Federal Reserve is about to set its post-crisis policy course

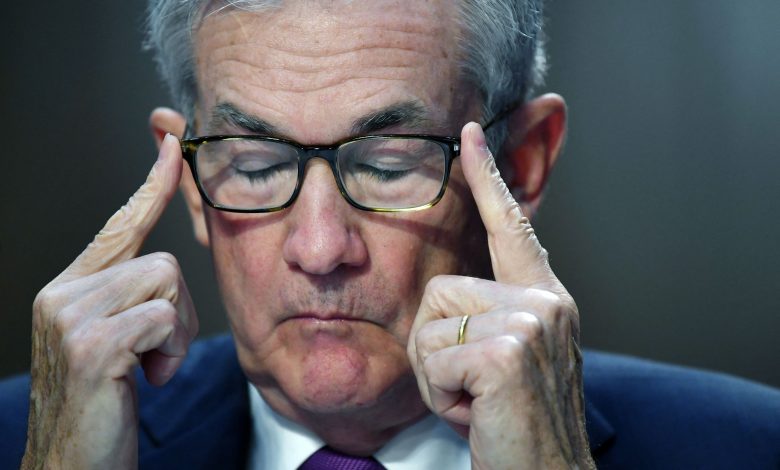

Chair of the Federal Reserve Jerome Powell seems earlier than a Senate Banking, Housing and City Affairs Committee listening to on the CARES Act, on the Hart Senate Workplace Constructing on September 28, 2021 in Washington, DC. – The listening to will study the consequences and outcomes of the Coronavirus Help, Aid, and Financial Safety Act, also called the CARES ACT.

Matt McClain | AFP | Getty Pictures

When the Federal Reserve adjourns its assembly Wednesday, it is going to be doing greater than cutting down its financial assist. The central financial institution might be charting a course for its post-pandemic future.

Just about everybody who cares about such issues anticipates the policymaking Federal Open Market Committee, upon the conclusion of its two-day assembly, will announce that it is reducing the amount of bonds it buys every month.

The method, know as “tapering,” most likely will start earlier than November ends.

In doing so, the Fed might be stepping away from a historic degree of help for the economic system and into a brand new regime by which it is going to nonetheless be utilizing its instruments to a lesser diploma.

Although the transfer to chop the $120 billion a month in bond purchases has been effectively telegraphed, there may be nonetheless threat for the Fed in the way it communicates the place it goes from right here.

Speak up the tapering an excessive amount of, and buyers will get nervous that rate of interest hikes are coming. Tender-pedal the transfer an excessive amount of, and the market might suppose the Fed is ignoring the inflation menace. There’s threat to each an excessive amount of optimism and an excessive amount of pessimism that the FOMC and Chairman Jerome Powell should keep away from.

“There’s only a very big selection of potential outcomes. They must be nimble and responsive,” mentioned Invoice English, a former senior Fed advisor and now a professor on the Yale Faculty of Administration. “I fear that the markets will suppose that they are on a gradual monitor to run purchases down after which start elevating charges when they might simply not be. They might need to act extra shortly, they might have to boost them extra slowly.”

As issues stand, the market is betting the first rate increase will come in June 2022, adopted by no less than one — and maybe two — extra earlier than the yr is out. Of their most up-to-date projections, FOMC members indicated a small probability of pulling the primary hike into subsequent yr.

For Powell, his post-meeting information convention needs to be a possibility to emphasize the Fed just isn’t on a preset course in both path.

“He wants to notice that there are dangers on either side. After all, there are dangers that the inflation we have seen proves extra persistent than they hoped,” English mentioned. “I would like to listen to him say there are draw back dangers. Fiscal coverage is tightening quite a bit.”

Certainly, at a time when the Fed is beginning to pull again on its financial coverage assist, Congress is offering much less assist from its aspect after pouring greater than $5 trillion into the economic system in the course of the Covid disaster.

Whereas fiscal spending added practically 7.9% to the economic system to begin 2021, that has morphed right into a drag that may see it subtract shut to three.8% by the center of 2022, in response to a gauge developed by the Brookings Institution’s Hutchins Heart on Fiscal and Financial Coverage.

That makes circumstances much more difficult for the Fed.

‘A giant change in tune’

The committee makes use of its post-meeting assertion to explain the way it feels about financial situations — GDP, employment, housing, commerce and the pandemic’s affect – and the way they might feed into coverage.

Via the pandemic, the Fed has developed boiler-plate language stressing economic growth but continued risks from the pandemic that necessitate straightforward coverage. This assembly, although, will possible see substantial adjustments to that assertion to put out a brand new course.

“It is a massive change in tune,” John Hancock Funding Administration co-chief funding strategist Matt Miskin mentioned. “You return six months, and the Fed was fully dovish. They have been assured within the transitory part [of inflation], they have been assured within the economic system doing effectively, they usually nonetheless had the time wanted for therapeutic, and it is actually modified. So, we do see quite a lot of change in language.”

In latest days, Powell and his colleagues have been walking back the “transitory” call on inflation. As a substitute, they’ve been saying that worth will increase have been stronger and longer lasting than that they had thought, and stress that the Fed has the suitable instruments — price hikes — to handle the state of affairs.

“The Fed has needed inflation for a lot of the final 10 years, they usually have been unable to generate it with [quantitative easing] and low rates of interest,” Miskin mentioned. “However now it is right here, and it simply goes to indicate it’s a must to watch out what you want for.”

The post-meeting assertion, then, possible will replicate the inflation realities in addition to the altering form of the economic system because it heads right into a post-crisis future.

Financial institution of America economists and market strategists anticipate a number of adjustments: a notice explaining the tapering course of and its versatile nature; a change within the characterization of inflation, from “reflecting transitory elements” to including a qualifier like “largely” or “partly;” and maybe some steering both from the Powell information convention or the assertion that may emphasize the Fed is tapering with out tightening.

In spite of everything, the Fed will nonetheless be buying extra bonds than it ever had pre-crisis for the subsequent a number of months, and its $8.6 trillion balance sheet will proceed to develop previous $9 trillion within the early a part of subsequent yr. There are not any discussions but on when the Fed will truly cut back its bond holdings, and that possible will not come till price hikes are underway.

“We predict Powell will possible use the press convention as a possibility to underscore that the tip of tapering doesn’t robotically imply the start of hikes. He’ll possible emphasize that the 2 coverage actions are distinct,” Financial institution of America World Analysis mentioned in a notice.

Markets are ready for the Fed taper, however such events will be supply of market volatility. So Powell should select his phrases rigorously.

“The market’s already priced in a comparatively swift taper and price hikes within the second half of subsequent yr. So in that sense, I feel it isn’t apparent that there might be an issue,” English, the previous Fed official, mentioned. “It will be useful if he simply added that the world is an unsure place and we’re not locked into something, we’ll modify as we have to adjustments within the outlook.”