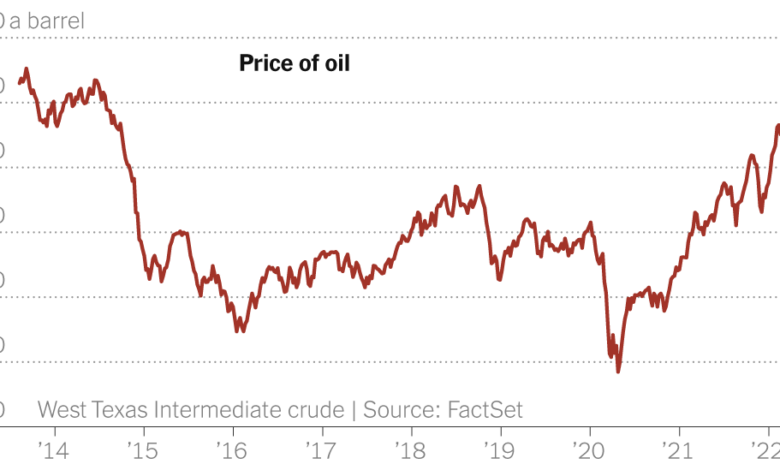

When oil falls below $90, where will the price go from here?

As oil prices fall, many costs to industry and agriculture, including chemicals and fertilizers, generally increase. And the shipping becomes more economical. But when they rise sharply, like in 2008 and the 1970s, they tend to raise other prices and slow down the economy as a whole. And political collapse often follows.

Predicting energy prices is always a stupid game because there are many factors, including the expectations of fuel traders buying and selling, the political fortunes of volatile producing countries like Venezuela, Nigeria and Libya, and public and private oil investment decisions. Company executives.

Today, those complexities are especially difficult to assess.

“(When) Will the oil bulls start to revise their forecasts down?” was the headline of a recent Citigroup commodities report. With a global recession “imminent,” it said, “is it more likely, a strong hurricane season, to see prices skyrocket? Iranian barrels are back? Or a recession, with oil prices at $60 by year-end/early 2023? If a barrel of oil drops to $60 a barrel, the average price of gasoline in the United States will likely drop by at least another dollar a gallon.

But a few days after Citi’s forecast, Goldman Sachs Commodities Research predicted prices would rise as fuel demand recovers. The report concludes: “We see increasing tailing risk to commodity prices inherent in the scenario of sustained growth, low unemployment and stable household purchasing power,” the report concludes. essay.

The war in Ukraine remains a major variable in the worldwide supply outlook as Russia typically supplies one out of every 10 barrels of the 100 million bpd global market. Since invading Ukraine, Russia’s daily exports have fallen by about 580,000 barrels. European sanctions on Russian oil are expected to be tightened further in February, reducing daily Russian exports by 600,000 barrels.

Read more about oil and gas prices

And as Russia further tightens its natural gas sales to Europe in retaliation for tit-for-tat sanctions, European utility companies will be forced to burn more oil as an alternative to gas.