Losses Shrink Amid Box Office Rebound – The Hollywood Reporter

As AMC Theatres sees rebounding October attendance figures for its film screens, dad or mum AMC Leisure Holdings shrunk its movement of purple ink on Monday, even because the cinema big warned pandemic challenges nonetheless stay.

The world’s largest movie show chain recorded a $224.2 million internet loss, or 44 cents per share, on $763.2 million in income. In the course of the year-ago interval, the corporate reported a lack of $8.41 per share and an general third quarter income of $119.5 million.

The newest quarterly efficiency beat an anticipated loss per share of 51 cents from analysts, and income for the quarter estimated to achieve $717.1 million.

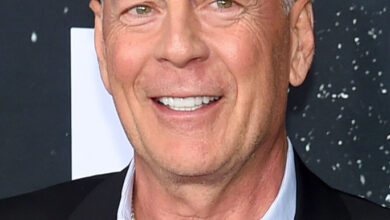

AMC president and CEO Adam Aron mentioned in an announcement his firm hosted just below 40 million friends in film theaters within the U.S., Europe and the Center East throughout the third quarter of 2021, which bodes properly for the exhibition big’s efficiency into 2022.

“We’re additionally inspired by the outcomes from the start of the fourth quarter of 2021. Certainly, as we introduced only a week in the past, our October theatre admissions revenues had been the very best of any month since earlier than the world pandemic pressured the closure of our cinemas greater than a yr and a half in the past. That is only one extra good signal amongst many we’ve seen in 2021,” Aron added.

Throughout an after-market traders name, Aron insisted AMC was on a sustained path to restoration, judging by key metrics from the primary three quarters of 2021. “The upward pattern is obvious and unmistakable,” he argued.

In the course of the newest quarter, admissions income climbed sharply to $425.1 million, in opposition to a year-earlier $62.9 million. Meals and beverage income additionally rebounded to $265.2 million, in comparison with $29 million throughout the identical interval final yr.

The newest monetary efficiency by the cinema big represented an enchancment on the third quarter of 2020 when AMC was reopening theaters to climate the coronavirus pandemic and keep in enterprise. However the newest quarterly income line continues to be properly down from the $1.31 billion in general revenues recorded by AMC within the third quarter of 2019, when it bought 87.1 million film tickets worldwide, earlier than the pandemic impacted its enterprise.

AMC and rival exhibitors have seen robust October film ticket income as client confidence underpins a strengthening theatrical movie market because the pandemic’s grip on the trade eases. And with a powerful theatrical launch schedule heading into Christmas, analysts are more and more bullish on theatrical field workplace into 2022 and past as main studios are far much less more likely to push again tentpole releases on the native multiplex or depend on hybrid releases.

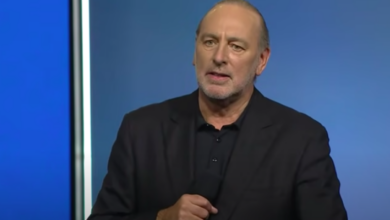

“We stay optimistic concerning the exhibition trade as attendance begins to rebound. Q3 attendance started to meaningfully decide up as soon as top-tier titles had been launched to theatres after prolonged delays, and This autumn quarter-to-date field workplace has been very encouraging,” Wedbush analyst Michael Pachter wrote in a Nov. 4 analysis observe.

Hollywood’s day-and-date mannequin for many tentpoles throughout the pandemic dented theatrical field workplace as the main studios pushed a number of massive releases into late 2021 or 2022. On the similar time, exhibitor shares have rallied of late as traders look past the affect of the delta variant on theater-going resulting from rising vaccination charges and the field workplace efficiency of latest movie titles like Venom, Dune and No Time to Die.

However a field workplace rebound however, Wall Road analysts stay bearish on unstable AMC shares after it used its standing as a meme inventory because of rogue retail merchants on Reddit and different social media hubs to lift recent money at a steep market premium to make sure survival and pay down debt and curiosity bills.

“The price of the corporate’s liquidity lifelines … carried a really excessive worth and can function a serious headwind for a number of years to return,” analyst Eric Handler of MKM Companions argued in a Nov. 4 analysis observe concerning the latest debt and inventory choices underpinning AMC’s new capital construction and a inventory standing at a steep premium to these of its trade rivals.

Regardless of an earnings beat, shares within the cinema big had been buying and selling decrease in after-market buying and selling, down 92 cents, or round 2 %, at $44.14, as traders proceed to weigh whether or not a rebounding exhibition trade warrants a unstable AMC share worth, or whether or not the corporate will lag its peer because the theatrical market enjoys a better-than-expected restoration within the face of streaming competitors.

In response to these market jitters, CEO Aron on the convention name advised traders: “Nevertheless, even amidst such excellent news, we’re not but the place we would like and should be. We want to emphasize that nobody ought to have any illusions that there’s no more problem forward of us nonetheless to be met. The virus continues to be with us, we have to promote extra tickets in future quarters than we did in the latest quarter, and adjusted EBITDA continues to be properly beneath pre–pandemic ranges.”

To diversify away from film exhibition, Aron additionally advised analysts that AMC is exploring easy methods to settle for cryptocurrencies for on-line cost and even presumably launch its personal cryptocurrency. And the cinema big is exploring with main Hollywood studios easy methods to use blockchain expertise to show commemorative movie show tickets into NFTs, or non-fungible tokens.

Aron added AMC was contemplating launching its personal branded bank card for shoppers, and even entering into film manufacturing. “We’ve made content material earlier than, and on this day of age, when a lot content material is being created, it’s attention-grabbing to think about whether or not AMC ought to fund content material, and whether or not AMC ought to fund its personal content material that may solely be seen at our personal theaters. These are all potentialities,” he mentioned throughout a convention name the place AMC execs answered questions nearly totally from retail shareholders, with just one taken from a Wall Road analyst.

The AMC boss was additionally requested about plans to pay down the exhibition big’s enlarged debt burden to get by way of the pandemic. “Of all of the issues which have stored me up at evening within the final two years, our debt load will not be one among them,” he advised traders, whereas including AMC has no main debt maturities due earlier than 2026, permitting time to rebuild the corporate’s stability sheet with debt refinancings.

And Aron touted a latest cope with Warner Bros. to return to an unique, 45-day theatrical window in 2022 as he mentioned the main studios shifting away from a reliance on day-and-date movie releases throughout the pandemic. “I feel you’ll see a revival of an unique theatrical window and that’s clearly to the advantage of AMC,” he argued.

AMC went into the market launch of its third quarter monetary outcomes on Monday with its inventory worth having climbed 8 %, or by $3.35, to finish the day at $44.06.