Warren Buffett Gives The Most In-depth Explanation As To Why He Doesn’t Believe In Bitcoin

Bitcoin has gradually been accepted by the traditional financial and investment world in recent years but Warren Buffett has maintained his skeptical stance on Bitcoin. bitcoin.

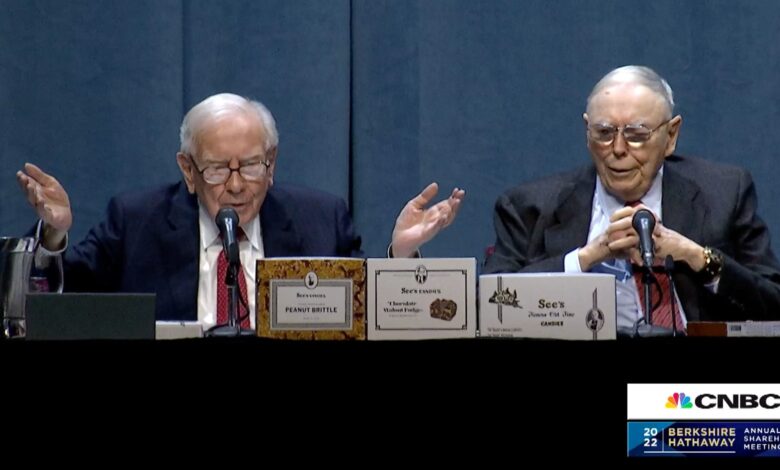

He said at Berkshire Hathaway’s annual shareholder meeting on Saturday that it’s not a useful asset and it doesn’t produce anything tangible. Despite the shift in public perception of cryptocurrencies, Buffett is still not buying it.

“Whether it’s up or down next year, or five or 10 years from now, it has a magic to it and people have attached magic to a lot of things,” said Buffett.

Even bitcoin enthusiasts tend to view the cryptocurrency as a passive asset that investors buy and hold and hope to appreciate over a long period of time. Buffet himself also commented that there is no “one” short of bitcoin, everyone is a long-term holder.

For more sophisticated crypto investors, some coins offer a way for them to effectively use their crypto – through lending or as collateral – to generate additional profits. beneficial for the investment portfolio. However, they are still young, highly speculative and have not yet become as mainstream as bitcoin.

Buffett explains why he doesn’t see the value of bitcoin, comparing it to things that create other types of value.

“If you say…to get 1% on all farmland in the United States, pay $25 billion to our team, I’ll write you a check,” Buffett said. “[For] $25 billion Now I own 1% of farmland. [If] you give me 1% of all condominiums in the country and you want another 25 billion dollars, i will write you a check, very simple. Now if you tell me you own all the bitcoins in the world and you offer me $25 I won’t take it because what am I going to do with it? I have to sell it back to you one way or another. It won’t do anything. Apartments will be rented out and farms will produce food. “

Investors for many years have Confused about how to value bitcoin partly because of its potential to serve different functions. In Western markets, it has come to be seen as an investment asset, especially in the past year when rates and inflation have been on the rise. In other markets, people still see huge potential for its use as digital cash.

“Property, to have value, has to give something to someone. And there’s only one currency accepted. You can think of all sorts of things – we can put Berkshire coins… but Finally, here’s the money,” he said, holding a $20 bill. “And there’s no reason in the world why the U.S. government … would let Berkshire money take the place of their own.”

Both Buffett and Charlie Munger have made hostile remarks towards bitcoin in the past. Most famously, Buffett said that bitcoin “is probably rat poison squared.” Munger doubled down on that sentiment on Saturday.

“In my life, I try to avoid things that are stupid and ugly and make me look worse than other people — and bitcoin does all three,” says Munger. “In the first place, it’s stupid because it’s still potentially zero. It’s evil because it’s undermining the Federal Reserve System… and third, it makes us look stupid in comparison to our territory. Communists in China. He’s smart enough to ban bitcoin in China.”