Shell boss Ben van Beurden left two big legacies when his successor was named | Business newsletter

Ben van Beurden, whose departure as Shell chief executive officer at the end of the year was confirmed on Thursday morning, leaves behind at least two major legacies.

The first is the £47 billion blockbuster takeover, announced in April 2015, by BG Group.

The deal drew criticism at the time. There’s a lot of uncertainty, at a time of falling oil and gas prices, about Shell’s ability to maintain dividend payments – which then account for £1 out of every £9 in dividends that companies pay. UK company pays. The company has been accused of overpaying BG.

Mr. van Beurden’s argument is that, at a time when Shell’s reserves fall, BG will significantly improve its position on that front. It is also a big bet on the recovery of oil and gas prices and a big strategic bet on liquefied natural gas (LNG).

In this case, the Dutch player is forced to Shell’s dividend cut for the first time since the Second World War in 2020, but that was due to the drop in oil and gas prices at the start of the pandemic.

At the time, the acquisition of BG Group proved shrewd, even more so since Russia’s attack on Ukraine this year sparked a global LNG scramble. Shell currently accounts for about 15-20% of the global LNG market – a position that will serve the company well for many years to come.

Along with BG Group, Mr. van Beurden is also busy reshaping Shell’s portfolio, weeding out less profitable or more productive assets. Of course, this is less flashy or eye-catching than the acquisition of BG Group, but it is still important to improve the overall efficiency of the team.

On Thursday, Shell pointed to an $80 billion divestment that has been completed over the past decade – something that has the company concerned about its debts and that would not have been possible without it. provide a higher quality source of income. implemented by the BG agreement.

The second major legacy Mr van Beurden will point to is that he kicked off Shell’s transition away from fossil fuels and towards renewable energy.

He announced in April 2020 that Shell would seek to become a net zero-emissions business by 2050 or earlier and while a fierce debate still rages in the industry over whether Shell or its rival BP is more ambitious find the way to solve climate changeIt is indisputable that both are ahead of the other global energy giants.

Of course, Shell will never be able to move fast enough to satisfy critics of the green movement, especially after it decided to protest. Judgment of the Dutch court last year required it to cut its net carbon emissions by 45% by 2030.

Skeptics also point to the fact that, according to this year’s results, renewables still make up just 5% or more of Shell’s total income – although part of that could be explained by Shell’s traditional hydrocarbon business has been more profitable. by the spike in oil and gas prices this year.

The company also highlights that, over the past decade, it has reduced its ‘Scope 1’ and ‘Scope 2’ emissions by a third (those caused directly or indirectly as a result of its operations). ).

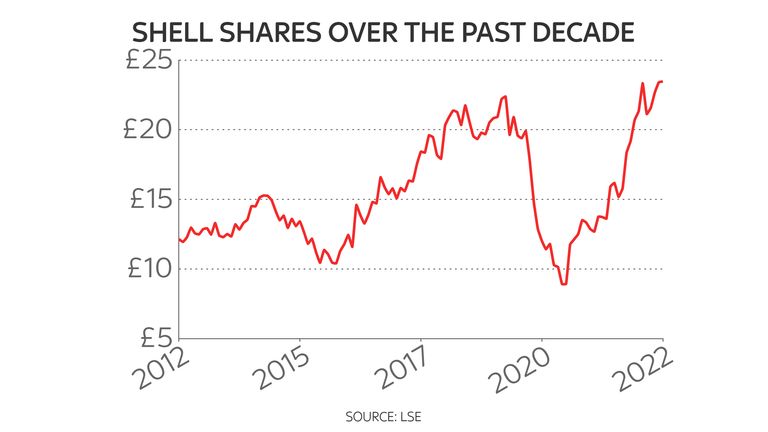

While those are the two major achievements Mr van Beurden can point to, somewhat more obscure is his legacy of pure stock price.

For most of the time since van Beurden became chief executive officer, in early 2014 Shell’s share price has been trading below what it was when he took the helm (at the time of writing this was around 9%). before that date).

Shell would legitimately argue that was partly due to events beyond van Beurden’s control, such as the pandemic, while it could also argue that a close comparison with January 2014 was also difficult because of the company’s landmark decision, last year, to be abandon its complicated double sharing arrangement and moved its tax residence from the Netherlands to the UK – in the process removing ‘Royal of the Netherlands’ from the company moniker.

Shell also highlighted a slide from its recent results presentation, pointing out that its organic free cash flow for the first half of this year was three times what it was in the same period in 2013 when Brent Crude was trading at a premium. almost the same price.

It also shows that adjusted earnings are up 65% from the previous period and distribution to shareholders has increased from $6.4 billion in the first half of 2013 to $12.8 billion in the first half of this year. . The company could also argue that, in absolute terms, Shell’s share price performance over the period has outperformed its global peers such as Exxon, Chevron and BP, although not Total. Energies.

When choosing Wael Sawan as Mr. van Beurden’s successor, Shell was very selective about his successor.

Mr. Sawan, who was born in Beirut and holds dual Lebanese-Canadian citizenship, was seen by investors as a frontrunner to succeed Mr. van Beurden when rumors began earlier this summer that he was set to retire. .

Currently director of Integrated Energy, Energy and Gas Solutions, he has been with Shell for 25 years, during which time he has made his mark in many key parts of the business. Karma.

Shell President Sir Andrew Mackenzie said: “Wael Sawan is an outstanding leader, with all the qualities needed to safely and profitably lead Shell during a period of transformation and growth. His track record of commercial, operational and transformation success not only reflects his extensive experience and knowledge of Shell and the energy sector, but also a clear strategy. your.

“He combines these qualities with a passion for people, which helps him get the best out of the people around him.”

The reason it is unlikely to change the strategic direction is because it has been posited by Mr. van Beurden. It can be summarized as generating enough capital from the company’s existing oil and gas assets to further invest in the energy transition.

Easier said than done and Mr. Sawan will face many challenges.

The most important of these is to satisfy the multitude of different stakeholders that Shell has. Governments and consumers want certainty about supply security, at a time when Vladimir Putin has weaponized energy, while investors want superior financial returns. Employees want a company they are proud to work for and where their safety is valued. And all want an efficient transition to pure zero – although opinions may differ on how quickly this is achieved.

That’s why running Shell is one of the biggest jobs in global business.

In full time, Mr van Beurden will be considered to have acquitted himself very well during those nine years of doing so.