Economic Costs of Fossil Fuel Removal – Raised by that?

By Andy May

The debate about the extent of human influence on climate change continues. As is well known to everyone so far, there is no observational evidence that humans have a significant impact on the climate, so debate largely the ability to predict future climate. Nor is it clear that the changes we can induce are bad, most of the evidence suggests that additional CO2 and the warming has been helpful so far and probably will beneficial in the future. But what if we decided to get rid of fossil fuels? What is the economic impact?

Gregor Semieniuk and nine co-authors just published an open access paper In Natural climate change discuss this option. The net present value of future lost fossil fuel profits exceeds $1.4 trillion, with $0.4 trillion lost in the US alone. Compare this to the loss of approximately $2 trillion in US home values in 2008, according to Zillow, due to the housing crisis. Note that the two numbers cannot be directly compared, as we are comparing fossil fuels profit about the total number of houses value, not the homeowner’s equity. The 2021 U.S. median home ownership rate is about $153,000 and the average cost of a house is about $374,900. This ratio reduces a $2 trillion home value loss in 2008 to a loss of $0.8 trillion in home equity. We can expect a severe economic shock due to the loss of oil, gas and coal assets.

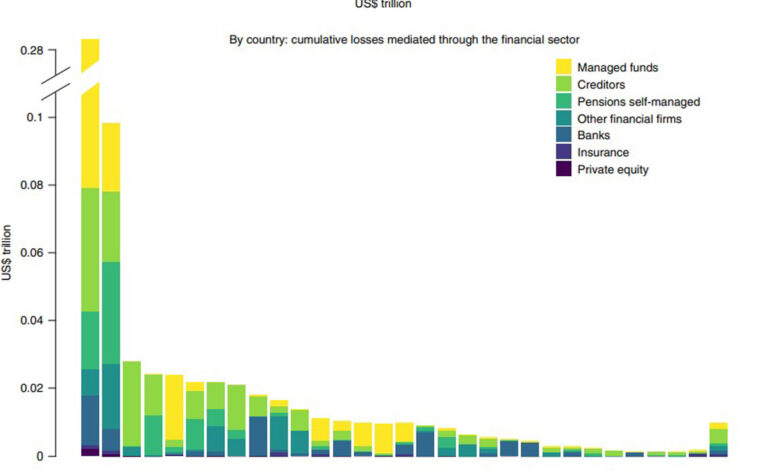

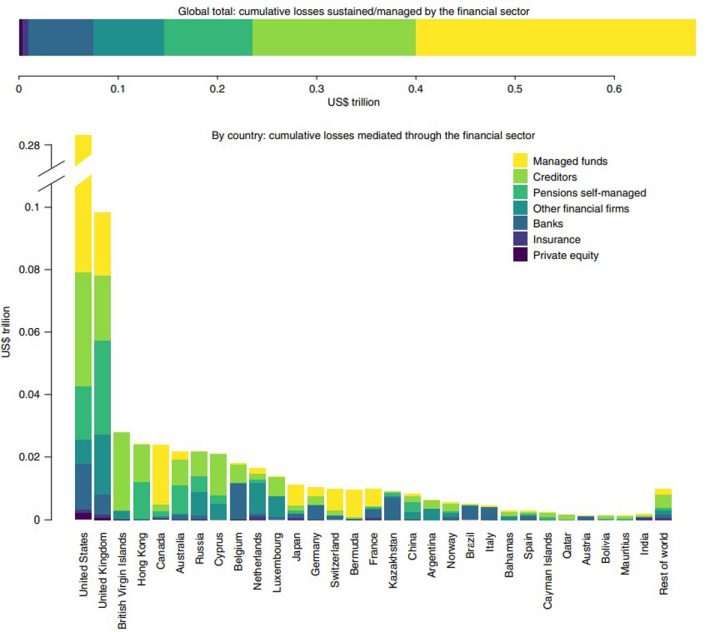

Most of the risk falls on the overwhelming private investors in OECD countries, particularly in the US and UK. To better understand this, the OECD GDP for 2021 is $59 trillion and the US GDP is $21 trillion.

Those who believe that climate change is dangerous want a rapid phasing out of fossil fuels, which will require wiping out fossil fuel assets. The article tracks the ownership of these assets. Once the property is trapped, who loses? The fossil fuel industry is huge and contains 43,439 oil and gas producing assets, not to mention many coal mines. The oil and gas assets are owned by nearly 70,000 individual oil and gas companies.

The ultimate owners of these assets are mainly managed investment funds (whose largest customers are pension funds), banks and other lending institutions, and self-managed pension funds. as shown in Figure 1. The highest losses relative to GDP are in countries with government ownership. significantly, as in Russia and Norway.

Discussion

The article claimed that covering the full losses of oil and gas companies would “only” cost one to two percent of GDP. However, they do not count the losses suffered by oil and gas service companies or the total number of unemployment resulting in unemployment, which could be more. nine million jobless only in the US. This does not count 42,117 jobs in the coal mining industry of the United States.

Suffice it to say that their estimate of the cost of cutting or eliminating fossil fuels is too low.

As Vaclav Smil makes clear in his new book book, oil, gas and coal underpin all modern life. Besides energy, they are essential to sustaining us. He calls ammonia, steel, concrete, and plastic the four pillars of modern civilization, and currently they can only be created with fossil fuels. These four indispensable materials use 17% of the world’s primary energy supply and generate 25% of total CO .2 emissions. The IEA report 14% of the world’s petroleum and 8% of natural gas are used as feedstock for petrochemical production. Furthermore, from 1973 to today, the share of fossil fuels in energy production has been virtually zero reduce and the drop was almost entirely due to additional nuclear power production. If fossil fuels were phased out, or “phased out” using the allegory in the article, the results would be catastrophic for the entire world, with almost unimaginable consequences.

Lomborg, B. (2020, July). Welfare in the 21st century: Increasing development, reducing inequality, the impacts of climate change, and the costs of climate policies. Forecast of Technology & Social Change, 156. Taken from https://www.sciasedirect.com/science/article/pii/S0040162520304157

Semieniuk, G., Holden, P., Mercure, J., & al., E. (2022, May 26). Trapped fossil fuel assets lead to huge losses for investors in advanced economies. Natural climate change. doi: 10.1038 / s41558-022-01356-y

Smil, V. (2022). How the world really works. Viking. Taken from https://www.amazon.com/How-World-Really-Works-Science-ebook/dp/B09CDB69WT/ref=sr_1_1?crid=15LL4YNFP77F&keywords=how+the+world+really+works&qid=1653753577&sprefix=How+ + World + Real % 2Caps % 2C79 & sr = 8-1