US oil companies are in no rush to solve Biden’s gas price problem

What’s modified is that, below immense strain from Wall Avenue shareholders, oil corporations are lastly attempting to stay inside their means. Although crude has surged above $85 a barrel amid roaring demand, drillers are solely steadily including provide.

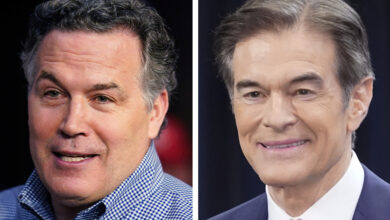

“They’ve PTSD. They’re scarred,” Robert McNally, president of consulting agency Rapidan Vitality Group, mentioned referring to US oil corporations.

US oil output is decrease than earlier than Covid

“Cease spending like drunk sailors. That is the message from shareholders,” mentioned Pavel Molchanov, an analyst at Raymond James.

That message was heard loud and clear. Regardless of increased costs, 50 of the most important oil corporations have elevated their annual budgets by simply 1% relative to their preliminary plans, based on Raymond James. As an alternative of plowing cash into costly drilling tasks, the oil-and-gas trade is concentrated on returning money to shareholders.

“It isn’t the federal government that’s banning them from drilling extra. It is strain from their shareholders,” mentioned Molchanov.

And it isn’t simply shareholders which can be demanding to receives a commission fatter dividends and rewarded with greater share buybacks.

The rise of the ESG motion is forcing fossil fuels corporations to rethink their futures.

Oil corporations are ‘very confused’

Not solely are oil corporations plowing cash into low-carbon companies, the local weather disaster has created huge uncertainty concerning the future demand for fossil fuels. Urge for food for gasoline is surging proper now because the economic system reopens from Covid. However the rise of electrical autos will change the outlook considerably within the years to return. Many count on oil demand to finally peak, although there stays nice debate over exactly when that can occur.

The oil trade has pointed to how this regulatory uncertainty is miserable its capacity to spend money on future tasks.

“Corporations are very confused about what the best tempo of funding ought to be. It is troublesome to plan when there’s such demand uncertainty,” mentioned Francisco Blanch, head of worldwide commodities at Financial institution of America.

But analysts mentioned it isn’t truthful to pin the blame for sluggish US oil provide, and thus excessive costs, on the local weather crackdown.

“Environmental regulation will play an enormous position within the oil and fuel trade within the subsequent decade and past. But it surely doesn’t by itself clarify why commodity costs are going up,” mentioned Molchanov, the Raymond James analyst.

‘They do not need them to spoil the celebration’

Numbers like these are seen as validation of the oil trade’s newfound self-discipline.

“Quite a lot of this has been pushed by investor sentiment. They do not need them to spoil the celebration,” mentioned Helima Croft, head of worldwide commodity technique at RBC Capital Markets.

The gradual return of US oil is an enormous downside for Biden, whose ballot numbers have tumbled partly as a result of excessive costs on gasoline and different gadgets.

Vitality Secretary Jennifer Granholm hinted at frustration over US provide.

Not like in OPEC nations, oil manufacturing is ready by non-public enterprise and the free market, not authorities leaders.

Biden’s local weather conundrum

Nonetheless, in concept, Biden might maintain talks with oil CEOs and urge them to activate the faucets to ease the ache on American drivers.

And so they might then ask him to slash purple tape and ease off environmental laws.

However that is not likely an choice for Biden, who ran on essentially the most aggressive local weather agenda in US presidential historical past.

Like all presidents, Biden needs to maintain power costs reasonably priced and stop costs on the pump from hitting ranges that gradual the economic system.

And but he cannot inform Large Oil to drill-baby-drill and nonetheless credibly argue his administration is doing its half to avoid wasting the planet.

Therein lies the inherent rigidity dealing with Biden proper now. His local weather ambitions are colliding head-on with financial actuality.