US oil companies spend twice as much capital compared to the same period last year – Raised by that?

Guest “Slap Down Another Biden Lie” by David Middleton

OIL Published June 11

Biden blames record oil prices: ‘Exxon made more money than God this year’

President Biden blames oil companies but credits fastest-growing economy’By Lawrence Richard

In a speech in Los Angeles on Friday, President Joe Biden blamed record gas prices on the oil industry and said U.S. oil companies like Exxon Mobil Corp are profiting. huge profits in the past year.

“This year Exxon made more money than God,” the Catholic president told union representatives at the Port Los Angeles because the national average gas price is $4.99 per gallon.

[…]

Biden also made the biggest accusation American oil and gas company spend their profits buying stock, instead of using it to drill and produce more oil.

“Why don’t they drill? Because they make more money, not produce more oil,” the president said. “Exxon, start investing and start paying taxes.”

[…]

“Exxon Made More Money This Year Than God”

“Exxon, start investing and start paying taxes”

July 22, 2022

US public oil producers have higher revenue and higher operating costs in Q1 2022

In the first quarter of 2022, 53 U.S. exploration and production companies reported both higher revenue and higher material and labor costs than in the first quarter of 2021.

Our analysis is based on the published financial statements of 53 publicly traded oil companies that produce the majority of their crude oil in the United States. Therefore, our observations are not representative of the entire industry as the analysis does not include private companies that do not publish financial statements. During the first quarter of 2022, these 53 publicly traded companies collectively produced 3.9 million barrels per day (b/d) of crude oil in the United States, or about 34% of all U.S. crude oil production. released in the quarter.

West Texas Intermediate (WTI) Crude oil prices averaged $95.18 per barrel (b) in the first quarter of 2022, up 64% from the first quarter of 2021 and up 23% from the fourth quarter of 2021. Operating cash The company totaled $25.7 billion in the first quarter of 2022, 86% more than the first quarter of 2021 and 9% less than the fourth quarter of 2021. Despite the higher revenue ( an extraordinary increase of $8.8 billion in Accounts can receive), the unpaid balance of delivered goods by the customer contributes to a decrease in cash from operations quarterly.

Capital spending by these companies nearly doubled year-on-year, reaching $14.6 billion in the first quarter of 2022. These companies reported a 5% decrease in capital expenditure in the second quarter of 2022 compared to the first quarter. Crude oil production was unchanged from the fourth quarter of 2021, despite a 10% increase from the first quarter of last year. Compared to pre-pandemic levels, output in Q1 2022 is 10% lower than Q1 2020.

Although rising crude oil prices boosted revenue in the first quarter of 2022, supply chain problems and financial losses from accident insurance contributed to increased costs. Production costs, such as COGS, operating expenses, and production taxes, totaled $28.06 per barrel of oil equivalent in the first quarter of this year, 59% higher than the average. pre-pandemic average and the highest level in any quarter of the year. past five years. Cost of goods soldincluding the cost of direct materials and labor used in production, have more than doubled from the pre-pandemic average.

Recently survey of oil and natural gas companies by the Federal Reserve Bank of Dallas found that 94% believe supply chain issues are having a negative impact on their companies and 66% think it will take more than a year. years to solve these problems.

Main Contributors: Alex DeKeyserling

Card: cost, crude oil, WTI (West Texas Intermediate), turnover

If capital expenditure doubles year-over-year, it’s not an investment… Then what happens?

Notice how the cost of drilling and producing oil goes up and down as cash flows from operations up and down. This is because the cost of drilling and producing oil goes up and down with the price of oil.

“Exxon Made More Money This Year Than God”

“Exxon, start investing and start paying taxes”

I don’t know how much money God makes… I think he probably created it all. Since Biden babbled this in June, neither he nor anyone else has known how much money ExxonMobil will make this year. It was June 11 when he broke his gums, before the end of the second quarter. We won’t know how much ExxonMobil will make this year until next year. They haven’t even reported their second quarter numbers yet… Most companies don’t. But we can look at what they did last year and compare that to a company where Biden never seems to lie.

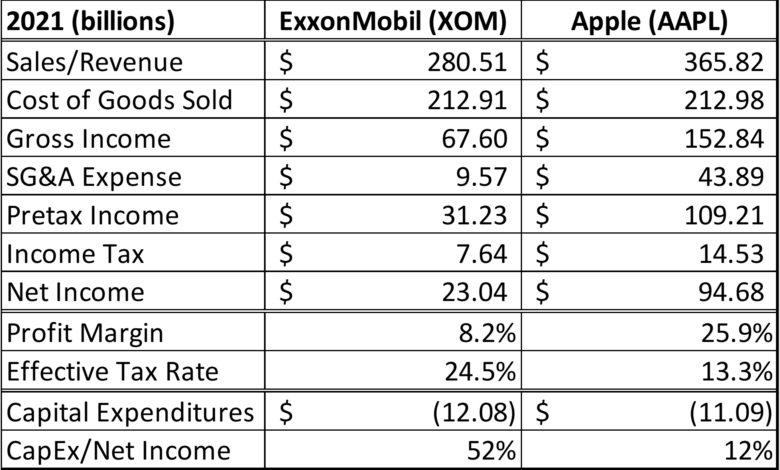

Based on the fact that ExxonMobil only generates an 8.2% profit margin, has a real income tax rate of 24.5%, and invests 52% of their net income back into the business *… I want say they make a lot less money than God, actively invest and pay their taxes. In practice, ExxonMobil’s effective tax rate is essentially the same as Biden’s.

Maybe it’s time for Apple to start investing and paying taxes for them.

Clarify

* Should, “invest the equivalent of 52% of their net income back into the business.” CapEx is from the cash flow statement, not the income statement.