EV tax credit supply chain regulations loosened, but China restrictions remain

In a coordinated effort across federal agencies, the Biden administration on Friday announced a revised set of regulations applicable to the electric vehicle tax credit, which will finally make it easier to claim the credit. for more vehicles in 2025 and 2026 but not easier for Chinese companies. to gain a foothold in the market.

The news comes in updated rules posted Friday by the U.S. Department of Energy (DOE), Department of Transportation (DOT) and Internal Revenue Service (IRS), each of which deals with the industry. their respective sectors in determining and enforcing the credit rules as laid down. under the Inflation Recovery Act of 2022.

Reduction of critical minerals until 2027

The good news for automakers, especially for battery and related component factories in North America, is that after Friday’s hearing, they have two more years to comply with the requirements. much more stringent about the origin of minerals in batteries.

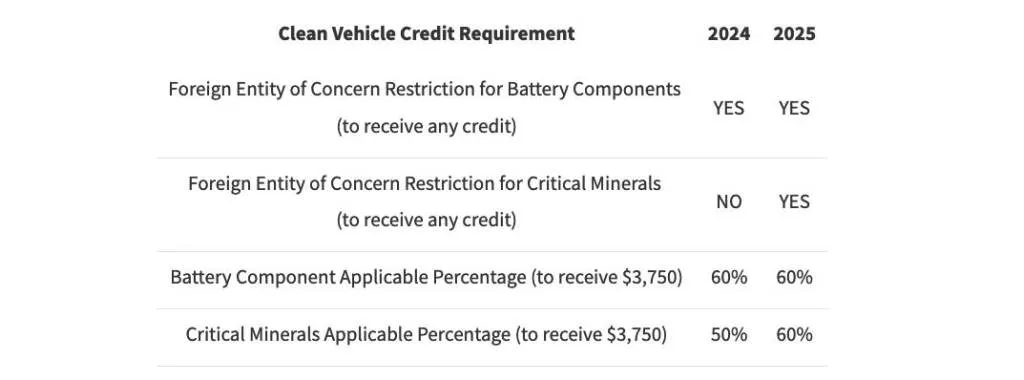

EV tax credit requirements – revised May 2024

Under the original IRA framework, electric vehicles would not qualify for the full electric vehicle tax credit in 2024 without 60% of its battery components being sourced from the United States and without at least 50% of its significant battery materials. material is mined or processed in the United States or another country. Favored trading partners such as Japan, South Korea or the European Union.

Those requirements will become even more stringent in 2025 with even tighter restrictions on the origin of battery materials; Vehicles containing any mineral resources from China or other relevant Designated Foreign Entities will be disqualified. But under Friday’s rule, companies have until 2027 to comply, allowing automakers and supply companies to get more serious about how they track their supply chains between now and then. at that time.

Kia EV9 2024

“Today’s actions by Treasury and DOE provide clarity and certainty,” John Podesta, senior adviser to the President for International Climate Policy, said in a statement summarizing the Biden administration. for the rapidly growing electric vehicle market.” “The direction we are headed is clear—toward a future where more Americans drive electric or plug-in hybrid vehicles and those vehicles are affordable and made in America. ”

Treasury Secretary Janet Yellen, in announcing the final rules, also pointed out how in Tennessee, North Carolina and Kentucky “ecosystems have evolved in communities across the country to bring bring clean vehicle supply chains to shore so the United States can lead in green energy.”

Current credit requirements remain

The Treasury Department and Internal Revenue Service have outlined the sections that automakers will need to comply with in 2025 versus 2024. Currently, cars earn a maximum of $7,500 if assembled in North America , while half of that amount involves critical minerals and half of that involves battery components.

The tax credit is only available to those with modified adjusted gross income limits of $300,000 for married couples filing jointly, $225,000 for heads of household, and $150,000 for single filers. Other applications and IRA tax credit rules set price limits at $55,000 for new cars and $80,000 for new trucks, SUVs and vans.

Ford F-150 Lightning 2024

Current regulations leave a relatively small portion vehicle qualifies for the full $7,500 credit amount. In 2024, credit also becomes one Discount right at the dealeralthough not all agents are registered with the IRS to provide that service.

The new rules unveiled Friday also support the program with “integrity measures,” requiring pre-compliance reviews “to ensure that qualified manufacturers accurately represent content their battery” so that taxpayers will not be fined if the vehicle is found to be non-compliant.

The new rules include upgraders in the definition of manufacturer — an especially important consideration for commercial vehicles aiming to claim the related 45W credit.

2025 Pole 3

Is it easier for China to get involved in electric vehicles or the supply chain?

The so-called Foreign Entity of Concern (FEOC) requirements enshrined in the code are a real concern for companies with partial or full Chinese ownership that want to set up facilities. facility in North America for electric vehicle supply chain or electric vehicle assembly.

The comments in the revised rule place jurisdiction on DOE to determine whether a company is in compliance. According to DOE, the agency also released subtle rules For the Foreign Entity restrictions of concern, the 25% threshold for voting rights, equity interests and board seats of a company seeking to claim tax benefits will be imposed by this authority. Independent and qualified assessment.

Given China’s Geely’s current stake in Polestar, that could make it excluded from full credit in the long term, although they plan to assemble vehicles in the US. That also means a slew of Chinese suppliers that have built factories in the US for other aspects of the auto supply chain, are looking to get into the electric vehicle supply. string, will not qualify. So of all these agencies, DOE may have the most important political and global role in tracking money.