Minutes of the Fed’s March 2022 meeting:

Federal Reserve officials discussed how they want to reduce trillions of bond holdings at their March meeting, by a consensus amount of about $95 billion, minutes released Wednesday showed .

Officials “generally agree” that a limit of $60 billion in Treasuries and $35 billion in mortgage-backed securities would be allowed to roll out, in phases over three months.

At the meeting, the Fed approved the first rate hike in more than three years. The 25 basis point increase – a quarter of a percentage point – has lifted the benchmark short-term borrowing rate from near zero since March 2020.

In addition to the balance sheet discussion, officials also discussed the pace of upcoming rate hikes, with members leaning toward more aggressive moves.

That means the possibility of a rate hike to 50 basis points at upcoming meetings, a level in line with market valuations for the vote in May. In fact, there was more sentiment going higher last month.

“Many participants noted that – with inflation above the Commission’s target, increased inflation risks, and the federal funds rate much lower than participants’ estimates for the long-term level – they would prefer 50 basis points increase in the target range for the federal funds rate at this meeting,” the minutes said.

Uncertainty about the war in Ukraine has prevented some officials from going with the 50 basis point move.

Also at the meeting, Fed officials also sharply raised their inflation outlook and lowered their economic growth expectations.

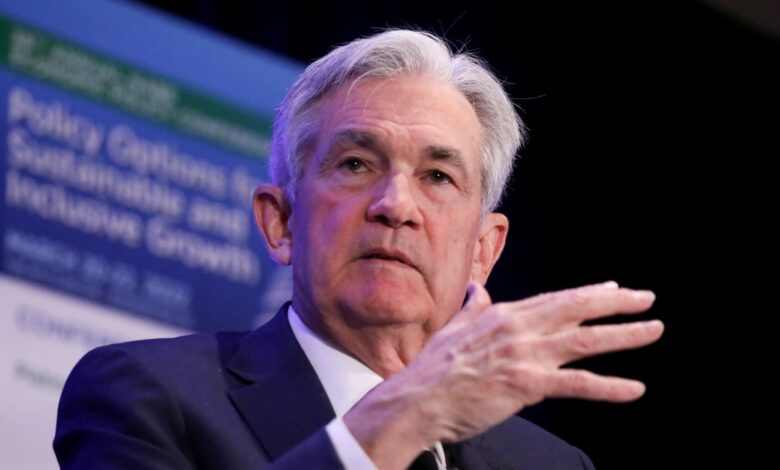

Markets are looking to the release for details on where to start monetary policy from here. Specifically, Fed Chairman Jerome Powell said in his post-meeting news conference that the minutes will provide details on thinking about the balance sheet cuts.

The Fed expanded its holdings to about $9 trillion, or more than doubled, in monthly bond purchases amid the pandemic. Those purchases ended only a month ago, despite evidence of higher inflation than anything the US has seen since the early 1980s, an increase President Paul Volcker when That was extinguished by dragging the economy into a recession.

Policymakers in recent days have become increasingly tough in their stance on curbing inflation.

Governor Lael Brainard said on Tuesday that lowering prices would require a combination of a steady increase and a sharp decrease in the balance sheet. The market expects the Fed to raise a total of 250 basis points this year.

This is breaking news. Please check back here for updates.