Your federal student loan payments will likely resume early next year : NPR

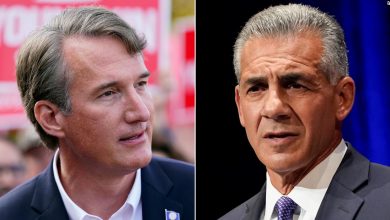

Richard Cordray is the chief working officer for the workplace of Federal Scholar Assist.

John Minchillo/AP

conceal caption

toggle caption

John Minchillo/AP

Richard Cordray is the chief working officer for the workplace of Federal Scholar Assist.

John Minchillo/AP

Scholar debtors, take word. In testimony earlier than a House subcommittee, the top of the workplace of Federal Scholar Assist instructed lawmakers that his company is making ready for federal pupil mortgage repayments to renew early subsequent yr.

Richard Cordray, FSA’s Chief Working Officer, oversees the federal pupil loans of roughly 43 million debtors. In a listening to Wednesday that ran simply over three hours, he shared new particulars about these plans to renew reimbursement, his company’s dealing with of the Public Service Mortgage Forgiveness program, the opportunity of broader mortgage forgiveness — and about whether or not he would maintain executives answerable for the collapse of schools that defrauded college students.

Here is a rundown of what Cordray mentioned, what he tried not to say, and why it issues.

Debtors must resume pupil mortgage funds quickly

Due to the pandemic, Congress and the U.S. Division of Schooling paused curiosity and reimbursement necessities for debtors with federal pupil loans again in March 2020. Now, a yr and a half later, Cordray instructed lawmakers these funds will resume as early as January 31, 2022.

“We all know this is not going to be a straightforward transition,” Cordray instructed lawmakers in his opening remarks. “This can be a defining second for FSA, and it is crucially necessary for thousands and thousands of Individuals that we succeed.”

The core of FSA’s plan to restart mortgage funds, Cordray mentioned, “is obvious communication, high quality customer support, and focused assist for these having hassle making their funds.”

One of many greatest challenges Cordray and FSA face is accommodating debtors who’ve misplaced work in the course of the pandemic and can need assistance adjusting their funds. For assist navigating this return to reimbursement, check out this FAQ.

Will the Biden Administration embrace broad pupil mortgage forgiveness?

Maybe the most important query Cordray faces nowadays is whether or not the Biden administration will pursue the type of broad pupil mortgage forgiveness championed by Senator Elizabeth Warren, D-Mass. Throughout Wednesday’s listening to, lawmakers requested Cordray if he would assist a coverage to forgive $10,000 in federal pupil mortgage debt for each borrower. Cordray’s reply?

A bureaucratic bob and weave: “That is a coverage choice. I’ve an operational job.”

“Alright, so you do not have a private desire,” replied Republican Congressman, Dr. Greg Murphy, of North Carolina. “If the President mentioned ‘Everyone will get $10,000 {dollars} off,’ you’d simply do your job and implement it, right?”

“I believe if that had been the choice, it could profit many, many debtors who’re in any other case in hassle,” Cordray responded, “however it’s not my choice to make.”

Cordray additionally ducked a query from Democratic Rep. Frederica Wilson of Florida, who requested a couple of memo, reportedly being drafted by the Schooling Division, explaining whether or not President Biden has the authorized authority to discharge federal pupil money owed.

“That is a matter for the White Home to find out,” Cordray mentioned, “clearly not for me.”

The Public Service Mortgage Forgiveness program is being mounted, slowly

Earlier this month, the Biden Administration introduced that it’s overhauling the troubled Public Service Mortgage forgiveness program, which promised federal pupil mortgage forgiveness for debtors who work 10 years in public service. Its poor administration and complicated guidelines have left many debtors within the chilly.

Wednesday, Cordray mentioned the overhaul is “game-changing” for a whole lot of hundreds of debtors whereas acknowledging “there’s an terrible lot of labor to do to make that announcement into actuality.”

One problem: The U.S. authorities would not straight handle pupil loans. It pays mortgage servicers to try this. Democratic congressman Joe Courtney of Connecticut instructed Cordray he is frightened these servicers aren’t ready for the massive modifications.

Courtney mentioned he is already listening to from constituents who complain, after they ask for assist, their servicers say they “haven’t got the steerage to implement the PSLF modifications.”

Debtors have shared comparable tales with NPR. A number of say they’ve referred to as their servicers for the reason that overhaul announcement, believing they now qualify for forgiveness, and requested, “What do we have to do?” However they had been instructed, primarily: “We do not know but.”

One borrower instructed NPR, when she referred to as to ask about her eligibility for this new PSLF waiver, her servicer “was about as ineffective as a chocolate teapot.”

Adopted directions offered by @fafsa & resent my PSLF type; received a letter saying I am ineligible b/c I made my funds earlier than consolidation (which does not matter below new guidelines). Known as @MyFedLoan; they mentioned they do not have up to date steerage from DOA. BLARGH. Making an attempt tweets! https://t.co/QXKFOvo7sm

— Melissa Crowe (@MelissaMCrowe) October 26, 2021

“We have heard among the identical stuff you’ve heard,” Cordray admitted to lawmakers, “and we wish to get this stuff sorted out as shortly as potential.”

However he additionally urged endurance, saying “we’re working in actual time right here. It has been a matter of days for the reason that [Education] Secretary’s announcement. And we wish to make certain individuals have the proper steerage right here, and typically the fast is the enemy of the nice.”

Cordray’s backside line, although: “We do intend — and we are going to — ship on the announcement that was made and get reduction to individuals.”

For those who’re a public service borrower anticipating readability, try this helpful thread:

1/ A Mortgage Forgiveness Thread…

For those who work in public service, have federal pupil loans and are confused about modifications to the Public Service Mortgage Forgiveness program, THIS is for you… pic.twitter.com/Ah1aRexOcL

— Cory Turner (@NPRCoryTurner) October 25, 2021

For those who ran a failed, predatory college, you is likely to be held liable

One of the fascinating moments in Wednesday’s listening to might sign a giant coverage shift.

Rep. Bobby Scott, the Democratic Chairman of the Home schooling committee, reminded Cordray that the Schooling Division has the authority to carry executives answerable for monetary prices when a college defrauds college students and collapses. However the Division has been detest to make use of it, even within the high-profile failures of Corinthian Faculties and ITT Technical Institute.

This can be a large subject for Scott, who sent Education Secretary Miguel Cardona a letter in August and convened a hearing in March, where Dan Zibel, of Scholar Protection, laid out the legal case for holding executives personally liable. On Wednesday, Scott once more urged Cordray to embrace the concept as “a deterrent” to stop future fraud.

Be mindful, it is a controversial concept. However, in contrast to Cordray’s muted responses to among the listening to’s different controversial questions, this time he was forthcoming.

“We see eye to eye on this,” Cordray instructed Scott. “We completely agree. Extra must be completed to stop individuals from abusing these pupil assist applications.”

“We agree on the route right here,” Cordray continued, “and I believed [your letter] was a superb little bit of a kick within the behind for us to verify we’re transferring down the street on this. And we are going to.”

And we are going to.

With these three phrases, Cordray forcefully embraced a coverage that’s prone to ship a shudder by means of the for-profit faculty house.