US-China trade tensions threaten Europe’s largest technology company

Many places claim they are Europe’s answer to Silicon Valley: Stockholm is proudest unicorn on human head, and London is the continent VC Center. But only the small Dutch town of Veldhoven – with a population of 45,000 – has the closest thing Europe has to a major tech giant.

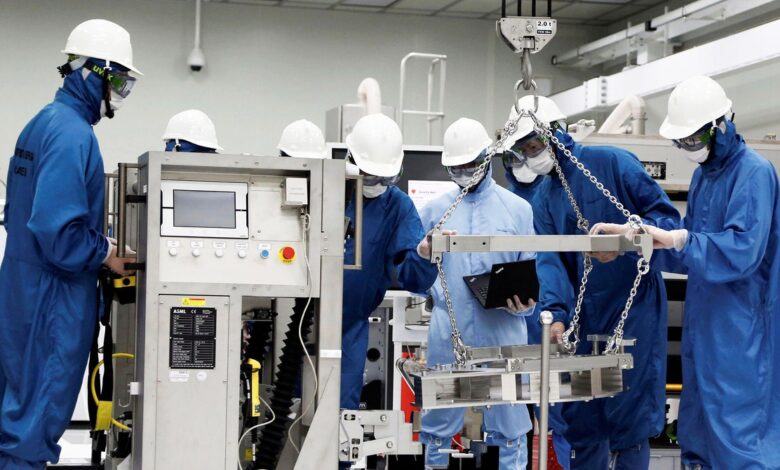

From a simple base near the Belgian border, ASML, a company that makes machines that make semiconductor chips, has mushroomed to become an important cog in the global technology industry. By the end of 2021, it will be named Europe’s biggest public technology companies by market capitalization, driven by the pandemic of demand for equipment and global chip shortages. Separated from Dutch electronics giant Philips in 1984, ASML allows other companies to manufacture semiconductor chip—Technological brains in phones, cars, computers and smart homes. Experts describe ASML as a bottleneck: The company claims it has between 80 and 85% share of the total market for semiconductor-generated lithography systems. When it comes to the most advanced type of chip-making lithography, known as ultraviolet (EUV) lithography, that market share has grown to 100%.

But despite ASML’s recent momentum, there is an area of uncertainty ahead. Due to trade tensions between Washington and Beijing, the company has been blocked from selling its most advanced machines to China. Although currently only selling domestically 7.6 percent the number of chips in the world, according to the Semiconductor Industry Association, the number is growing rapidly, and chips are one of seven technologies that Beijing has targeted for development. Efforts to keep China out of global supply chains have raised concerns that the country will rush to develop its own version of ASML, threatening the Dutch company’s overwhelming influence over the semiconductor market.

Thanks to the gamble ASML took in the 1990s to pursue the development of EUV technology, which uses microscopic rays of light to carve patterns on silicon wafers to form semiconductor chips, the industry’s dominance Company in this field is currently unchallenged. ASML estimates its most advanced technology is so complex that it takes at least 15 years for other technologies to replicate.

“Several companies competed [in the 1990s] Chris Miller, an associate professor of international history at Tufts University, who is writing a book on the geopolitical history of computer chips. As a result of that bet, ASML’s valuation has grown to over $300 billion and its share price has more than doubled since the start of 2020. Speculation is mount that it could become the first European company to be valued at over $1 trillion.

The transition to EUV is lengthy and expensive. The company had to convince its customers – including Intel, Samsung and Taiwan Semiconductor Manufacturing Co – to buy shares in the company to get enough money to fund research. By the time it was able to launch its first commercial EUV machines in 2017, the process had already cost $9 billion. But the rewards are great. It is currently the only company that can supply EUV machines, the most advanced chips found in newer phones and game consoles, to industry giants like TSMC or Intel. As of September 2021, the company has sold 125 EUV machines. It doesn’t sound like much, but there aren’t many companies capable of making the most advanced chips using these machines, and ASML sells them for well over $100 million each.