Capital One Venture Bonus vs. Wells Fargo Signature Journey: Full Details

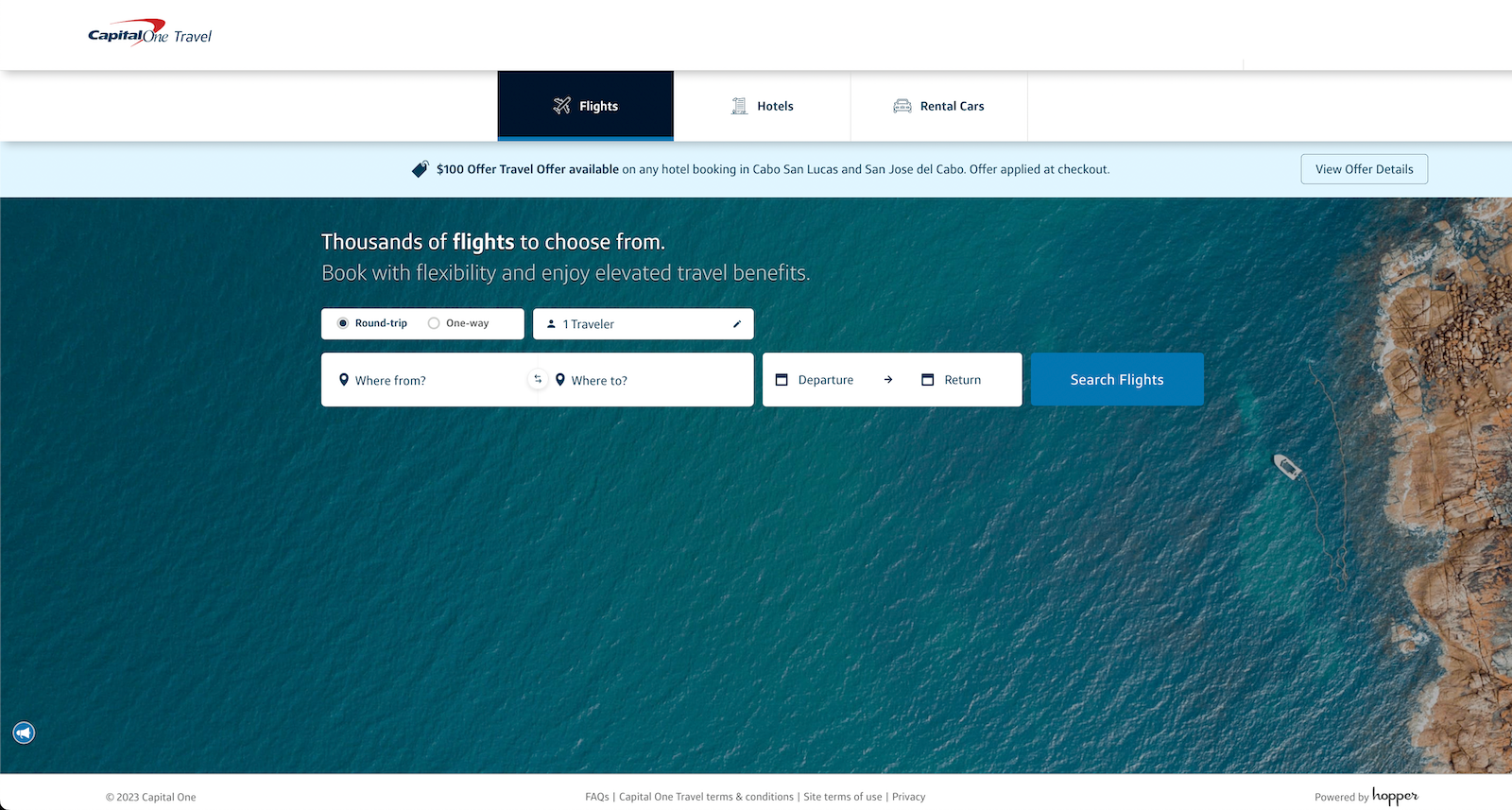

The mid-tier travel rewards card space is pretty cramped. One of the best options on the market is Capital One Venture Rewards Credit Cardoffers great value for the average traveler for just a $95 annual fee (see exchange rates and fees). It adds 2 miles per dollar spent on all purchases and comes with a Global Entry Credit or TSA PreCheck up to 100 USD.

But there is a new product that is of interest: a recently launched product Wells Fargo Signature Cruise Card℠ (see exchange rates and fees). It also has a $95 annual fee, plus an earning rate and valuable benefits that make it a serious competitor to the more established Venture card.

Which choice is better for you now and which choice will be better in the future? Let’s dive into the details of the cards to find out.

Compare Capital One and Wells Fargo Autograph Venture Bonuses

| Card | Journey to get Wells Fargo’s signature | Capital One Venture Rewards |

|---|---|---|

| Annual fee | $95 | $95 (see exchange rates and fees) |

| Sign up bonus | Earn 60,000 bonus points after spending $4,000 in the first three months of account opening. | Earn 75,000 bonus miles after spending $4,000 in the first three months of account opening. |

| Income ratio |

|

|

| Other benefits |

|

|

Welcome offer Capital One Venture Bonus vs. Wells Fargo Autograph Journey

The Joint venture rewards comes with a welcome offer of 75,000 bonus Capital One miles after spending $4,000 in the first three months of account opening.

