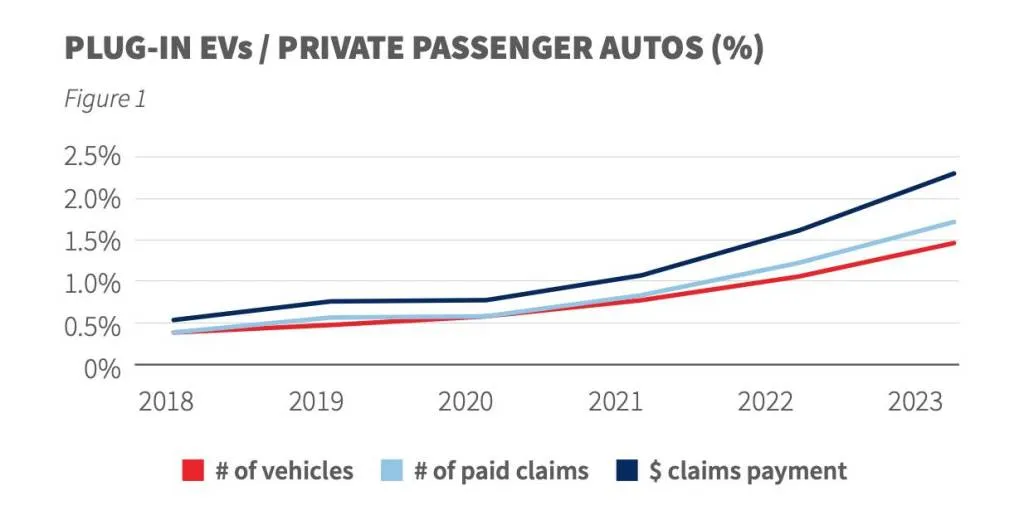

“As a result, the number of paid claims as well as the total amount of electric vehicle claim payments has increased faster than the number of electric vehicles as a share,” LexisNexis noted in a report released Thursday. hundred of the total PPA market in the past year”. Although the electric vehicle fleet in 2023 represents only 1.5% of the insured fleet, it accounts for 1.7% of all paid claims and 2.3% of total claim payments compensation, citing its own exclusive analysis.

Rivian R1T IIHS 2022 crash test

As Consumer Reports found last year, Electric vehicle insurance costs hundreds of dollars more each year compared to comparable gasoline models—including hybrids. Based on these common factors, LexisNexis is emphasizing, plus the high cost of battery replacements, that doesn’t look like it’s going to change anytime soon.

Electric vehicles aren’t always bad news for risk-minded insurers. According to the Highway Loss Data Institute (HLDI), Electric vehicles are less likely to be stolen than gasoline cars.

More electric vehicles do not reduce the risk pool

As pointed out, 2023 is indeed a big year for electric vehicles in the real world. Electric vehicle sales increased 54% compared to 2022, to 1.4 million units. That means the total number of insured electric vehicles in the United States increased by 40% to 3.9 million, including plug-in hybrids, while insured private passenger vehicles increased by only 1.2 % to 265 million.

However, a larger pool of owners and drivers — and vehicles — is not enough to create more advantages for electric vehicle drivers.

LexisNexis EV insurance claims trends – 2024 report

“The higher frequency and severity of electric vehicle claims has contributed to increasing profitability challenges for all electric vehicle insurers,” the company said. “Various electric vehicle (EV) driving experiences have contributed to higher and more severe claims compared to internal combustion engine (ICE) vehicles,” the company said.

Green Car Reports reached out to LexisNexis to understand what these driving experiences are and whether it refers to urban environments, less cautious driving, or some other factor.

Driving is more adventurous and goes beyond electric vehicles

American drivers in 2023 are likely to be more adventurous. Speeding, driving under the influence (DUI) and distraction violations all increased, far exceeding pre-pandemic levels. DUI crimes increased nearly 9% in the first six months of 2023 compared to the first six months of 2019.

Overall, across all vehicle types, the severity of bodily injuries increased 20% from 2020 to 2023, while the severity of physical damage (by claim amount) compensation claims) increased by 47%.

That also means a higher percentage of electric vehicle drivers are actively seeking lower prices, the company found — on top of record levels of procurement and contract switching in 2023. That’s driven by sharp interest rate hikes triggered by insurance companies starting in the second quarter of 2022 and lasting there. at least through 2023—leading to an unprecedented 14% premium increase for all of 2023 compared to the same period last year.

The high price of electric vehicle insurance has prompted Tesla to create its own insurance product. Tesla insurance remains available in 12 states and in all but California, where the company uses it Real-time algorithms impact rates and based on driving habits.

Chevrolet Bolt EV 2023

LexisNexis was involved in a scandal in which GM shared specific data about the above driver Chevy Bolt EV driving habits with the company through the OnStar Smart Driving program—with many drivers completely unaware that they are registered by a dealership.

Meanwhile, insurance companies don’t do well in terms of promptness or satisfaction. 40% of respondents said it took a month or longer to receive full payment from the insurance company, and 46% of those involved in such a claim were dissatisfied with the experience. So there’s plenty of room for improvement for insurers—and perhaps competition for safe drivers.