NFTS is about to have exclusive programs for loyal customers at brands like Budweiser

Alex Tai | SOPA images | beautiful pictures

NFTor irreplaceable tokens, have appeared in every nook and cranny of the Internet, and every business is willing to throw money at the so-called “Web3“- a hypothetical, future version of the network based on blockchain technology.

As they do, Cavea new B2B startup in the fledgling space, looking to help some of the world’s biggest brands replace their existing loyalty and membership programs with NFTs using this technology.

The growth of the Internet means that anyone can view pictures, videos and songs online for free. People are buying NFTs because they believe they will be able to prove ownership of a virtual item through blockchain technology, which serves as a digital ledger of transaction history.

Last week, the company announced that it has raised a $16 million Series A funding round led by crypto venture firm Paradigm, which holds stakes in some of the biggest crypto players, including FTX , BlockFi and Coinbase. Hang’s other investors include Tiger Global, an eyewear company Warby Parkershoe retailer Allbirds and Kevin Durant’s Thirty Five Ventures, among others. Its early customers included Budweiser, Bleacher Report, Pinkberry as well as music festival groups Bonnaroo and Superfly.

“For most brands of a certain size, it’s hard to offset the growing customer acquisition costs,” Hang co-founder and CEO Matt Smolin told CNBC. “The best way to do that is to increase the lifetime value of their user base and mine loyalty,” which he adds is often done through a level-based reward system: guest The more often a customer purchases something or interacts with a certain brand, the more benefits they receive, and in some cases, they can “promote” to a certain type of customer status.

“Thanks to blockchain technology, NFT creates a way for brands to incentivize their users to not only rank to a new level in their program, but to truly appreciate the value of the assets they own. owned and can then be resold. [NFT] Smolin said.[Brands] can also take royalties or percentages from each resale as users continue to fast track their loyalty status, which will definitely make them a better fit for that brand. “

But its not without its risks.

NFT is a unique digital asset, usually collectibles such as works of art and sports trading cardare also verified and stored using blockchain technology, but critics consider them too much and potentially harmful to the environment due to the energy-intensive nature of cryptocurrencies. Multiple NFTs are built on the back-end network ethereumsecond largest token.

CNBC’s Eamon Javers recent report that, since May, criminals have stolen up to $22 million in NFTs using Discord – a social platform that has become a hotbed for crypto traders to communicate in recent years. this. Analytics firm TRM Labs discovered that there were at least 10 compromised accounts in NFT channels on the Discord platform last month. Those hackers used what the company calls “social engineering” techniques to create a false sense of urgency about a certain digital asset, sending impersonated messages that would incite “FOMO”, or fear of missing out, in users looking to buy or sell their NFT.

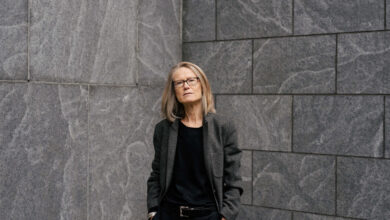

Matt Smolin, co-founder and CEO of Hang

Carlton Canary

“Much of what we’re doing isn’t really for your typical crypto audience,” Smolin said. “We’re trying to work with some of the biggest brands in the world and help them solve real-world problems for their businesses. Yes: if [the brand] want, they can ask their customers to pay in ethereum or any crypto token, but for the most part, many of these brands are actually opting for their customers and users to sign up with email and credit cards. “

That would, of course, involve the brand converting the customer payment into crypto to complete the NFT transaction as the basis for a certain reward redemption. But Smolin asserts that Hang’s long-term success, and wider adoption of NFT beyond artists and collectors, will rest on integrating some of the trading technologies that consumers are already familiar with, “like,” email and credit cards.”

Investors were quick to confirm that lasting value in digital assets will come from their utility. It’s a message that is hard for institutional investors to digest in the form of collectible artwork, such as the striking Bored Ape Yacht Club and Crypto Punks, which continue to experience price volatility significantly parallels recent times”crypto winter“Depression.

“The Bored Ape Yacht Club model is all about exclusive, limited supply and that really works for them. But for most brands, attracting millions of people spends. spending 10% more per year than it does for 10,000 people per year would have a much more impact. people spend $400 once or twice,” he said. “A lot of the future we’re building is towards these NFTs being free and users actually getting them in the store, on the website, or in an app. And there’s no longer a scarcity of resources. the number of NFTs being sold as well, which is just the leveling system.”

It’s a new perspective in the struggling crypto industry. In the midst of the “crypto winter”, big names like Three Arrows Capital and lending institutions like Celsius and Voyager Digital have all filed for bankruptcy, shakes confidence in the industry.

Still, ethereum and other coins rise in price this week, with ethereum hitting its highest level in almost a year, after a protracted plunge that saw it drop nearly 70% from its peak last November.