Tesla stock price habit takes headlines from Rivian, Lucid collapses

When Tesla Inc.

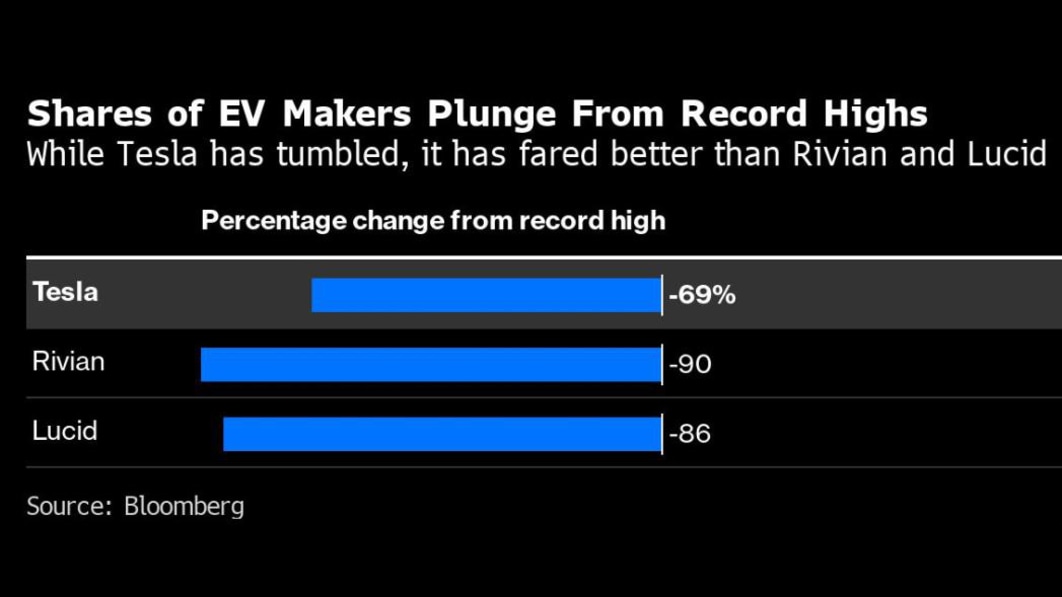

Two of the most prominent new EV manufacturers — Rivian Automotive Inc. and lucid Group Inc. — has lost about 90% of its equity value since the peak of the bull market, compared with Tesla’s 69% drop. Companies have struggled to ramp up vehicle production amid supply chain woes as investors grow wary of overvalued companies with no income.

“Tesla’s stock performance has certainly had an impact on the group, and the company’s own manufacturing issues have taken a heavy hit as well,” said Canaccord Genuity analyst George Gianarikas.

A representative for Rivian declined to comment on the stock price drop, while Lucid did not respond to a request for comment. Both stocks traded lower in New York on Thursday, with Rivian down as much as 3% and Lucid down 3.4%.

amazingness 740Tesla’s % gain in 2020 has helped fuel investor excitement in the sector. Types of EV stocks – whether companies are making passenger cars, commercial vehicle, bus or small car — booms, even the smallest names are worth several billion dollars. Rivian and Lucid are touted as potential “next Teslas,” with valuations greater than centuries-old car companies.

wisdom begins transactions in in July 2021 and its equity value peaked at $91 billion in November of that year. Rivian stock peaked just days after its November 2021 initial public offering, valuing the company at $153 billion — more than volkswagen AG, even though Rivian had no revenue at the time.

Rising interest rates over the past year and fears of a recession have limited investors’ risk appetite, driving them to flee loss-making companies with high expected growth. Rivian is currently worth $14.8 billion, while Lucid is valued at $13.7 billion. Even Tesla, which was already profitable, plunged, casting a shadow over the rest of the industry.

Lucid built 7,180 Air The sedans in 2022 are a far cry from the 20,000-car forecast earlier that year, as the automaker grapples with supply chain difficulties and logistical issues. Rivian also narrowly missed its goal of producing 25,000 vehicles annually.

Their falling share price will increase the cost of equity financing for automakers, which are still investing heavily in their businesses.

Lucid, which has $3.3 billion in cash, said in November that it could raise up to $1.5 billion in equity in the following months. Currently, Rivian has no immediate need to tap capital markets — the company has about $13.2 billion in cash as of September 30, which is expected to be sufficient through 2025, although although they spent a lot of money to bring models to market and expand production.

“People worry that at the rate of production, they won’t be able to produce cars fast enough to get to the point where they don’t need to raise cash anymore,” Canaccord’s Gianarikas said of Rivian.

EV startups are increasingly proving risky at a time when investors are looking for safe havens. Automotive manufacturing is already a capital-intensive, supply-chain-focused business. In addition, the industry is very sensitive to economic fluctuations and escalating borrowing costs increase the cost of financing a vehicle purchase. And as consumers tighten their wallets, electric cars, which are typically more expensive than gas-powered cars, are sure to be hit harder.

“Most non-yielding tech stocks were hit hard last year by Fed tightening and the commensurate impact on interest rates,” said Ivana Delevska, chief investment officer at SPEAR Invest. “But aside from that, fundamentals for EVs deteriorated in the fourth quarter as it became apparent that there was too much supply in the market.”

For Rivian, the sell-off was particularly bad. It underperforms Tesla and Lucid, as well as other electric vehicle makers like Nikola Corp., Fisher group, The North Star Automotive Holding UK Plc, Workhorse Group Inc. and Lordstown Motors Corp.

The disadvantages of being a smaller electric vehicle maker in the moment became more apparent last week when Tesla announced price cuts on its product line, a move that analysts say thought it could deal a stronger blow to competitors forced to follow suit. In the Friday trading session after the cuts were announced, shares of Rivian and Lucid fell more than Tesla’s.

Shrinking equity values and falling prices aren’t the only risks startups face. The pace of electric vehicle sales is also expected to be slower than previously expected. According to BloombergNEF, while the adoption of Electric Car will continue to increase in 2023, at a slower rate than two years ago.

“Even without a recession, the risks to the ‘next Teslas’ are high,” said SPEAR’s Delevska. “Tesla has scale and profitability right now, and while we expect that profitability to drop significantly, we don’t think Tesla will go out of business. Many newcomers will.”

Related videos: