Surreal but also real issue of excess qi in the UK | Business Newsletter

The UK energy system is drowning in natural gas. There’s so much going on in this country that at least for now, no one is sure what to do with it.

If at this stage you are wondering if you have lost your mind or are you reading an article from a year or two ago: no.

It’s mid-May 2022; the war in Ukraine is still raging; Europe is desperately trying to phase out Russian natural gas, and the UK’s household energy bills (including gas bills) are at record levels.

And I promise I won’t lose my marbles. The UK is indeed experiencing an almost unprecedented glut of natural gas.

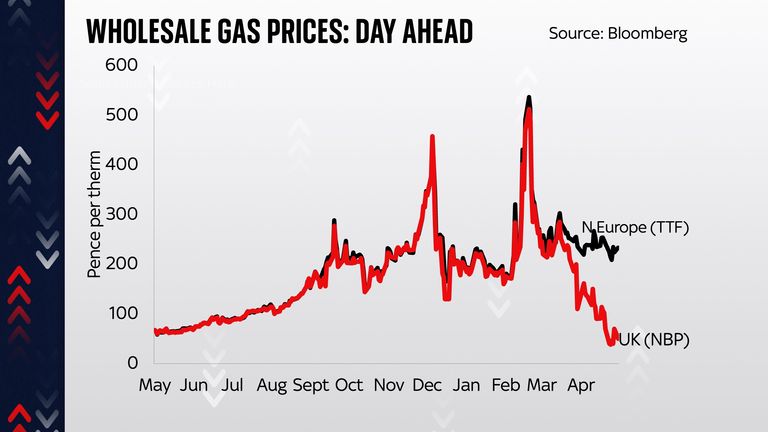

This may sound far-fetched, so let’s take it as proof of the spot price of gasoline on the wholesale markets right now. Here we are talking about what is known as the “immediate” price: the price you must pay for natural gas if you want it delivered tomorrow.

The main Nordic price (TTF, as it is known) has fallen a bit since Russia invaded Ukraine but it is still significantly higher than it was before the invasion and more than double what it was last summer.

Now look at the UK’s main wholesale gas price, the NBP or the “national equilibrium point” to give it a technical name. It dropped from about 285p a heat in late March to just 38p a few days ago. At the time of writing, it was bouncing up to 100p a heat, but still much lower than it was before the Russian invasion. In fact, this wholesale price is at its lowest level in nearly 18 months.

What’s going on here? Why are prices in the UK so low, while across the channel are still so high?

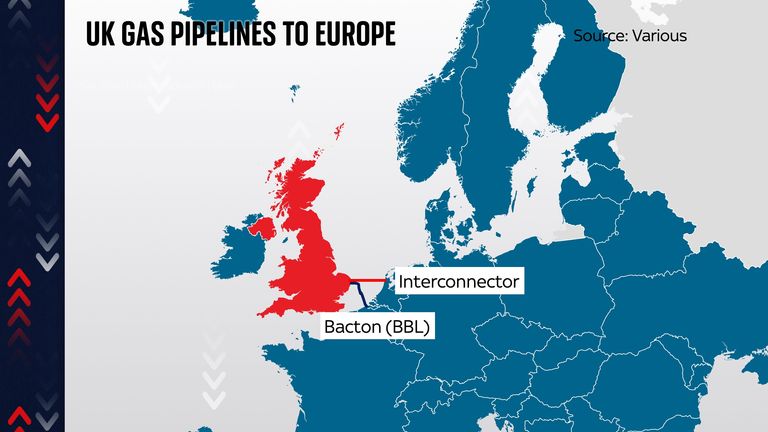

To understand the answer, you need to remember that energy markets are largely a product of physical infrastructure. Not only do you need to get natural gas out of the ground, you also need to build pipelines to get it into people’s homes. When it comes to gas, geography matters; steel pipe problem.

Much of Europe, as we all know, relies heavily on Russian gas, much of which is routed through a chain of pipelines across Eastern Europe, the Baltic, and the Black Sea into central Europe. In particular, Germany is very dependent on this gas flow.

And, as you well know, everyone in Europe is doing everything to reduce dependence on Russian gas.

Good news…and not so good

Now, Europe is likely to get more gas from North Africa and some more from Azerbaijan, which is building new pipelines into the continent. It can’t get more gas from the North Sea, from Norway or the UK – in large part because they (mainly Norway) are currently pumping as much as they can.

That leads to another option: get gas from the tanker more remotely. The good news here is that there’s quite a bit of potential for gas, especially from the US, where shale deposits are producing methane at a rapid rate.

But now we run into another problem with physical infrastructure: even with an infinite supply of gas in the US and an infinite number of LNG (liquefied natural gas) tankers to transport. ship it to Europe, there are still not enough ports where we can get it. In fact, it’s a bit more sophisticated than that: there aren’t enough LNG terminals in place.

In fact, there is a lot of LNG capacity in the Iberian peninsula, but the problem is that the pipeline from Spain to Germany is really difficult. There are three major railway stations in the UK. There are several stations in France. But there isn’t a single LNG terminal in Germany.

