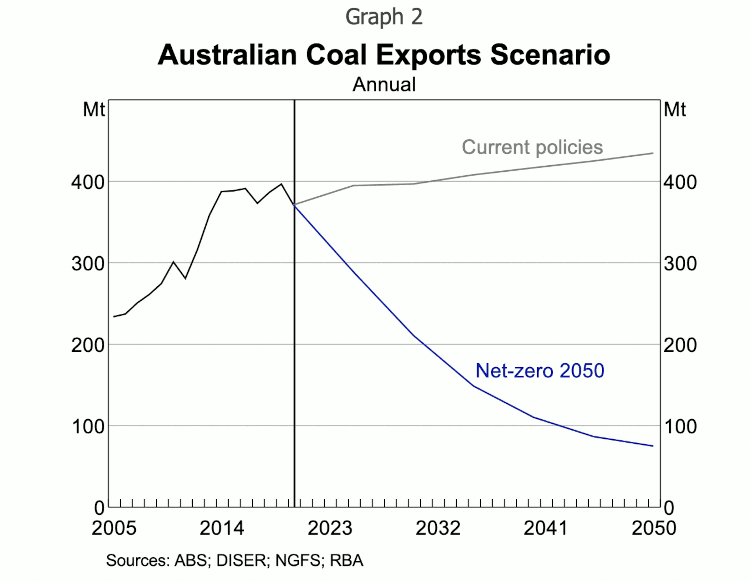

Reserve Bank of Australia predicts collapse in coal exports – A sharp drop with that?

[*]

Essay by Eric Worrall

There was a time when bankers felt embarrassed when they published a ridiculously unrealistic chart like the product at the top of this page.

Climate change risks in the financial system

Jonathan Kearns[*]

Head of Domestic MarketCredit Law Seminar ‘Managing Financial Services Risks in an Age of Uncertainty’

Sydney – August 24, 2022Introduce

Climate change is a significant issue with far-reaching implications for the economy, financial system and society. The average temperature in Australia has increased by 1.4 degrees since 1910, and climate scientists tell us that with current policies, the average temperature will rise by about 2.7 degrees above the average. pre-industrial by 2100.[1] The frequency of extreme weather events has increased, with many days of excessive rainfall and a high risk of fire and explosion (Figure 1).[2] We’ve seen how climate change is already affecting people’s lives in Australia and around the world, and it will continue to do so. The climate will continue to warm, with associated changes in the overall climate system over the next 20–30 years, largely independent of our emissions trajectories.[3] But our actions in the coming years will clearly influence the way climate change is already underway.

…

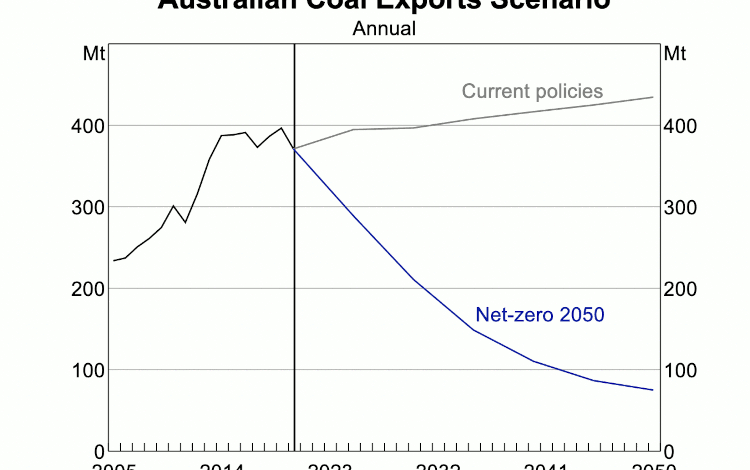

Transition risk will almost certainly be related to changes to the structure of the economy. An important aspect of transition risk is its strong international dimension. Not only are changes in domestic policies, incentives and technology relevant to the Australian economy – given the importance of international trade in goods, services and capital, the global changes are also significant. tell. For example, policy decisions or changes in priorities in other countries regarding their coal use will affect Australia’s coal exports.that is a scenario the Bank has considered in terms of its impact on the economy (Figure 2).[4]

…

Read more: https://www.rba.gov.au/spearies/2022/sp-so-2022-08-24.html

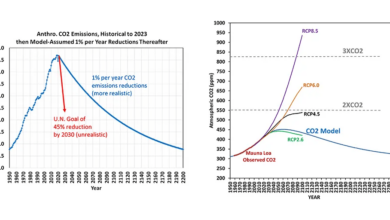

The RBA speech recording contains a similar graph for overall greenhouse gas emissions (5 . graph).

Back to the real world, Europe is restarting coal plants, while declaring all temporary, Japan just started a new coal plant, China is making coal as fast as it canand even dark green Australia is paying coal capacity subsidies to prevent miners from closing their plants.

I expect a sharp downturn in coal and gas exports to be imminent, along with all other economic activity. Europe and Britain are about to experience a deep recession, thanks to their politicians’ energy policies, the Chinese economy is in free fall, with bank runs and real estate collapsing. Ponzi scheme engulfs at least a third of their economy, New Zealand has embraced green purity to the point where they seem to ban all forms of economic activity, and the US is run by people who don’t understand the economy. economic or business.

If everyone were to copy New Zealand’s climate policies, global economic activity could tumble and return to medieval levels for a long time. But New Zealand seems to be a special case. Even Europe doesn’t accept how fresh the climate is in New Zealand, it’s as busy restarting coal plants as most.

As the global economy recovers from the coming recession, I think we can safely predict that the economy will not be powered by solar panels, regardless of governments. What public statements have been made about their energy policy intentions around the world?

Related

[*]

[*]Source link