Musk sells another $973 million in Tesla shares amid strong growth in the sector

Tesla Managing director Elon Musk sold an additional $973 million in stock to pay taxes after exercising the option on Tuesday, filings show after tram Manufacturer’s stock rebounds during regular trading.

Musk bought 2.1 million shares worth $2.2 billion at Tuesday’s closing price and sold 934,091 for $973 million to pay taxes, SEC filings show.

In a sector led by Rivian Automotive and Lucid Group, Tesla rose 4.1 percent to close at $1,054.73, leaving its market capitalization down about $187 billion from its previous level. Musk started selling stocks last week.

Shares of Rivian are up 15%, with the electric-car maker now up more than 120% since its initial public offering last Wednesday.

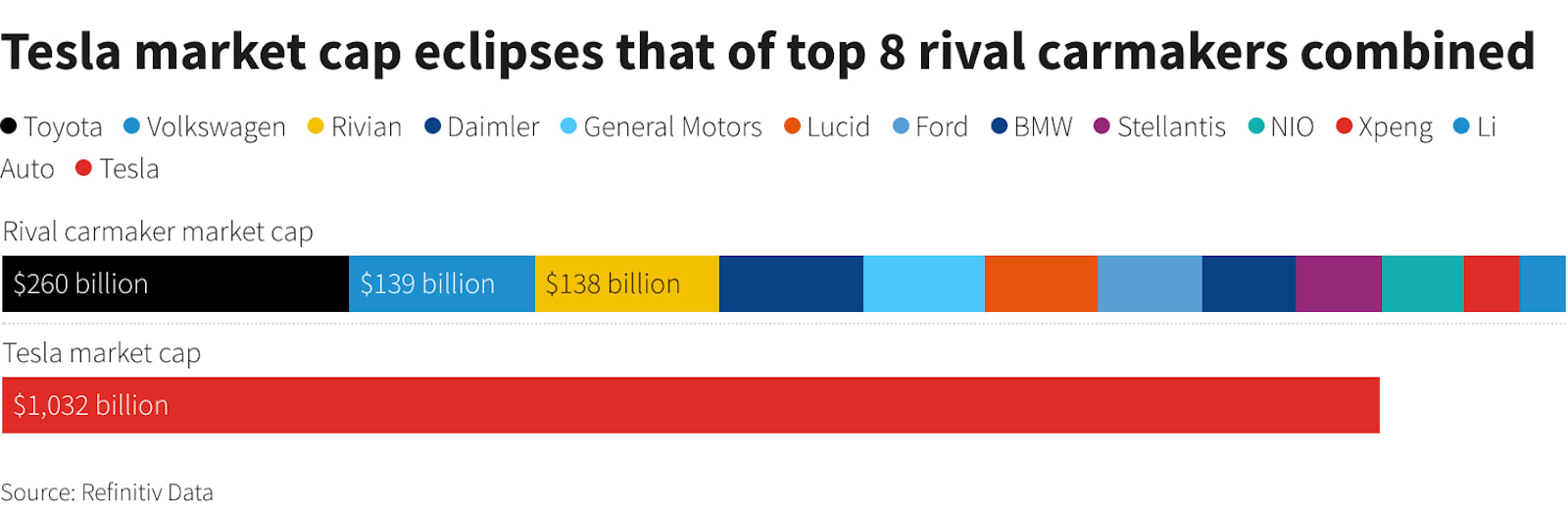

Rivian disclosed in a filing on Tuesday that its underwriters purchased an additional 22.95 million shares, boosting the total size of the IPO. Including those shares, Rivian’s market capitalization has grown to $153 billion, surpassing Volkswagen AG raises $14 billion and makes Irvine, California, the company’s third most valuable automaker in the world. Tesla’s market capitalization pales in comparison to the top eight rival automakers combined.

Lucid grew nearly 24% after it said its car reservations rose to 13,000 in the third quarter and it is confident it will produce 20,000 of the upcoming Lucid Air sedans by 2022.

Lucid’s stock increase has raised stock market worth $90 billion, surpassing Ford and leave $first missing a billion Synthetic engine.

In the past week, Musk has sold about 8.2 million Tesla shares for about $8.8 billion. That sale is almost half complete his pledge on Twitter to sell his 10% stake in Tesla.

Musk started selling shares last week after pitching the idea in a Twitter poll.

With growing demand from electric carmakers on Wall Street, Tesla’s stock has surged more than 150 percent in the past 12 months.

“There’s still a lot of people interested in buying because I still think investors are ultimately seeing this as a phase and seeing the pullback as one,” said Craig Erlam, senior market economist at OANDA. opportunity”.

“If you ask me where the stock price will be six months from now, 12 months from now? I would say it’s more likely to be 20% higher than 20% lower.”

Related videos: