Do you know? US oil and gas up 60% this year – Rise thanks to that?

Guest of David Middleton’s “Illuminate the Big Lie”

While most of my recent writing has focused on Biden’s lies about the oil and gas industry, there’s one BIG WORD that has become popular and has become common knowledge.

US producers reluctant to extract more oil, despite sky-high gas prices

OF IRINA IVANOVAUPDATE: 03/25/2022

Consumers battered by sky-high gasoline prices shouldn’t expect relief from the oil industry anytime soon.

Many oil and gas executives say they have little interest in increasing oil production – even with near-record crude prices, which makes mining very profitable for their companies.

Crude oil prices have been steadily rising since the beginning of last year. It hit $100 a barrel in March after Russia Invades Ukraine – for the first time in 12 years it breaks three digits.

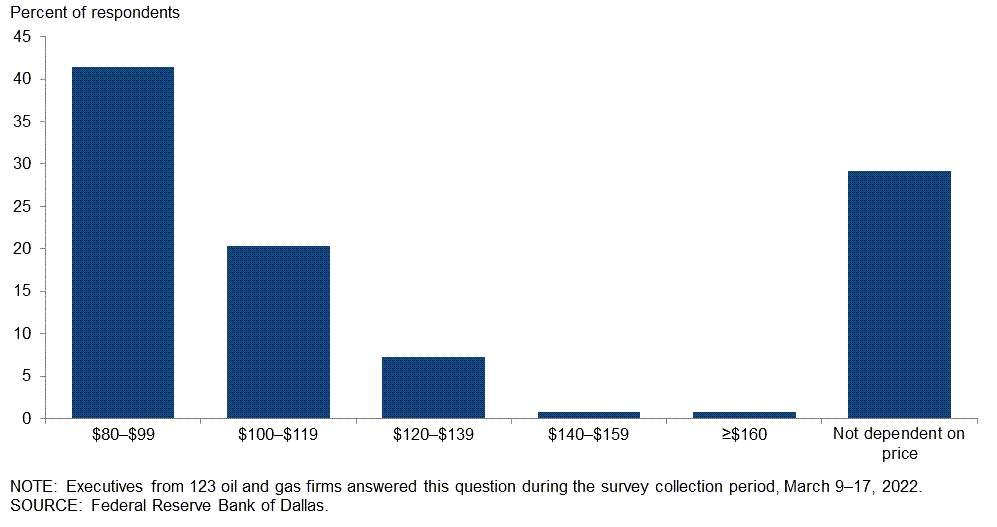

At that price, oil and gas companies will often race to land and drill new wells. But a large number of oil and gas executives are saying they won’t increase output at any cost, according to one survey issued this week by the Federal Reserve Bank of Dallas.

[…]

To be fair to the mainstream media, they are too stupid to understand the difference between not increasing output and maintaining capital discipline. This particular journalist is completely misread The Dallas Fed Survey. The survey did not find that “a large number of oil and gas executives are saying they will not increase production at any cost”.

“Is West Texas Intermediate Crude Price Necessary to Get Publicly Traded U.S. Producers Back in Growth Mode?”

Fed Dallas

Saying that the decision to “go back to growth mode” is not price dependent is not even close to “saying they will not increase output at any price”. First, oil companies cannot simply switch a switch and increase output. Oil companies must increase capital expenditure (CapEx) and drill more wells to increase production. And guess? Oil and gas companies are increasing CapEx and drilling more wells. Second, “back to growth mode” is a 100% subjective phrase. Shrinkage is sometimes a prerequisite for growth (shrink to grow).

CapEx

In my previous postI focus on Pioneer Natural Resources Co. (PXD) because Biden specifically lied about what their CEO said about oil prices and production increases. Today, I am expanding it to include two other large independent “shale-focused” oil and gas companies, EOG Resources Inc. (EOG) and Devon Energy Corp (DVN). First, let’s go back to the time when “shale” was beaten for not making a big enough profit. Right before the start of the shamdemic phase*, the “shale” sector had actually started generating free cash flow.

- Shamdemic: Pointless economic lockdown orders ordered by the government in response to ChiCom-19.

US SALES INDUSTRY POSITIVE CASH FLOW

August 21, 2019According to Rystad Energy, Q2 2019 was the first three-month period on record as US shale operators achieved positive cash flow from operations after accounting for capital expenditures.

Rystad Energy – an independent Norwegian energy research and consulting firm with offices around the world – studied the financial performance of 40 dedicated US shale oil companies, focusing on cash flows from business operations (CFOs). This is the cash available to expand the business (through capital expenditures, or invested capital), reduce debt, or return it to shareholders.

During Q2 2019, 35% of miners in the peer pool balanced their spending with operating cash flow and reported a $110 million cumulative surplus in CFO over invested capital.

[…]

I don’t have the time (or inclination) to try to recreate Rystad Energy’s “40 dedicated shale companies,” but I did have time to review three of the “unique shale companies.” set” larger.

