Didi expands, inDriver monetizes to rival Uber, Bolt in Africa – TechCrunch

The on-demand transport house in Africa has advanced since San Francisco-based ride-hailing agency Uber first arrange operations in South Africa in 2013, setting the stage for its foray throughout the continent whereas radically remodeling your complete taxi trade.

Nearly a decade later, Africa’s taxi trade is now dominated by tens of native and worldwide tech-led ride-on-demand platforms, with the most recent additions being world giants Didi Chuxing from China and Russia’s inDriver.

Trying to edge out its opponents, Chinese language behemoth Didi is presently increasing throughout the continent, stepping up competitors for market leaders Uber and Estonia-based Bolt. Proof reveals it’s getting ready to enter Nigeria, having begun operations in South Africa in March and Egypt simply final month when the corporate posted a job opening for a driver middle supervisor in Lagos – the identical function it first marketed for when getting into South Africa and Egypt.

A key indicator of the corporate’s imminent growth into Nigeria was hidden inside the strains of the motive force middle supervisor’s tasks – “to collaborate with operations and Didi’s workforce to help the profitable launch.”

Didi didn’t reply to a number of TechCrunch requests for remark about its growth plans in Africa.

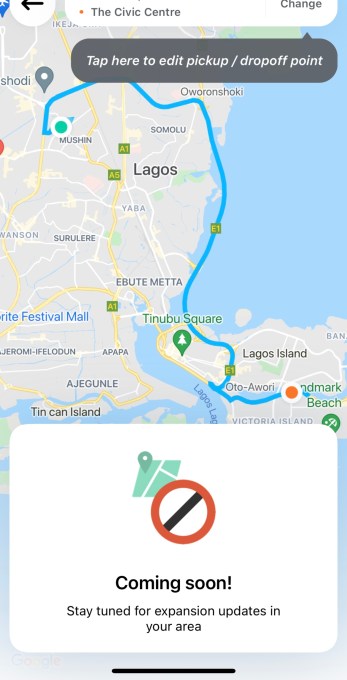

Screenshot of Didi’s app in Nigeria

Didi is without doubt one of the largest ride-hailing companies on the earth. Nevertheless, not like world opponents Uber and Bolt, which years in the past noticed Africa as a key market of their quest for world dominance, the Chinese language agency held off the continent till now.

Based in 2012, Didi has around 600 million users throughout 17 international locations in Africa, Asia, Latin America and Russia. The corporate additionally has over 15 million annual energetic drivers.

Along with launching different mobility platforms, Didi now owns minority stakes in different world platforms — the USA’ Lyft and Uber, Indonesia’s Seize, Egypt’s Careem and India’s Ola. It additionally absolutely acquired Brazil’s 99.

As Didi begins its incursion into Africa, Russia’s inDriver is firming up its presence throughout the identical markets, the place it just lately began taking commissions from drivers.

Not like different taxi-hailing apps which have a unilateral billing construction, inDriver permits riders to barter journey expenses with drivers, making it common amongst taxi customers.

Taxi drivers in Kenya’s capital Nairobi utilizing inDriver, which rolled out its companies in Africa in 2018, have over the previous few days obtained notifications from the corporate confirming the introduction of a 9.52% fee for each journey made. The fee is decrease than Didi’s 13%, though each are a lot decrease than Uber’s 25% and Bolt’s 20%.

InDriver inferred that it was introducing the costs because of the elevated demand of the service, however it was eager to maintain the fee decrease than these of its opponents. The app was launched about three years in the past throughout a number of markets in Africa together with South Africa, Nigeria, Tanzania, Morocco and Botswana with the promise of a commission-free first 12 months. The corporate is simply now introducing commissions in a few of these markets, though the deductions are already in impact in Nigeria and South Africa.

In a notification despatched to drivers in Kenya, inDriver mentioned that it “turned a noticeable occasion within the passenger rides market in Nairobi. Many individuals use it day by day and their quantity is rising. This in depth work requires important prices. To cowl these prices, we introduce funds for every order within the quantity of 9.52%. To maintain inDriver nonetheless worthwhile for each passengers and drivers, the quantity of funds is decrease than in different companies, the place funds can vary from 15% to 30% of every order.”

