This is the year the financial industry skyrocketed

It wouldn’t matter if it all remained confined to the realm of social media. Except the last few years have seen an explosion of commission-free trading apps that allow easy access to the stock market — and suddenly everyone can follow their love of memes. US Securities and Exchange Commission Chairman Gary Gensler has often protested how Robinhood and its ilks have “gambled” on investments — through the inclusion of social media-like features, Fun push notifications and confetti animations in the best Vegas slot machine tradition. But the chemistry game goes beyond the flashy visuals: It deals with how easy to use and how cheap these trading apps are (until someone uses them up, with potential consequences). —being able to use them allows people to idle by trading instead in, say, play Candy Crush or strumming on the lute. “It’s just a hobby, in many ways: It’s a little money,” said Mel Stanfill, an assistant professor of games and interactive media at the University of Central Florida. “But in terms of scale, small sums turn into huge sums that can move the stock market.”

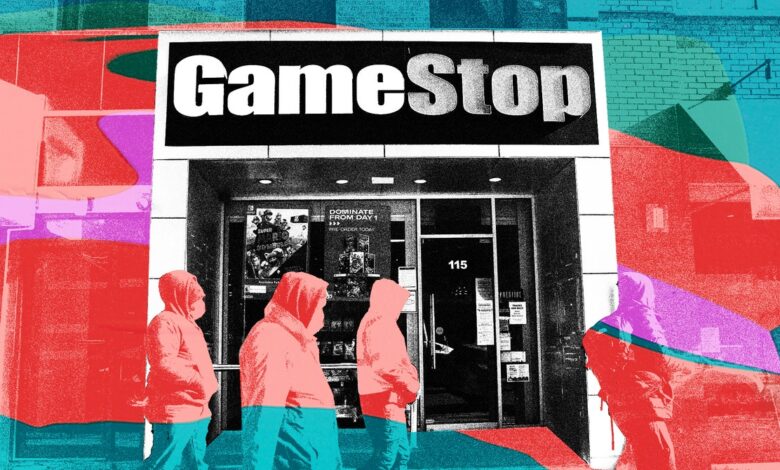

Combine a financial meme with a handy app and you’ll have a GameStop moment. Are people on r/wallstreetbets convinced of GameStop’s business potential? The “fanatics” among them — the likes of Keith Gill (aka DeepFuckingValue), one of the stock’s staunchest supporters — actually seem to think the retailer is on the verge of a comeback. sadly. Are the people on r/wallstreetbets trying to punish hedge funds? Some certainly did (and a few of their less-than-savory groups in Telegram’s QAnon-themed groups have launched the attack in vile anti-Semitic terms). But a lot of other people just joined in for fun, writing about how they wanted to.”looking for the moon” and “love this stock”—Their goal is to keep raising the price of GameStop and keep playing with their friends online.

Obviously, the return home memes increased dramatically this year, as millions of people globally, forced into their homes by the pandemic, were bored and looking for a pastime. On top of that, the US government issued a $1,200 stimulus check, providing much needed cash for many amateur traders. However, the financial memorization process has been around for a while. It has been thriving in 2020, with success beyond the imagination of less stocks like Kodak or Hertz, supported in a similar way through transaction on emerging applications. But really, you can go back to crypto.

Before everyone on r/wallstreetbets declared their love of the stock meme, people on other subreddits, as well as on Telegram and Twitter, shouted their misspelled motto, “HODL.” That is, “hold,” like buying a certain cryptocurrency — from Bitcoin to the latest scam — and holding it in your wallet in the hopes of its value increasing. once more, to the Moon. If spending large sums of money hoarding stock of a brick-and-mortar chain during a pandemic causes distrust — or much nihilism — then the confidence it takes to invest your savings in a New money whose price is determined simply by its popularity on the net is amazing. And yet, right after the GameStop craze, Crazy Dogecoin, with the Robinhood brigade pumping a imitate cryptocurrencies, its icon is a dog meme, from $0.0041 on January 1 to $0.5 on May. Elon Musk, who likes Dogecoin, has kept the attention high with a series of Doge-filled tweet and Dogecoin thank you on Saturday night live. In Q2 2021, Robinhood earned $144 million in revenue from Dogecoin trading. (Robinhood makes money from market makers placing actual trade orders, through a controversial mechanism known as order-flow settlement.)