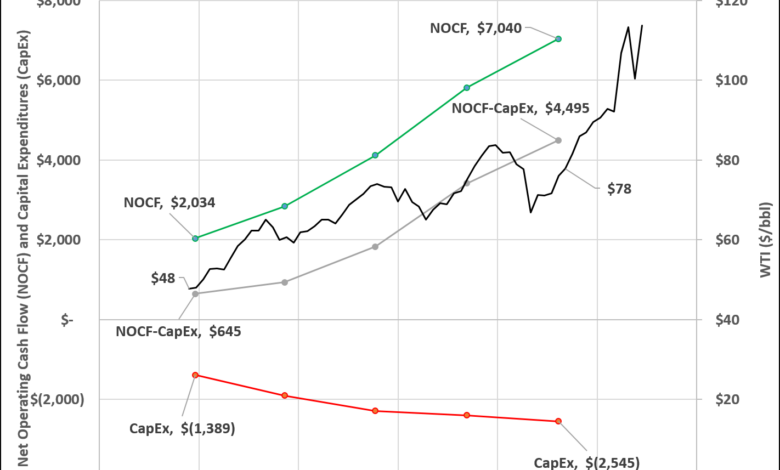

As can be easily seen on the chart above, the three companies have almost doubled their CapEx as the price of oil rose from $48 to $78/bbl. However, they did so in a financially disciplined manner. They not only maintain positive free cash flow, but also increase free cash flow when oil prices rise. They did exactly what they were whipped for not doing from 2008-2019. These companies will release their Q1 2022 financial statements in the coming weeks. I’ll try to update this chart with those numbers.

Drill

US oil companies increased drilling volume by 60% in a year

Robert Rapier Senior ContributorMarch 27, 2022

One of the latest attacks on rising gasoline prices goes something like this: America’s oil companies are getting lots of licenses, claiming to be making huge profits while they refuse to extract the oil. .

This is mostly false, but with a kernel of truth that is never understood in context. So let’s discuss what’s really going on.

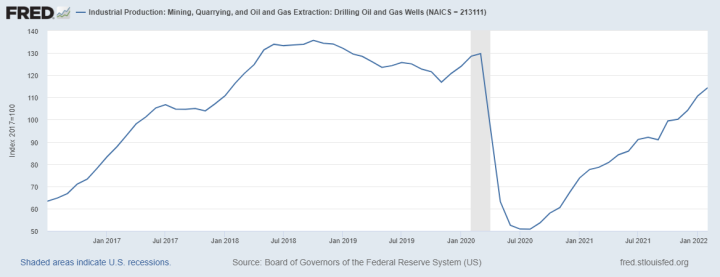

The truth is that the number of oil rigs in the US is steadily increasing. The annual increase in the North American Baker Hughes rig count is about 60%. In fact, historically, it has rarely increased at a faster rate than this. Obviously, the view that oil companies are just sitting on their hands, content with stopping production and squeezing American consumers is wrong.

[…]

Finally – and here’s the hint of truth – many oil companies have said they will be more financially disciplined than in previous boom and bust cycles.

Critics of the oil and gas industry have seen this financial discipline as proof that oil companies are holding back production. However, one of the biggest criticisms of the shale boom of the past 15 years is that oil companies never make steady money. Indeed, if you look at the finances of many oil companies, they have lost money in four of the last ten years.

[…]

I can assure you that every oil company wants to produce as much oil as possible at current prices, because they will actually be very profitable with oil prices above $100/barrel. But they can’t instantly switch output higher, and they don’t have crystal balls. They don’t know where the price of oil will be a year or two from now, and that’s why you don’t see them ramping up drilling at an even faster rate.

You can disagree with their decision, it’s your right. But you should at least understand the reasons for these decisions.

As Mr. Rapier goes on to note, there is a lag time between drilling and production. However, oil and gas companies are increasing CapEx and they are spending more money on drilling.

St. Louis Fed

While still below its pre-pandemic peak, oil and gas drilling is growing at a similar rate to 2017-2019.

Quantity

US crude oil production is growing slowly. It is now about 1 million bbl/d higher than it was in September 2020. Although it is still about 1.4 million bbl/d lower than it was before the shamdemic*.

As the largest oil producer, the Permian Basin has already exceeded its pre-pandemic* levels.

Here is an enlarged version of oil production in the Permian basin (bottom left panel):

Maybe if Biden doesn’t stop illegal rental sales and slow down permits, America’s second most prolific oil-producing region, the Gulf of Mexico, might do the same.

No crystal ball

After 41 years in the oil and gas industry, if I’ve learned one thing, it’s that most oil and natural gas price predictions are wrong.

We think gas prices will stay in this $9 to $11 range, there will be times like in July when they’re above it, there will be times when they’re below it and of course the weather will matter too. . But we are fairly confident that under $9 you will see a drop in drilling activity especially among conventional drilling and then a pretty steep 35% to 40% drop in the first year. market launch and rebalancing.

I saw something the other day where some analysts had suggested production in 2010 would rise to around 8 to 10 BCF a day and gas prices would be $6.25. That kind of analysis I think can only happen at the dangerous intersection of Excel and PowerPoint, it can’t happen in reality.

Chesapeake CEO Aubrey McClendon, August 1, 2008

NEW YORK (Reuters) – Texas oil billionaire T. Boone Pickens said on Thursday crude oil prices could soon fall to $110 a barrel amid falling gasoline demand, but should not fall below $100. la because the United States is heavily dependent on oil imports.

“I don’t think it’s going to drop below $100,” Pickens told Reuters in a phone interview. “I would say $110 is where it could go, something like that.”

Needless to say, the late Aubrey McClendon and late T. Boone Pickens’ predictions of permanently high oil and natural gas prices were wrong. This is not a criticism of either person. They are all excellent pioneers in the oil and gas industry. They were wrong.

We may not have a crystal ball, but we do have one futures market. Why would any sane oil company spend money on the assumption that $100-130/barrel oil is still here, when the same kind of financially disciplined investor thinks oil prices are going to drop? $80 next year?