Cost of living: Rising energy bill burden will push UK into disaster territory | Business newsletter

We have never seen anything like this.

The UK has been through all sorts of ups and downs (sadly more of the latter than the former) in recent years.

There was the financial crisis of 2008 and the recession that followed, a lost decade due to stagnant food and productivity, Brexit and of course COVID-19 pandemic and related lockdowns.

Invoice set to increase after price cap announcement – live update

Each of these events constitutes a major economic moment, but none of them will prepare us for what we are about to experience this winter.

Because energy crises are simply different.

This time period is not financial plumbing breaking but the most important force in our lives: heat and energy.

Energy is an important, pervasive part of the economy, just like many other important, ubiquitous things like air and water, we often take for granted.

But this crisis is one of those moments where we must pay attention.

Nearly all economic activity is, in one way or another, a form of energy transfer.

The consequences are huge

Most economic output depends on energy, whether it’s powering your computer or the natural gas and coal we burn when we make glass or steel (or silicon chips).

All paths eventually lead you back to the energy in all its guises.

So when the price of that ubiquitous essential force rises, as it has recently done, the consequences are enormous.

Read more:

Explainer: Everything you need to know about higher bills

Explainer: Who is suggesting what to tackle soaring energy bills?

This is not a UK-specific issue; Every country around the world is grappling with this challenge – mostly European countries – but Britain’s somewhat odd domestic pricing means it provides a clear example of the scale of the problem.

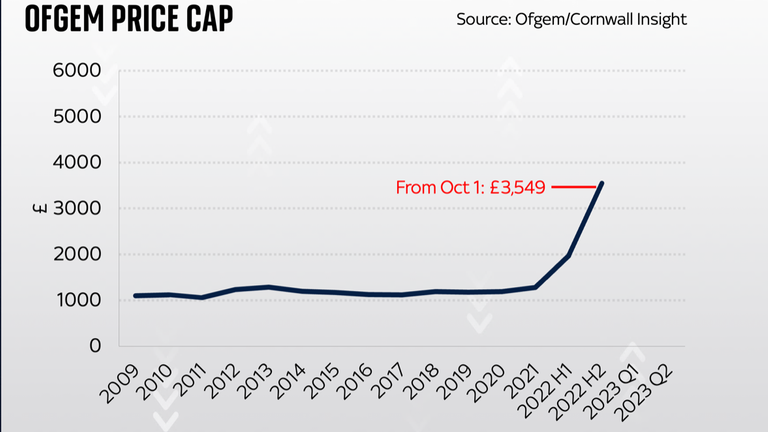

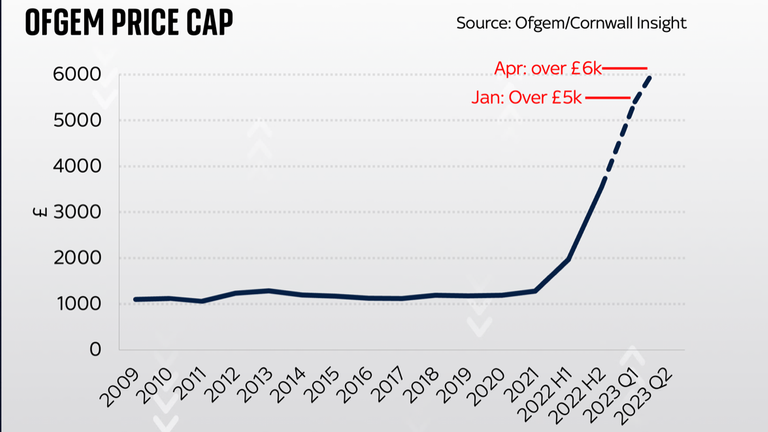

The system works roughly like this: every six months, the regulator Ofgem reviews wholesale prices, runs them through its model that allows for some extra costs including the legacy of renewable energy. generate expensive and a small profit for suppliers and set average unit prices for gas and electricity.

Those prices are usually published as “household averages” based on typical usage.

The last time the limit was announced average is £1,971; Now Ofgem has announced that it will up to £3,549 from the beginning of October.

However, these bare numbers only tell you so much.

