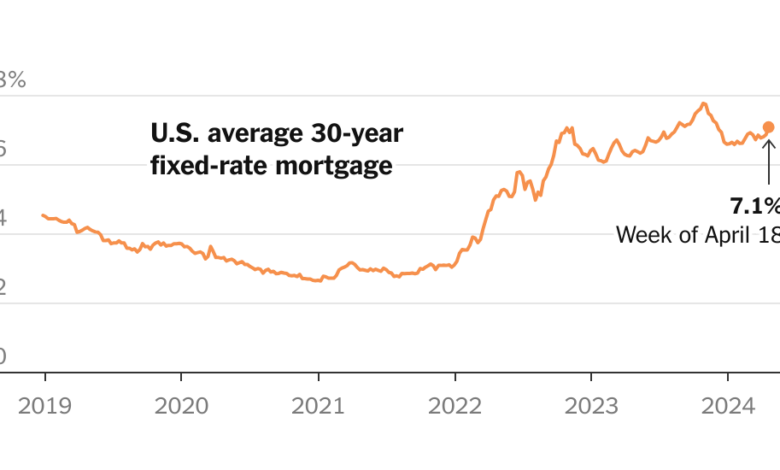

Mortgage interest rates in the US increased above 7% for the first time this year

Mortgage rates rose above 7% for the first time this year, surpassing a worrying symbolic threshold that risks leaving millions of potential home buyers and sellers on the sidelines in the US housing market. is showing signs of slowing down.

The average interest rate on 30-year mortgages, the most popular home loan in the United States, rose to 7.1% this week, says Freddie Mac reported on Thursdaythe highest since November. Mortgage rates hit a recent high of nearly 8% late last year — a level not seen since 2000.

As mortgage rates have risen in recent months, making homeownership more expensive for buyers, potential sellers, who may feel locked into lower interest rates on their existing loans, have kept their homes off the market, thereby pushing home prices higher. Combined, the forces have created a broader sense of disappointment about the economy, at a time when inflation remains hotter than expected.

“Potential homebuyers are deciding whether to buy before interest rates move higher or delay in hopes of a reduction later this year,” Sam Khater, chief economist at Freddie Mac, said in a statement. . “It remains unclear how many homebuyers can withstand future rate increases.”

At the same time, the market has slowed down. Existing home sales fell 4.3% in March and 3.7% from a year earlier, according to the National Association of Realtors.

In April 2021, mortgage interest rates were around 3%, less than half of what they are today. They began rising that year and continued to rise in 2022 as the Federal Reserve began raising benchmark interest rates in an effort to fight inflation. Although inflation has cooled significantly, it is still above the central bank’s 2% target.

The Fed has signaled in recent months that it may keep borrowing costs higher for longer amid persistent inflation. The Fed’s benchmark interest rate is currently at its highest level in 22 years.

Mortgage lenders typically track 10-year Treasury notes, which are tied to mortgage rates, and expectations that the Fed will keep interest rates high have pushed Treasury yields up. The yield on the 10-year Treasury note has soared since the beginning of the year, now at around 4.6%.

NAR agree to resolve the dispute last month will eliminate standard sales commissions, a move that housing experts say could depress home prices. Sellers currently have to pay a 5 or 6 percent commission to real estate agents, a cost that is often passed on to buyers through higher listing prices.