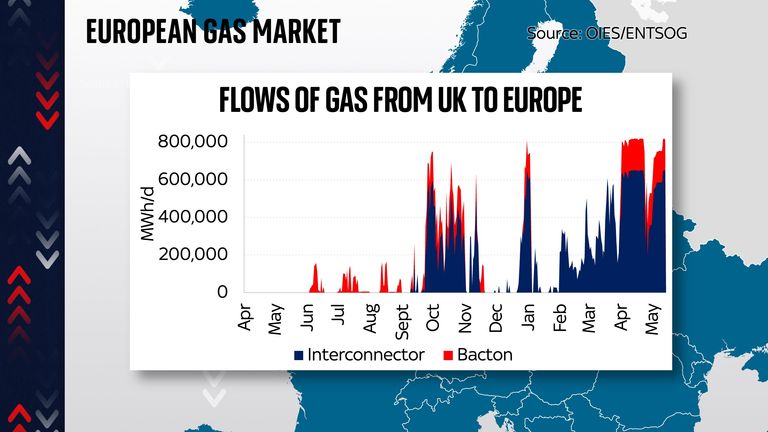

In recent months, there has been a large amount of LNG being diverted to Europe (attracted by high gas prices), but the ships are running out of space to bring their gas. This brings us back to the UK, where a lot of LNG has been flowing out of tankers, through refueling facilities and into the gas grid in recent weeks. The two gas pipelines connecting the UK to the rest of Europe are currently operating at full capacity (in fact, they have recently run at 20% more capacity).

The problem, however, is that these pipelines simply aren’t big enough to push all the gas into the UK via those LNG carriers into mainland Europe. And since we don’t have a lot of domestic stock in this country, and since it’s pretty warm right now and most of our boilers are off, there’s really nowhere else to use gas.

There have been some odd consequences. One is that with increasingly cheap gas available, UK electricity producers have been happy, turning on their gas-fired power plants and producing as much electricity as they can.

As a result, the UK, which is often dependent on electricity imports from the continent, has temporarily become a major exporter of electricity, bringing electricity at more than 4 gigawatts to mainland Europe in recent days. .

Another result is that not only are natural gas prices very low, wholesale electricity prices are also lower in this country than in most other parts of Europe.

Fun footnote: if Britain had more domestic reserves (instead of running out of our largest underground gas tank a few years ago), we could put a lot of this cheap gas aside , before a terrible winter. Instead, we burn it in power stations. On the other hand, if we have a lot of stockpiles then that is the extra demand for gas, which could mean that this price anomaly won’t happen.

Anyway, at this stage you may be wondering: how long until this is reflected in my bill? Is the cost of living crisis over now?

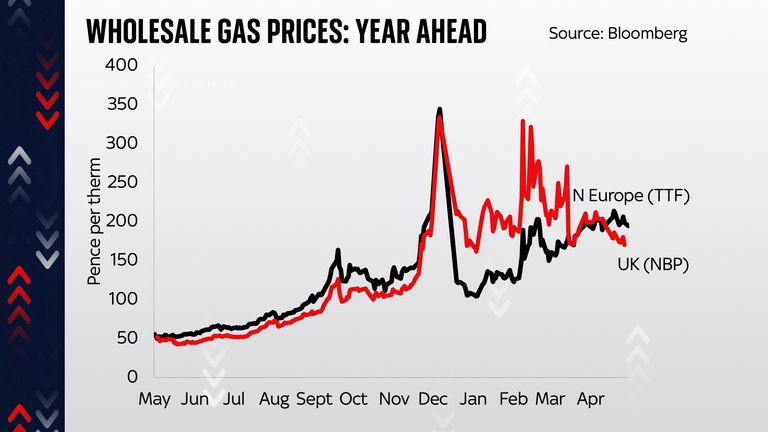

I’m afraid the answer in both cases is boredom. While it is certain that the actual wholesale prices of gas and electricity for next-day delivery are indeed rock bottoms, the domestic energy suppliers we all have accounts with say they instead tend to sign energy contracts for delivery months or even years ahead.

And when you look at the price of gas next year, it’s at roughly the level of Nordic and still significantly higher than it was before the invasion. In other words, even though the UK is drowning in gas, the markets assume we won’t be around for a few more months, and so consumers won’t be as relieved by the prices. This is very low.

One reason these markets may be correct, is that many countries in Northern Europe are moving very quickly to install LNG capacity.

According to Mike Fulwood of the Oxford Institute for Energy Studies, although it would take several years to build a gas terminal as complete as the three we have in the UK, there is a temporary solution: special tankers. These are known as floating storage platforms (FSRUs).

The Dutch have already put a few of them up and running, and Germany is planning to launch one of them in the winter. So come the cold months, the market can actually be proven right.

This very low price may just be a temporary anomaly.

Even so, there was something bizarre about the situation. If, in a short period of time, during a period of natural gas shortages, the price of natural gas rises to a record, Britain suddenly has a surplus of gas.