New Prime Minister Kwasi Kwarteng reaffirms Bank of England independence | Business newsletter

New Prime Minister Kwasi Kwarteng has told the Governor of the Bank of England that he wants to reaffirm the independence of the bank.

During the previous meeting on Wednesday, Mr. Kwarteng told Andrew Bailey: “Real independence is fundamental to the way we see the management of the economy.”

These words appear to be intended to show investors that the new government under prime minister Liz Truss will not put pressure on the central bank.

During the Conservative leadership race, Ms Truss said the government should set a “clear direction” for monetary policy, although she later appeared to back away from this position.

Mr Kwarteng also said on Wednesday that he and Mr Bailey would meet regularly – twice a week initially – to coordinate as they try to pull the UK out of the economic hole.

Speaking to the MPs’ Treasury Select Committee ahead of his meeting with the prime minister, Mr Bailey said BoEThe role of policy setting was last considered almost a decade ago.

“I think it’s a good idea to review transfers from time to time, other central banks do that,” he said, adding: “It’s clear to the government to choose whether to do the review or not.”

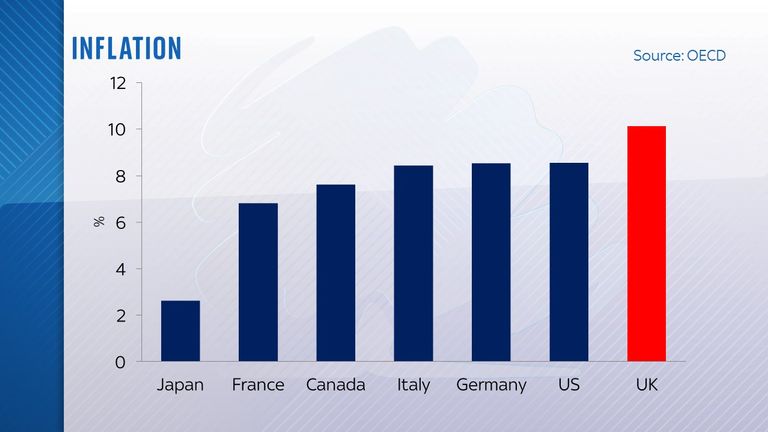

The Treasury Department said the pair had agreed that controlling inflation – one of the BoE’s key mandates – was “central to addressing cost-of-living challenges”.

It added: “The Prime Minister updated the governor on his fiscal and growth strategy, noting that reforms that facilitate a high-growth economy could help ease inflationary pressures.

Read more:

Pound Sterling falls to lowest level against US dollar since 1985

Bank of England governor hails prospect of ‘important’ energy bill clarity in fight against inflation

“He outlined the government’s plan for action this week in response to high energy prices and reiterated that action would require short-term fiscal easing.

“The Prime Minister confirmed that over the medium term the government is committed to seeing debt fall.”

The British pound fell to its lowest level against the US dollar since 1985 on Wednesday afternoon, driven in part by a strong dollar but also by growing concerns about the economic outlook for the UK.

The struggling pound could boost inflation by raising import costs, pushing the BoE to raise rates further when its monetary policy committee meets next week.

It came like Ms. Truss is set to reveal how she handled the cost of living crisisamid speculation that energy prices will freeze.

There is hope that freezing energy prices will help slow inflation.

However, after saying she wants tax cuts and does not support extending income taxes from oil companies to finance the plan, there are concerns that government borrowing will increase.