The brand new replace comes as the corporate plans to develop in numerous markets, having already diversified into the courier enterprise.

The corporate launched its supply enterprise in April final 12 months, on the peak of the pandemic, to faucet the demand for parcel supply companies. Courier companies enlisted on the app embrace auto, foot and moto, and can be found in over 16 international locations. The corporate is now introducing freight companies in numerous markets all over the world.

Based in 2013 by Arsen Tomsky, inDriver is presently obtainable in 34 international locations and just lately crossed the 100-million obtain mark.

Because it joins Didi to step up competitors in Africa, market pioneers Uber and Bolt are increasing their service vary in cities throughout the continent.

At the moment, Uber is rolling out Pool Likelihood, a function that lets riders headed in the identical path share the price of the journey, in Kenya, with plans to supply the low-cost service in Ghana and Nigeria. The corporate says that the rollout of finances companies is a part of its plan to draw price-sensitive customers.

Throughout the continent, Uber has over the previous few months expanded into new areas and launched new merchandise as a part of its technique to retain current prospects and entice new ones amid rising competitors. Earlier this month, the agency entered two further cities in Nigeria — Ibadan and Port Harcourt — bringing into the areas a service that’s already obtainable in three different cities.

Frans Hiemstra, basic supervisor for Uber Sub-Saharan Africa

In South Africa, Uber is now obtainable in 40 cities, serving 80% of the city inhabitants, with premium companies Uber Consolation, UberX and UberBlack and finances service UberGo. It just lately expanded into 21 new cities and added a function final August that enables the reserving of journeys a month prematurely.

The corporate plans to proceed investments into African cities by means of collaborations with nationwide and native authorities.

“We all know that we face important competitors throughout native transportation modes in Africa. These are vibrant and aggressive with many viable alternate options, together with ridesharing, private vehicles and public transportation—which customers can and do select between,” Frans Hiemstra, the overall supervisor for Uber Sub-Saharan Africa, advised TechCrunch.

“We consider competitors makes us higher, which improves the service for our riders and earners alike,” he mentioned.

Uber remains to be king when it comes to mixed market share in Africa; it claims to have about 150,000 drivers in its eight markets throughout the continent, whereas Bolt is available in second.

Bolt has been aggressively expanding its services in Africa. The agency is planning to roll out electrical taxi choices in South Africa 4 months after introducing e-bike meals supply companies in Johannesburg and Cape City. Bolt additionally launched its meals supply service in Nigeria final month.

Like Uber, Bolt sees myriad alternatives within the continent.

“We see that there’s room for a number of gamers throughout the continent. The infrastructure and expertise we now have constructed up with our ride-hailing enterprise give us an excellent platform to develop and diversify our companies,” mentioned Bolt’s regional director for Africa and Center East, Paddy Partridge.

For brand new gamers like Didi, it is going to be an entry to a market that handled drivers and companions demanding higher working phrases.

In Nigeria and Kenya, each Uber and Bolt confronted a collection of protests earlier this 12 months as their drivers expressed displeasure with the ride-hailing corporations’ resolution to extend their commissions, regardless of burdening customers with value surges. Nevertheless, no notable adjustments have been made out of both of the 2 corporations in keeping with the calls for of drivers.

Didi’s operations elsewhere haven’t been with out drama. Earlier than it went public on the NYSE this 12 months – 9 years after working as a privately held startup and elevating $25 billion from buyers – the Alibaba, SoftBank and Apple-backed firm confronted scrutiny from the Chinese language authorities and regulators. It was accused of using anti-competitive practices and pricing and misusing customers’ private data.

Didi’s fallout with China is simply one of many many struggles it handled this 12 months. Making an attempt to compensate for the troubles at house, the agency appeared to enter the U.Ok. market, however the transfer was met with issues from the British Parliament that China may harvest information from Brits utilizing Didi’s service. Nevertheless, it appears its entry into African markets has been easy — and will clarify why it needs to maintain its operations quiet: to keep away from scrutiny.