Japan’s BOJ was ‘wrong’ on inflation, analyst says

Bank of Japan Governor Kazuo Ueda arrives to conduct an interview with a small group of journalists in Tokyo on May 25, 2023.

Richard A. Brooks | AFP | beautiful pictures

Analysts are divided over the Bank of Japan’s moves after the country’s core inflation topped the central bank’s 2% target for the 15th straight month.

CLSA Japan strategist Nicholas Smith said the BOJ was “wrong” on inflation.

“They watched the Fed say inflation was temporary and were seen as foolish to do so,” Smith said in an interview with CNBC.Asian street signs.”

“They decided to ignore that and continue forecasting this fiscal year, inflation at 1.8%. Inflation has been above 2% for 15 consecutive months.”

core of Japan consumer price index increased by 3.3% over the same period in June, in line with the expectations of economists polled by Reuters and slightly above the 3.2% recorded in May.

Core inflation in Japan removes fresh food prices from the general consumer price index. The headline inflation rate stood at 3.3% in June, up slightly from 3.2% in May.

Inflation numbers are key to the BOJ’s monetary policy considerations ahead of next Friday’s meeting.

In a note, Barclays economist Tetsufumi Yamakawa said the majority of the market still seems to view price increases in Japan as “transient”, arguing that it is due to “cost push” rather than “demand pull”.

However, he sees a “gradual intensification” that sustainable inflation will materialize with massive wage increases due to the latest wage negotiations, aka “shunto”.

“We expect ‘temporary’ wage hikes to be smaller in FY2024 than FY23, but forecast increases of around +3%, in line with our +2% price stability target.

Change stance YCC

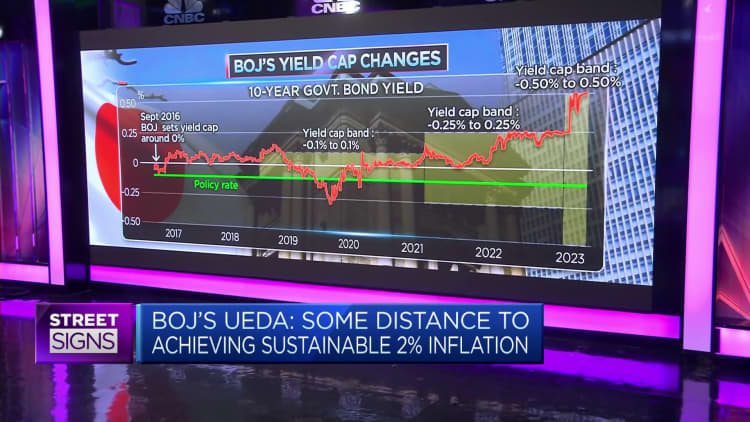

With this in mind, investors will be looking for signs that the BOJ will change its stance on its extremely loose monetary policy – or more specifically, its “yield curve control” policy.

Under YCC policy, the central bank targets short-term interest rates at -0.1% and 10-year government bond yields at 0.5% above or below zero, with the aim of maintaining the inflation target at 2%.

However, BOJ governor Kazuo Ueda signaled in a recent Reuters report The BOJ’s ultra-loose monetary policy may be maintained for now, saying that “there is still a gap to achieving the central bank’s 2% inflation target in a sustainable and stable manner.”

As for Smith, there is a “very high probability” that the BOJ will change its stance on the YCC at its next central bank meeting next Friday.

According to Smith, the so-called “core” inflation rate – which excludes fresh food and energy costs – was “spiking” at 4.2% in June. That was the highest level since September 1981, he added that “its own measure shows what they’re saying is wrong.”

The main driver of inflation is food, along with rising electricity prices, rising wages and a weak yen, the CLSA strategist said. Noting that wages have also seen their biggest increase in 30 years this year, Smith said inflation in Japan is likely to rise unexpectedly in the near-term, due to a growing wage price spiral.

“If the BOJ doesn’t do anything, the yen will break through 150” against the dollar, he said. “We know from experience that intervention doesn’t work. I’ve seen $95 trillion worth of forex intervention since 1990 and the effect of that is hours, not days.”

Smith said the BOJ’s bond purchases have increased just to maintain its YCC policy, pointing out that its bond purchases have amounted to 15.8% of Japan’s gross domestic product since early December.

Ueda said the BOJ is reaching the limit of what it can do because it already owns a third of the bond market, he added. “Now it owns 55% of the bond market and it’s starting to look like Looney Tunes.”

However, Yamakawa does not see the BOJ changing its stance on monetary policy at its July monetary policy meeting. Instead, he predicts the central bank will begin phasing out the YCC at its October meeting, when its next quarterly outlook report is released.