The biggest threat right now is recession, not inflation

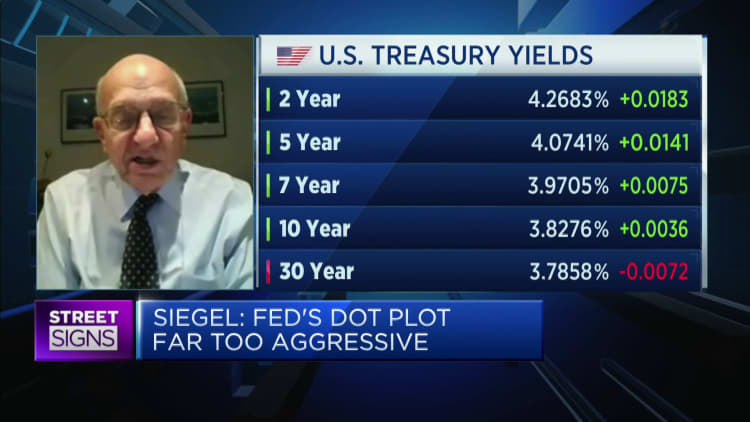

Jeremy Siegel, professor emeritus of finance at the Wharton School of the University of Pennsylvania, said the US Federal Reserve had raised interest rates too quickly and the risk of a recession would be very high if it continued to do so.

“They should have started tightening much earlier,” he told CNBC’s “Asian street signs” on Friday. “But now I’m afraid they’re braking too hard.”

Siegel said he was one of the first to warn about the Fed’s “inflationary policies” in 2020 and 2021, but “the pendulum has gone too far in the other direction.”

“If they keep as tight as they say, and keep raising rates until early next year, then the risk of a recession is extremely high,” he said.

Most inflation is behind us, and then the biggest threat is recession, not inflation, today.

Jeremy Siegel

Professor Wharton

Official data, often a month late, may not immediately show what changes are happening in the real economy, he said. “Most of the inflation is behind us, and then the biggest threat is recession, not inflation, today.”

Siegel said he thinks interest rates are high enough to be able to bring inflation down to 2% and that the final interest rate, or end point, should be between 3.75% and 4%.

In September, Fed benchmark interest rate hike added 3/4 of a percentage point to the 3%-3.25% range, the highest since early 2008. The central bank also signaled that interest rates could end up as high as 4.6% by 2023. .

“I think that’s way, way too high – with the policy delay, that’s really going to force a contraction,” he said.

Follow CME Group’s FedWatch tracker on Fed fund futures bets, the probability that the target interest rate range will reach 4.5% to 4.75% in February next year is 58.3%.

If it were up to him, Siegel said, he would raise rates by half a point in November, then wait and see. If commodity prices start to rise and the money supply increases, the Fed will have to do more.

“But my feeling is that when I look at sensitive commodity prices, property prices, housing prices, even rental prices, I see a decrease, not an increase,” he said.

But not everyone agrees. Thomas Hoenig, former president of the Federal Reserve Bank of Kansas City, said interest rates need to be higher in the long run.

“My own view is that you have to raise rates. If inflation is 8%, you need to raise rates much higher,” he told CNBC’s “Asian street signs.”

“They need to stay there and not step back too soon to where they curb inflation,” said in the second quarter [of] 2023 or the third quarter,” he added.

– Jihye Lee of CNBC contributed to this report.