ESG is the mental bully of the investment world – How to get there?

By Linnea Lueken and H. Sterling Burnett

Without swift action, environmental, social and governance (ESG) scoring frameworks will become hopelessly embedded in our daily lives, and ESG promoters don’t care about our health. our health.

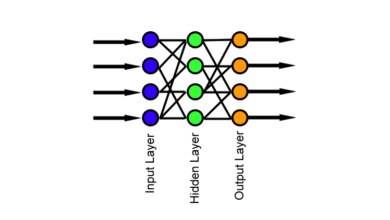

For those who are still new to the ESG movement, at its core is a mechanism of “that a group of influential interests are ideologically linked working through unelected supranational institutions that are trying to ‘reset’ the global financial system to their advantage.” Disrupting national sovereignty, free markets, and individual rights, global government organizations, bureaucrats tampering with their employees, and governments that fund and establish their membership are doing Working with international corporations and financial elites to change traditional financial methods for risk assessment and capital and credit allocation. Under the ESG system, companies and potentially soon individuals will be assigned an arbitrarily defined ESG social credit score, which financial institutions, portfolio managers, and Tech can use it to guide investment choices, decide who can get into banking or license business, and who can join on social media platforms. Basically, ESG is a backdoor for a social credit scoreencouraged by the government, and often imposed through regulations.

ESG is particularly interested in social justice and fossil fuel divestment, and your business can be scored whether you like it or not.

Companies (and finally individual) do not get a high possible ESG score punishment; Banks may refuse to lend or limit capital investment for the company. There may also be limited access to tax credits, insurancesubsidies, and other types of contracts. People with low ESG scores may also be banned from using social media.

While the ESG investment framework is seen as a caring, environmentally conscious alternative to traditional revenue-focused investing, it is truly the weapon of the deranged, prioritizing pursuing “awakened” political ends rather than promoting human welfare.

Take, for example, the reaction of an analyst at a “risk intelligence” company named Maplecroft, to a recent violent coup plot in the small island nation of São Tomé and Príncipe. In one Interview with RigzoneThe analyst said “[t]His coup plot is extremely damaging to the political reputation and ESG of the country and will likely deter investors in the nascent oil and gas industry.[.]”

Four people are reported deadThe coup was averted, but some experts are thinking of an investment fad.

To the average person, this is crazy—but for world leaders in government and CEOs of multinational corporations, ESG is the future. At the recent United Nations Climate Change Conference (COP27), the message was strange: the use of fossil fuels in particular must end and financial institutions should enforce it.

Fossil fuels and their derivatives have lifted much of the world out of extreme poverty, has dramatically improved crop yields, helped provide clean water and transport to the most remote areas, aided in the development of medicines, provided clean and inexpensive heating and air conditioning, and thousands of other things that we take for granted. More than 4,000 items and products are used daily in developed and many developing countries, contain fossil fuels as a necessary ingredient, or are derived entirely from fossil fuels. Even for essential products that are not derived from fossil fuels, they are often developed, manufactured and distributed through fossil fuel-based technologies. A strictly enforced ESG effort will pause this opportunity and development for poor countries, regardless of their political stability.

However, the damage caused by ESG will not stop in poor countries. By limiting investment in domestic oil and gas operations, it will also continue to keep energy prices high, undermine economic growth, and make the United States dangerously dependent on energy and industrial resources. foreign technology.

And it is getting worse. New rules from the Biden administration allow review of ESG is a factor in your 401(k) management, and your employer can invest your money in an ESG fund as the default option.

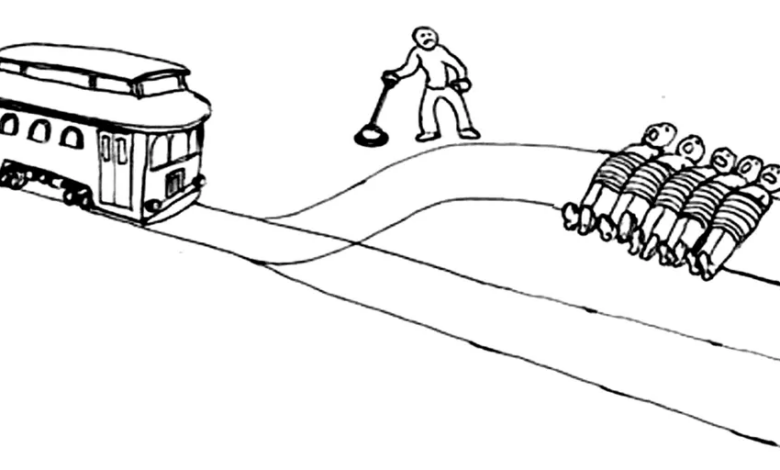

The vast majority of people who invest in the market, whether individually or as part of a private or public pension fund, do so in the hope of maximizing returns to provide them with a retirement. secure, a fund that gives them the ability to not only survive, but thrive, and enjoy some freedom to pursue their dreams after retirement. By allowing ESG to be considered in the goals of banks, investment managers and stock portfolios, the government is punishing these financial elites for using other people’s money to pursue their own interests. social and environmental goals of their own choosing. According to the ESG, the government is weakening the standard of trusts that use client funds in pursuit of profits as the sole legal guide to maximizing returns for their client investors; and replace it with whatever social or environmental goal banks and fund managers think people should pursue.

BlackRock, the world’s largest asset manager, with more than $10 trillion under control, is just one of many companies driving ESG. Some colleges are creating curricula for busy people with sustainability ambitions. To give you an example of the kind of people these careers attract, a sustainable investment website has put together a list ESG jobincluding one that has the remarkable opening line, “[h]Have you ever wanted to be a bodyguard but lacked physical strength? If so, the ESG career path could be your second chance.”

Fortunately, it’s not all doom and gloom. Some states passed legislation prohibiting ESG-focused financial firms from doing business with state and local contracts. Best of all, it seems to be working. After some states pulled money out of Black stonesThe company’s share price has been downgraded, and it continues to face pressure from oil-producing nations that aren’t particularly excited about fossil fuel divestment plans.

ESG is the mental bully of the investing world, its advocates using emotional blackmail and fear of climate change to get away with being corporate leaders, at the same time forcing companies not to follow closely”stakeholder capitalism“Agenda out of business. They don’t care that it hurts the families and the poor of the world. So we must not let them win.

Originally published at Townhall.com

Linnea Lueken ([email protected]) is a research fellow with the Arthur B. Robinson Center for Climate and Environmental Policy at the Heartland Institute.

H. Sterling Burnett, PhD, ([email protected]) is the director of the Arthur B. Robinson Center.