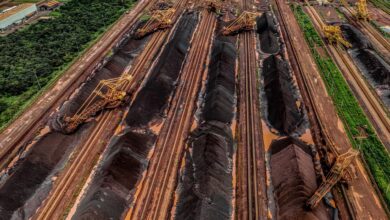

Caixin manufacturing PMI, China, currency, oil

SINGAPORE – Shares in the Asia-Pacific region were mixed on Monday ahead of the release of a separate survey of Chinese factory activity in July.

Over the weekend, China’s official purchasing managers index for July stood at 49, down from 50.2 in June and below the 50.4 expected.

Japanese Nikkei 225 and the Topix index is partially lower.

In Australia, S&P / ASX 200 inched up 0.11%.

The Kospi in Korea down 0.55% and Kosdaq down 0.2%.

MSCI’s broadest index of Asia-Pacific shares outside Japan lost 0.2%.

China’s Caixin/Markit Purchasing Managers’ Index for July is expected to come in at 51.5, versus 51.7 in June.

PMI readings are sequential and represent a monthly expansion or contraction. The 50 mark separates growth and decline.

On Friday in the US, Alibaba was added to the list of companies at risk of being delisted under the Foreign Companies Accountability Act. US-listed shares fell 11% in normal trading.

HSBC Bank will announce interim earnings on Monday.

Currency and oil

The US Dollar Indextrack the greenback against a basket of other currencies, at 106.005, lower than last week’s level.

The Japanese yen was trading at 133.27 per dollar, stronger than the levels seen early last week. The Australian dollar is $0.6972.

Oil futures prices fell. US crude oil Futures fell 0.95% to $97.68 per barrel, while Brent Crude Oil down 0.77% to $103.17 per barrel.