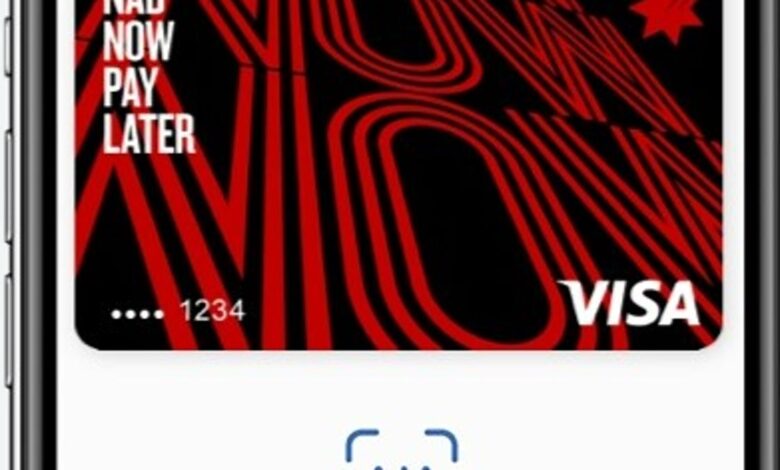

NAB introduces NAB Now Pay Later when entering the BNPL market

National Australia Bank (NAB) has entered the buy now, pay later (BNPL) market with the launch of NAB Now Pay Later.

NAB boasts that unlike other BNPL products, NAB Now Pay Later does not charge late fees, interest and account fees. Customers will be able to access up to A$1,000, split purchases into four payments and use it anywhere Visa cards are accepted.

Speaking to ZDNet, NAB personal banking chief executive officer, CIO Ana Cammaroto, explained the bank’s introduction of a version of the BNPL product was based on customer needs.

“We’re continuing to monitor the market and although some of the conversation you see going on [about BNPL], our customers are voting with their experience and clicks. They say they want that accessibility, they want that ease,” she said.

Cammaroto emphasizes that a key design aspect of the new product is that it is made in-house.

“We didn’t buy it, and it was an important decision for us in advance,” she said.

“We want it to be fully integrated into our existing data, our existing systems and our existing experiences, so that at no stage we are putting our customers at risk. ourselves or through security or fraud – or any other risk – by partnering with something outside of our ecosystem.”

NAB Now Pay Later will be integrated into the NAB app, allowing customers to add it to their digital wallet for online or in-person payments as a virtual card with built-in spin and detection security numbers. biometric fraud.

“We do a lot of behavioral analysis… that’s our mechanism for protecting our customers when it comes to fraud, because cybercriminals don’t do that – they don’t work the way our customers do. we do,” Cammaroto said.

“Being able to do that because we have access to that information is very important. Then it’s the little features like CVV roaming that are hugely important… this gives the customer a lot.” peace of mind.”

Cammaroto also believes that the company’s ability to provide products microservices architecture.

“100% of our microservices are in the cloud, 40% are fully reused. I don’t need to worry about scaling them. I don’t need to worry about securing them. I no need to worry about doing anything other than just turn them on,” she said.

“For 40% we made some minor feature modifications but again, no security, no care about resiliency, no concern about performance, I can focus in 10% made the difference.”

NAB is the second largest bank entering the BNPL market. Commonwealth Bank of Australia has announced its version called Payment step last year. At that time, the CBA stated that their decision to enter the market was because they thought that will spur policymakersto promote the current way of managing the emerging region.

Under current regulations, when signing up for BNPL services, such as Afterpay and Zip Co, customers are not required to go through a credit check – they simply sign up and spend.

However, for NAB Now Pay Later, Cammaroto guarantees a credit check will be performed.

Customers can start pre-registering for early access now, with the product expected to be released in July.