So the best place to look next is typical household spending and see what those kinds of numbers mean for our typical spending rates.

Part of the reason so many of us take energy for granted is that it’s been relatively cheap in recent decades – although the word “relative” is important here: for some families, the cost Energy costs have long been a serious burden.

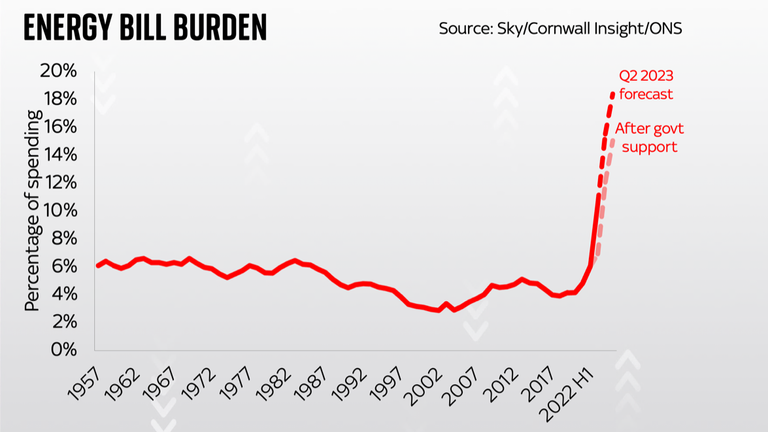

However, the average is the simplest metric we have here, and the average amount households pay to heat their homes and provide electricity between 2000 and 2020 is about 3. 9% of their total spending.

Things are starting to look creepy

This is a historical and relative low: from 1957 to 1987, our share of heat and electricity was just over 6%.

But due to the most recent increase of the price cap and things are starting to look ghastly.

The proportion we spend on heat and electricity has increased in recent years, to around 6% by the middle of this year – when the price cap hits £1,971.

This is the highest household “energy burden”, as we might call it, since the mid-1980s.

It is worth mentioning that this level has caused a significant increase in the number of people in poverty caused by fuel, as well as the number of people who owe their electricity and water bills.

But the October increase would push the energy bill burden up to 10.5% of typical spending.

This would be the highest level since comparable records began in 1957.

In a word, it’s like we’re currently spending on food and drink, although of course they’re also going up (largely because of the high cost of energy – you see, everyone sugars all return to energy).

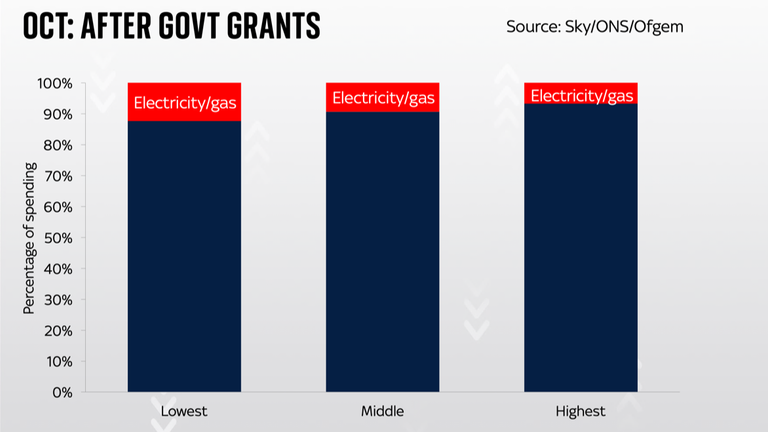

Now the government has rolled out a range of measures to help: there is a £400 subsidy for all households, a £150 council tax break for most households. family and an additional £650 for vehicle-checked benefits (as well as benefits for pensioners and those on disability benefits).

At the time, it was a really generous package, costing more than £30 billion.

However, even if you factor this into our calculation, the average household will still face an energy bill that accounts for 6.9% of their total spending.

This would be the highest ever – albeit lower than that 10.5% without government help.

The problem, however, is that this is very unlikely to be the end of it.

Future movements in wholesale gas prices are difficult to predict, but based on where the futures market is headed right now, a Cornwall Insight analyst thinks the cap will exceed £5,000. when it’s recalculated in November (the cap will be revised every three months from then on – a procedural switch introduced by Ofgem at the worst possible time).

