Tesla could get ‘a lucrative revenue stream’ from selling credits with Biden’s mpg standards

Tesla has made selling emissions credits to other automakers a significant part of its revenue, and that could continue under stricter emissions standards set by the Biden Administration. proposed, according to a new source IHS Markit report.

IHS Markit argues that these new standards, along with the more stringent regulations expected in Europe and China, could constitute “a lucrative revenue stream” for Tesla in the coming years – and could Probably other EV newcomers as well.

Automakers that exceed fleet emissions targets generate credits, which can then be sold to automakers that fall short of the target. Because Tesla’s product line is all-electric, the automaker has made a quick business of selling emissions credits. IHS Markit noted that it made $5.3 billion from credit sales and total emissions globally, IHS Markit noted, citing a U.S. Securities and Exchange Commission (SEC) filing ).

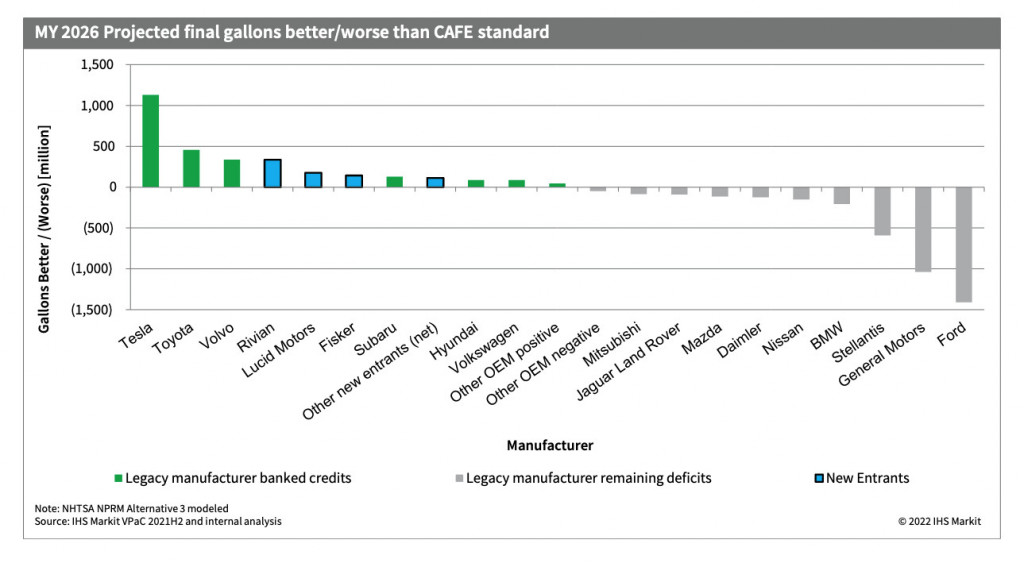

MY2026 expected gallon better/worse than EPA std – IHS Markit

The EPA has proposed standards that exhibit a cumulative 28% increase in rigor over the 2023-2026 model year period, IHS Markit noted. The organization predicts that fuel economy improvements may not keep up with these standards, leading to increased credit transactions.

Under current rules, an EPA report in 2021 seems to suggest that the fleet regulates itself it’s too easy for automakers to meet—Particularly consider alternatives with “out of cycle” credits. Especially larger trucks continue to be allowed one bar lower by U.S. standards, as vehicles are classified by their “footprint,” as well as by cars and light trucks.

For the 2026 model year, Tesla is predicted to have the most credit for sales, followed by Toyota and Volvo, according to IHS Markit. Rivian, Lucid and Fisker are predicted in the next three positions, but there is no guarantee that they will be able to scale up vehicle production.

Rivian R1T

This could be good news for Tesla, which could otherwise see some of its emissions credit revenue dry up. For example, Fiat Chrysler Automobiles (FCA) paid hundreds of millions of dollars for Tesla for emissions credits, allowing for more Ram and Jeep truck sales, but it says that like Stellantis it won’t need such credits.

IHS Markit predicts credit opportunities will be strongest in Europe over the next few years — potentially one reason why Tesla promote to build the factory ‘Giga Berlin’ quickly.

Coming soon, car manufacturers will also face higher fines for exceeding their allowable fleet emissions — potentially driving up credit prices even further.