India Smartphone Shipments Down 1% Last Quarter, Xiaomi Top Brand: Counterpoint

India’s smartphone shipments fell 1% year-on-year (YoY) in Q1-March 2012. Due to component shortages and plummeting demand, smartphone shipments reached 38 million units in Q1 2022. The data has been revealed in a latest study from Counterpoint’s Market Monitoring service, which reflects the impact of COVID-19 on the smartphone market in India. The third wave of the pandemic, which hit the country in January of this year, caused a slow start to the quarter, a pace that accelerated in the last few weeks of the March quarter.

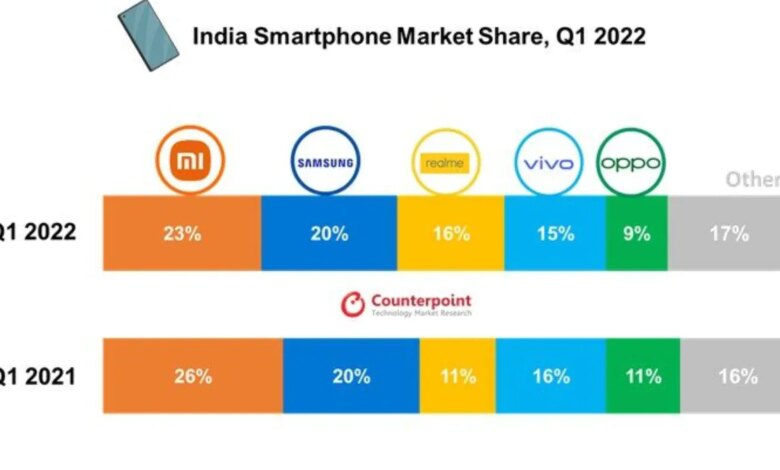

According to a report of Counterpoint Research, despite the decline, Chinese brands still dominated with over 74% market share in Q1 2022. Just like the first quarter of last year, Xiaomi remains at the top of the Indian smartphone market with a 23% market share. However, its year-over-year market share fell 13% year-on-year. Counterpoint’s shipments figures for Xiaomi include Poco brand. The Chinese smartphone maker has managed to stay ahead of the market even amid stiff competition, component shortages and inflation. The brand has also won second place in 5G shipments for the first time in the Indian market.

Xiaomi followed by Korean smartphone brand SAMSUNG, which boosted consumer demand with the introduction of the Galaxy A series. Interestingly, the company retained its top spot as the best-selling 5G smartphone brand in India in the fourth quarter. two in a row. With a 1% year-on-year decline in Q1 2022, Samsung held a 20% market share in smartphone shipments.

Next on the list is Myself, the only brand among the top 5 to achieve 40% year-on-year growth in Q1 2022. Realme’s market share was at 16%, up from 11% last year in Q 1. Shipments for Realme models have seen a quick pick-up after the festive season. Other factors in favor of Realme are the use of Unisoc chipsets, a targeted product portfolio and an aggressive channel strategy.

Vivo and Oppo take fourth and fifth place, respectively. While Vivo faced an 8% year-on-year decline, Oppo’s shipments fell 18% year-on-year in Q1 2022, however. Vivo’s intelligence is at 15%, while Oppo accounts for 9%. Counterpoint’s Oppo figures do not include OnePlus brand.

Apple recorded 5% year-on-year growth in Q1 2022, being the best-selling brand in the premium segment, the report said.

![]()

India’s overall handset market share

Image source: Counterpoint Research

For India’s overall handset market (feature phone + smartphone), Counterpoint reports 16% year-on-year shipments and feature phone market in particular saw shipments drop by 39% year-on-year. Itel leading the feature phone market, with 21% market share. When combining all the trademarks of Transsion Group – Itel, Infinix, Tecno – the company occupies the fourth place in the overall handset market. Meanwhile, OnePlus grew 347% year-on-year in Q1 2022, showing the success of OnePlus Nord CE 2 5G and OnePlus 9RT shipments. OnePlus also takes third place in the premium segment.

Of the total smartphone shipments, 5G handsets contributed more than 28%, along with a growth of 314% year-on-year. The market share is expected to surpass 40% in the coming quarters.