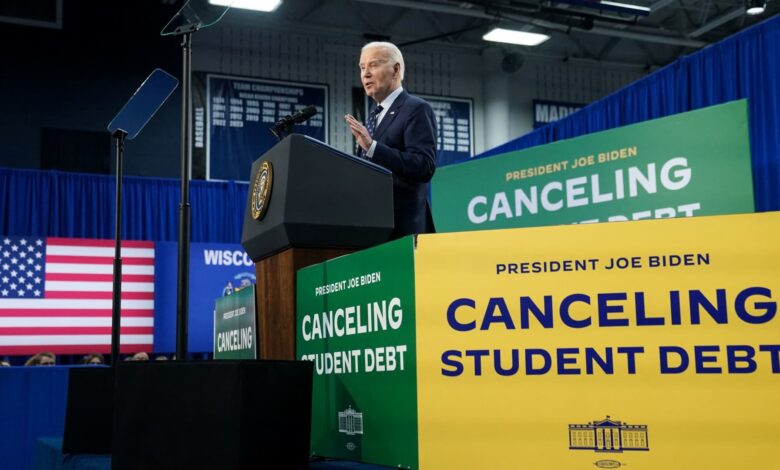

Biden administration not accelerating student loan plan

A senior Biden administration official says the U.S. Department of Education has no plans to start forgiving up to $147 billion in student debt for many people. 25 million Americans before the final rules on the program are published — although claim in contrast to seven Republican state attorneys general.

Last week, the attorneys general persuaded a judge in Georgia to temporarily block President Joe Bidennew federal debt relief plan for student loans by claiming the Department of Education tried to secretly implement the plan before the final rule was issued October.

AGs in one litigation challenged the legality of the program alleging that the Secretary of Education Miguel Cardona “quietly sent orders to loan servicers to begin canceling loans en masse as early as this week,” which would violate rules requiring final rules to be issued first.

But Biden administration officials told CNBC that the Department of Education is only instructing loan servicers to prepare for debt forgiveness.

“We will not implement any regulation before it is finalized,” the official said.

A person close to the lending industry confirmed the information to CNBC, saying the DOE is only asking servicers to prepare for the debt forgiveness program.

Those preparations included training customer service representatives on how to explain the relief to borrowers when it becomes available and drafting new information for the website.

“It’s a mandatory and necessary preparation,” the source said. “It’s similar to any kind of product launch.”

“Service providers are not provided with records for debt forgiveness,” the source said.

But a spokesperson for the Missouri Attorney General’s Office, one of the plaintiffs in the case, said in an email to CNBC when asked about the Biden official’s and the source’s comments: “We have evidence to the contrary, and we have filed this evidence under seal.”

“It remains sealed until the ministry agrees to unseal it,” the spokesperson said. “It is worth noting that the ministry has so far refused to agree to release this evidence.”

The program is the Biden administration’s third attempt to forgive student debt but has been blocked by Republican-led legal challenges.

In June 2023, the Supreme Court ruled that the administration’s first attempt to cancel up to $400 billion in student debt without prior congressional approval was unconstitutional.

Two months ago, a federal appeals court temporarily halted Biden’s new affordable student loan repayment plan, called SAVE. Several Republican-led states argued that the Department of Education with SAVE was essentially trying to find a roundabout way to forgive student debt after the Supreme Court ruling.

In a new lawsuit challenging the third relief program, filed in U.S. District Court in Augusta, Georgia, seven states argue that the Biden administration’s debt relief plan violates the U.S. Constitution’s separation of powers principle by seeking to forgive billions of dollars in debt without congressional approval.

In addition to Missouri, the states that filed lawsuits are Alabama, Arkansas, Florida, Georgia, North Dakota and Ohio.

On Thursday, when he issued temporary restraining order In an effort to block the new program from taking effect, U.S. District Court Judge Randal Hall wrote that the attorneys general “have obtained documents that reveal the Secretary is implementing this waiver scheme … without public disclosure and has planned to do so since May.”

Hall wrote that the states “showed a significant likelihood of success” in their lawsuit given the Secretary’s “attempt to implement a regulation that deviates from normal procedures.”

Hall has scheduled a hearing for next week on the case.

Mark Kantrowitz, a higher education expert, told CNBC that it’s normal for law enforcement agencies to take steps to prepare for a new regulation.

“The preparatory work does not violate the law,” Kantrowitz said. “Forgiveness cannot occur before the final regulation is issued,” he added.

Hall could still strike down the debt forgiveness plan as unconstitutional or for other reasons, even if he finds that the Biden administration did not violate the regulatory timeline.

But consumer and legal advocates are concerned about Hall’s quick acceptance of states’ complaints that the Biden administration improperly accelerated the plan.

“There is a growing license structure for conservative judges to just make things up without having to base them on sound principles or precedents,” he said. Luke HerrineAssociate Professor of Law at the University of Alabama.