Those miles are worth $1,388 based on TPG’s valuationso you will get great value from the bonus, even though this is a standard offer for card based preferential history.

The Signature journeyMeanwhile, comes with 60,000 bonus points after spending $4,000 in the first three months. These points are worth $960 USD based on our valuation.

Winner: Adventure reward. It has a more valuable welcome offer than the Signature Journey.

Related: How to redeem Capital One’s 75,000-mile sign-up bonus for maximum value

Capital One Venture Rewards vs. Wells Fargo Signature Journey benefits

The Joint venture rewards comes with up to $100 credit for TSA PreCheck or Global Entryplus travel and rental car accident insurance, extended warranty protection, Hertz Five Star Status* and access Capital One Lifestyle Collection of hotel and Capital One Entertainment.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

Meanwhile, Signature journey comes with a $50 annual statement credit toward airline ticket purchases, effectively reducing the annual fee to $45 if you can take advantage of that perk. Cardholders also receive mobile phone protection and access to a new benefit called “Signature Card Perks”.

While details are scarce at the moment, Autograph Card Exclusives promises to offer access to concerts featuring “big-name artists in small venues,” which seems to make for a great experience. intimate experience with famous performances.

Winner: Adventure reward. Despite the promise of Signature Cruise perks, the Venture’s longer list of established benefits still wins out.

Earn miles on Capital One Venture Rewards vs. Wells Fargo Signature Journeys

With Joint venture rewardsYou’ll earn 5 miles for every dollar spent on hotels and rental cars booked through Capital One Travel and 2 miles per dollar spent on all other purchases.

But Signature journey There are broader bonus categories. With it, you’ll earn 5 points per dollar spent on hotels, 4 points per dollar spent on airlines, 3 points per dollar spent on other travel and dining, and 1 point per dollar spent on other purchases.

Winner: Signature journey. While we think Wells Fargo points are worth a little less than Capital One miles, the additional bonus categories — specifically dining and air travel — more than make up for that difference for with most consumers.

Redeem miles on Capital One Venture Rewards vs. Wells Fargo Signature Journeys

The Joint venture rewards Earn incredibly valuable Capital One miles, giving you multiple redemption options that make each mile worth around 1.85 cents per mile, according to our valuation.

You’ll get the most value by transferring your miles to one of these Capital One travel partnerbut you can also exchange them for one Credit statement to pay for travel purchases or for gift cards or refunds.

The Signature journey has a much smaller list of redemption options and transfer partners at launch. It remains to be seen how these options will change. However, the issuer has promised more transfer partners throughout the year (see further information below).

Winner: Adventure reward. Again, this could change if the Wells Fargo program continues to expand, but for now, Capital One still has the advantage.

Related: Should I transfer Capital One miles to a partner or exchange them directly for travel?

Transfer miles with Capital One Venture Rewards vs. Wells Fargo Signature Journeys

The Joint venture rewards allow you Transfer your miles to any of Capital One’s 15+ hotel and airline partners, including valuable options like AviancaMiles Life, British Airways Executive Club And Miles&Smiles of Turkish Airlines.

And if you can take advantage of transfer rewards, you’ll get more value from your miles. For example, I want to redeem my miles by transferring them over Air France-KLM Fly Green in a period of time Transfer bonus promotion and use them to book business class flights to Europe.

The Signature journey Currently allows cardholders to transfer points to 5 airline programs:

- Air France-KLM Fly Green

- AviancaMiles Life

- Club operates British Airways, Aer Lingus AerClub and Iberia Plus (all earn Avios)

These are all great transfer partners and TPG favorites, although the number of options is obviously much smaller than those available with the Venture Bonus.

You will also be able to switch to a single hotel program, Privilege of choicealthough that list will hopefully continue to grow.

Winner: Adventure reward. Once again, the current Wells Fargo transfer lineup isn’t quite on Capital One’s level.

Related: Wells Fargo Transfer Partners: How to use Go Far Rewards points

Should I get the Capital One Venture Bonus or the Wells Fargo Signature Journey?

If you want an established card with great benefits and redemption options, you’ll want to stick with Joint venture rewards. You’ll get a high rate of return, the ability to take advantage of Capital One transfer partners, and several travel benefits for just a $95 annual fee (see exchange rates and fees).

If you want higher income rate, newly launched Signature journey is a viable option worth considering.

Bottom line

Despite their differences, Joint venture rewards and Signature journey are great travel rewards cards with valuable benefits and an average annual fee accrual rate. Venture Rewards’ established list of perks and transfer partners gives it the edge, but Signature Journeys may soon get tough with its growing list of redemption options .

Taking advantage of both cards certainly makes sense if you can handle the two $95 annual fees (see exchange rates and fees for Joint Venture Award)..

For more details, read more about Joint venture rewards and Signature journey.

Register here: Capital One Joint Venture

Register here: Journey to get Wells Fargo’s signature

For Capital One products listed on this page, some of the above benefits are offered by Visa® or Mastercard® and may vary by product. See the respective Benefits Guide for details on when terms and exclusions apply.

*Once enrolled, accessible through the Capital One website or mobile app, eligible cardholders will remain at the upgraded status level until December 31, 2024. Please note, sign up Enrolled through the regular Hertz Gold Plus Rewards enrollment process (e.g., at Hertz.com) will not automatically detect cardholders as eligible for the program and cardholders will not be automatically upgraded to status status. applicable status. Additional terms apply.