Montana adapts innovative hospital billing model, experts are watching

Montana is signaling that it can creatively move away from setting the price its public employee health plan pays hospitals for services, an approach that has saved the state thousands of dollars. million dollars and became a model for health programs across the country.

The plan became nationally known to employers and health care price reform advocates when, in 2016, it set a maximum amount the health plan would pay for all services. inpatient and outpatient services. Those amounts are tied to the Medicare reimbursement rate. Adopting that model, known as reference-based pricing, has saved the state tens of millions of dollars. Taxpayers help fund health and insurance programs for employees and their families, which total about 28,800 people.

Montana didn’t invent reference-based pricing, but the state made waves by having a health plan of that size that sets prices for all services, not just certain procedures. determination, such as a knee replacement.

Now, Montana is positioning itself to adapt its model, and like many states and employers looking to cut costs, consider adopting it. That leaves health economists and those working to reduce hospital prices elsewhere wondering if the state is ahead of the curve – or setting itself a step backwards.

“We look to Montana because of its success story,” said Gloria Sachdev, president of the Employers Forum of Indiana, a nonprofit trying to improve healthcare prices. “Now that it’s doing something new, I think a lot of eyes will be on Montana.”

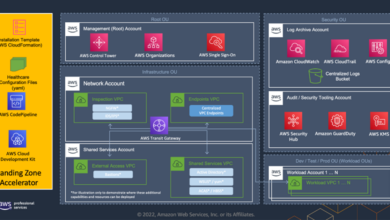

In September, the state awarded Blue Cross and Blue Shield of Montana a contract to take over management of the public employee health plan beginning next year. The contract calls for using Medicare rates as a basis to set overall goals for how much the plan will reimburse hospitals. It gives Blue Cross the ability to meet those goals with reference-based pricing – but also by negotiating deals with individual healthcare providers using a combination of reimbursement models.

State said in a news release announcing the contract that its new repayment targets will save $28 million over the next three years. But the contract details on how to get there are vague.

Blue Cross, one of Montana’s largest insurers, would not detail its plan while Allegiance Benefit Plan Management, the current manager of the employee health plan, challenged the decision. state contract. Allegiance has held the contract since the state adopted a reference-based pricing model.

John Doran, a spokesman for Blue Cross, said state officials have directed company officials to refer all inquiries to the Montana Department of Public Administration.

When asked how the upcoming changes would affect the existing model of the health plan, Montana officials pointed to the state’s contract with Blue Cross. According to that document, Blue Cross may create “custom alternative payment arrangements with providers” with state approval.

Not a Modern Healthcare subscriber? Sign up today.

In a state press release, officials said the goal is to “modernize” their six-year-old reimbursement strategy. Department of Administration Director Misty Ann Giles said in the statement that the state has selected a provider to help them “become more agile to effectively achieve their goals.”

The United States has struggled to cope with rising health care costs. The Centers for Medicare & Medicaid Services estimates that in 2020, health spending will increase by nearly 10% to $4.1 trillion, or $12,530 per person. More than 160 million people in the US have employer-sponsored health insurance. Previously, the rates paid by employee health plans were negotiated separately between health care providers and third-party administrators such as Blue Cross, with negotiations often starting from the price offered by the hospitals.

That process has exacerbated a lack of transparency in the cost of care and has contributed to a wide range of prices paid by private insurance plans. In a study of medical claims data from 2018 to 2020, think tank Rand Corp. found that private insurers in some states, such as Washington, paid hospital prices 175% less than Medicare would pay for similar services at similar facilities , while in other states they pay 310% of the Medicare price or more.

In 2016, Montana took a bold leap. Instead of negotiating a discount off the hospital’s list price, the state sets a range for what the hospital can charge for services, setting the maximum cost as a set percentage on Medicare prices. If hospitals refuse to negotiate through that model, they risk losing access to insured patients through the state’s largest employer.

Marilyn Bartlett, who spearheaded the shift to reference-based pricing when she worked for Montana, said that at the time, the plan had been losing money for years and was in danger of shrinking its reserves to negative levels. In 2017, Bartlett said, the plan’s reserves had accumulated more money than the state’s general fund, and the premiums paid by public employees remained at the level.

“We have flattened the price curve,” said Bartlett, now a senior policy fellow at the National Academy of State Health Policy advising other states on how to reduce health care costs. and the fact that we ran into negative problems. “That was unheard of.”

Dr. Stephen Tahta, president of Allegiance Benefit Plan Management, said that while Allegiance was the administrator of the health plan, it saved more than $48 million.

Hospital representatives say a growing number of employer-based plans are looking at increasing their reliance on reference-based pricing.

In recent years, California’s retirement plans that offer benefits to public employees have worked to expand reference prices for certain drugs.

Download the Modern Healthcare app to stay up to date with industry news.

And the state of Colorado joined a purchasing coalition to negotiate with hospitals about pricing for its public employee health plan this year, seeking to use Medicare pricing as a basis. So far, while major health systems have limited that process, patients also have a tool to compare prices for care, said Bob Smith, executive director of that alliance, Colorado Business Group on Health. health care provider to choose a provider that is reasonably priced and provides high-quality care. .

The American Hospital Association opposes reference-based pricing, arguing that it can increase the amount patients pay for care. One possible way is through balance billing, where the provider charges the patient the difference between the cost set by the plan and the amount charged by the provider.

Advocates of price reform have said that the initial prices of hospitals before negotiations can be arbitrary and that Medicare prices are a fair starting point. Medicare reimbursement may be adjusted if the provider faces major expenses such as operating in a rural area or hiring staff to provide intensive care services.

In the contract awarded in September, the state sets a cap of no more than 200% of the Medicare price on what the Blue Cross plan will pay to providers overall in the first year. The contract says Blue Cross will target reimbursement to providers at an overall rate of 180% of the Medicare rate by the third year of the agreement.

Bang gave it to Blue Cross to figure out how to achieve those goals.

After KHN shared details of Blue Cross’s reimbursement on state contracts with Chris Whaley, health economist and policy researcher for Rand, he said it’s hard to know how the new approach will work. how to move. Blue Cross’s plan does not indicate how often the company will negotiate deals with external vendors for reference-based pricing. Whaley said that could distract Montana from its reimbursement strategy.

“It looks like the model has worked really well,” Whaley said. “Is the reference-based pricing model something to be developed and improved upon? Or could something be stripped away and no longer have the same impact? “

Allegiance alleges that the contract was awarded through an illegal tendering process and that it could lead to increased healthcare costs for public employees and taxpayers.

Belinda Adams, a spokeswoman for the Department of Administration, said state officials were looking into the issues raised by Allegiance but believed the hiring process was fair and legal.

The state has 30 days from Allegiance’s objection to decide on the company’s claims if the two parties fail to reach an agreement to resolve the dispute. Meanwhile, Adams said, Blue Cross is preparing to take over management of the employee wellness program in January.

Kaiser Health News is a national health policy news service. This is an editorially independent program of the Henry J. Kaiser Family Foundation not affiliated with Kaiser Permanente.