It should rise above £6,000 in spring, based on current trends.

This is unbelievable

Given that energy bill burdens were already at historic highs in October, it goes without saying that these future increases will send us into dire territory.

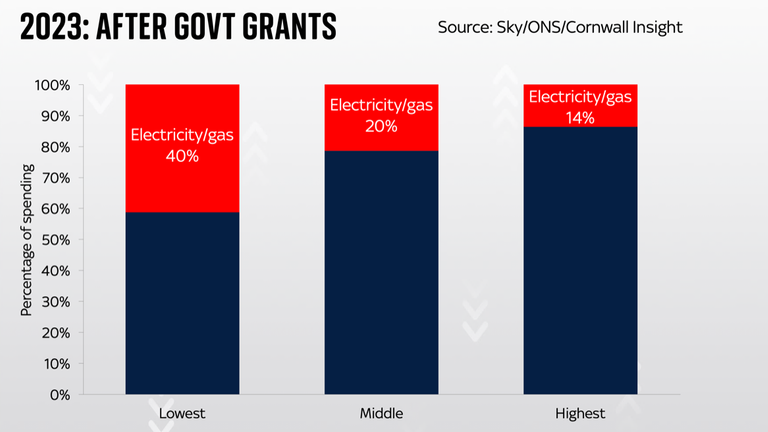

At those levels, the average household will pay about one-fifth of the household budget on energy bills.

Poorer households will be even worse: my somewhat crude and readily available calculations show that even after that generous government funding, about 40% of their spending will go to gas and electricity.

This is unimaginable.

It alludes to widespread poverty and an economic winter of the kind that we have not seen outside of war.

All of which is why it seems unbelievable that the next prime minister, could be Liz Truss or Rishi Sunakwill not interfere, and interfere, this winter.

The moment feels no different than the days and weeks before the announcement of the furlough scheme in early 2020: The UK is headed for a shutdown but the government has yet to announce widespread support, save for a number of small scale plans.

In the end, it carried out the largest intervention in postwar history.

The furlough scheme ended up costing more than £50 billion a year – and had incredibly far-reaching consequences with which we are all so familiar.

That brings us to the current situation.

The government has committed around £30 billion to energy bills.

Mr Sunak and Ms Truss have both outlined plans that involve distributing a few billion pounds more in support.

This is unlikely, given the scale of what we discussed above, is sufficient.

It will not prevent a widespread increase in fuel poverty and a very deep recession.

Sir Keir Starmer proposed a more radical policy: a freeze capping energy prices at £1,971.

This will certainly prevent a sharp increase in poverty and many economists think the prime minister will eventually have to do something similar.

But how much will it cost?

A rough and ready calculation suggests the following.

This is a big job, with huge consequences

With an energy price cap of £3,549 (in other words, on October 1), it would cost around £40 billion.

If the price cap rises as predicted by Cornwall Insights and exceeds £6,000 next spring, it will cost a whopping £120-130 billion.

It would be more than double the size of the furlough scheme, putting the UK’s national debt above 100% of GDP.

In short, this is a big deal, with huge consequences.

Subscribe to the daily podcast onApple Podcasts, Google Podcasts, Spotify, Speaker

And we haven’t even taken into account the consequences for businesses, which is doubly important here because if businesses start to collapse in mass it means the incomes of many families across the globe. The whole country collapsed.

Now, much of the above (including those costs) depends on what happens next with energy prices.

It is very likely that after the gas and electricity prices (which have been held high due to a combination of factors, most obviously the invasion of Ukraine) Russia will likely drop.

Again, it also makes sense for Europe to completely lose Russian gas this winter, which will likely push gas prices even higher than they are currently.

It would be grisly for all involved.

A crisis of everything

The UK can at least console itself that it is a bit more insulated against the possibility of running out of gas, such as Germany.

But if there’s a cold snap, anyone can guess what happens next.

It’s all quite sad, but this is the logic of energy.

An energy crisis, as I’ve said several times over the past year, is a crisis of everything.

We’re starting to figure out what that means.