VCs are racing to pay more to get smaller pieces of less profitable companies – TechCrunch

It’s information season, with teams like Silicon Valley Financial institution (SVB), CB Insights, PitchBook and Crunchbase Information placing out information units that we’re having enjoyable exploring. This morning, we’re including another to our arsenal.

The Alternate spent a while this week diving into the SVB “State of the Market” report for the fourth quarter. As is frequent from the financial institution’s publications, it’s a dense riff of charts and notes, starting from financial information and commerce figures to enterprise capital statistics.

The Alternate explores startups, markets and cash.

Learn it every morning on TechCrunch+ or get The Exchange newsletter each Saturday.

Whereas perusing the collected info, we discovered an fascinating sample: Enterprise capital buyers are racing to pay extra to purchase smaller items of startups which can be much less worthwhile than earlier than.

Whereas that will sound considerably impolite, it isn’t. As a substitute, the capital crush that we’ve seen overtake startups all over the world, the spherical preemption that has change into frequent, the rising valuation marks which have change into the entry value to sizzling startups’ cap tables and investments into development have all come collectively to create a enterprise capital market not like any that I can recall.

SVB gave The Alternate permission to share a couple of charts, so what follows is a graphical dig into the info, proving that I’m not a brat for claiming that enterprise buyers are getting a rawer deal than traditional however merely sharing what the info signifies.

SVB gave The Alternate permission to share a couple of charts, so what follows is a graphical dig into the info, proving that I’m not a brat for claiming that enterprise buyers are getting a rawer deal than traditional however merely sharing what the info signifies.

Much less for extra

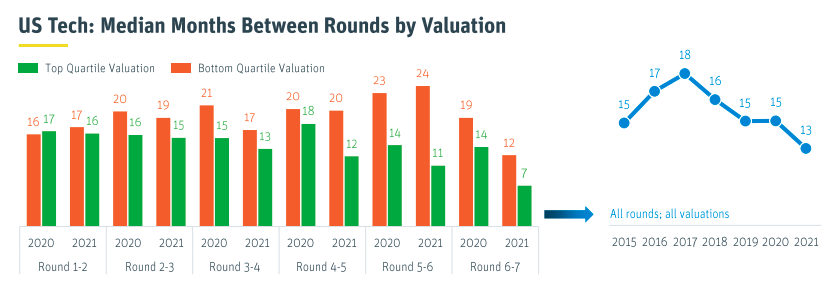

First, let’s study how the time between funding rounds has fallen. SVB information reveals a helpful 2020 versus 2021 differential, with an combination chart monitoring the identical information over an extended time interval on the correct:

Picture Credit: SVB

As you’ll be able to see in each charts, enterprise capitalists are accelerating the tempo at which they make successive investments into startups. That is what we meant by sooner.