What credit score do you need to get the Citi/AAdvantage Platinum Select World Elite Mastercard?

Citi is TPG’s advertising partner.

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a solid choice for American Airlines travelers looking for their first free checked bag on domestic flights.

You can spend it on Million Miler Status And build up balance your AAdvantage miles for your next trip. If you’re considering applying for Citi/AAdvantage Platinum Select, you may be unsure whether you have a high enough score. credit score for approval. Here’s what you should know.

Information about the Citi/AAdvantage Platinum Select World Elite Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

What credit scores qualify for approval?

Citi does not publish specific credit scores required for approval for its cards. After all, your credit score is just one of many considerations an issuer must take into account when deciding whether to approve a card to a consumer.

But generally you will need one good credit score at least 670 or higher to be approved for one credit card rewards like Citi/AAdvantage Platinum Select Mastercard. That said, you may be denied if your score is high, even if other aspects of your credit portfolio may be appealing to the issuer.

Related reading: Why good credit is key to building your wealth

What is Citi/AAdvantage Platinum Select?

Citi AAdvantage Platinum Select is a co-branded product American Airlines credit card Issued by Citi. This credit card can easily be worth the $99 annual fee (waived the first year) even if you only fly American Airlines domestically a few times per year.

This is because this pass alone will get you and up to four people traveling with you on the same booking First checked bag free on American Airlines domestic itineraries.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

You’ll also earn 2 miles for every dollar spent at the gas station, restaurant and more qualifying purchase from American Airlines.

Related reading: Citi/AAdvantage Platinum Select card review

How many card accounts can I open?

Citi doesn’t appear to limit the total number of credit cards you can have open. However, Citi appears to have one Maximum credit limit that it’s ready to expand across all your Citi cards.

So if you have at least one other Citi credit card And Not approved for new cardsYou can call Citi’s reconsideration line to see if transfer some credit from one of your existing cards will allow you to open a new card.

Related reading: How many credit cards do you have?

Who is eligible for a sign-up bonus?

You will not be eligible for a sign-up bonus on the Citi/AAdvantage Platinum Select Mastercard if you have received a card sign-up bonus within the last 48 months. Specifically, the information and selling price section on this card application page notes:

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for your Citi® / AAdvantage® Platinum Select® account in the past 48 months.

Related reading: Earn extra AAdvantage card sign-up bonuses: What you need to know

How to check your credit score

There are many ways to Check your credit score for free. For example, many Credit cards allow you to check your FICO score free for you. It’s a good idea to track your score’s progression over time, especially if you’re trying improve your credit score.

But it’s important to realize that you don’t just have one credit score. Instead, there are different calculation methods, such as FICO Score and VantageScore as well as various credit reporting agencies such as TransUnion and Experian.

Your credit score will vary based on the calculation method and credit reporting agency used.

Related reading: 6 things to do to improve your credit

Factors that affect your credit score

Once you know your credit score range, you may wonder what factors affect your credit score. There are several formulas for calculating your credit score, but no exact calculation is publicly available.

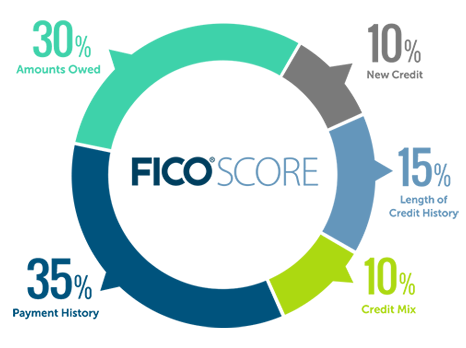

This being said, FICO is relatively transparent about the different factors they evaluate and the weighting of each factor:

- Payment history (35%): Whether you were have paid off credit accounts in the past timely.

- Amount owed (30%): The relative size of your current debt and the ratio of your current debt to your available credit.

- Length of credit history (15%): How long your credit accounts have been established (including the age of your oldest account, the age of your newest account, and the average age of all your accounts), given credit accounts been set up and how long it has been since you have used certain accounts.

- New credit (10%): Number of accounts you have recently opened.

- Credit structure (10%): The number of different types of credit accounts you have. This includes credit cards, retail accounts, installment loans, finance company accounts and mortgages.

What to do if you get rejected

If your application is denied, you will receive a letter stating the reason Citi denied your application. Depending on the reason for the refusal given, you may want to use this information to improve your credit score before reapplying.

Or, if you believe you can provide additional information that may help your application be approved, you can call Citi’s reconsideration line at 1-800-695-5171 and submit your case.

You will want to explain that you recently applied for the Citi/AAdvantage Platinum Select World Elite Mastercard, were surprised to see your application denied, and asked to speak to someone about reconsidering the decision there.

Once the agent takes your application, be prepared to present a compelling case for why Citi should approve your application.

Related reading: How bad is being declined for a credit card?

How long must I wait before reapplying?

It’s best to avoid reapplying for a Citi card until you resolve the reason Citi gave you for denying you. However, if you want to reapply or apply for another Citi card, the consensus is that you can only apply for one Citi card (personal or business) every eight days and no more than two cards within a period. 65 days.

Related reading: Basic guide to restrictions when applying for a credit card

Do you have access to the lounge?

No, you are not entitled to lounge access as a Citi / AAdvantage Platinum Select Mastercard holder.

If you are looking Admirals Club Access When flying American Airlines, you should consider the $595 annual fee Citi® / AAdvantage® Executive World Elite Mastercard® (see exchange rates and fees).

This card provides full member access privileges to Admirals Club lounges for primary cardholders.

Related reading: Best credit cards for airport lounge access

Do you get a free checked bag?

As a Citi AAdvantage Platinum Select cardholder, you and up to four people traveling with you on the same booking will receive a free first checked bag on domestic itineraries marketed by American Airlines and operated by American Airlines. American Airlines or American Eagle operators.

To take advantage of this benefit, your credit card account must be opened at least seven days before travel and the reservation must include the primary credit card member’s information. American Airlines AAdvantage at least seven days before travel. Overweight and oversized fees still apply.

Related reading: How to avoid checked baggage fees on major domestic airlines

Bottom line

There is no single best credit card for American Airlines passengers. Instead, best card for you depends on what you are looking for in a tag. The Citi/AAdvantage Platinum Select and AAdvantage Aviator Red are all good options for American Airlines travelers flying with the frequent carrier to get at least $99 in value from the card’s checked baggage allowance on American Airlines domestic itineraries.

These cards have different earning rates and benefits, so you just need to decide which card benefits you prefer.

*Points Guy’s credit range is derived from a FICO® Score of 8, which is one of many different types of credit scores. If you apply for a credit card, lenders may use a different credit score when reviewing your credit application.