Ben Bernanke among 3 Americans to win the Nobel Prize in Economics: NPR

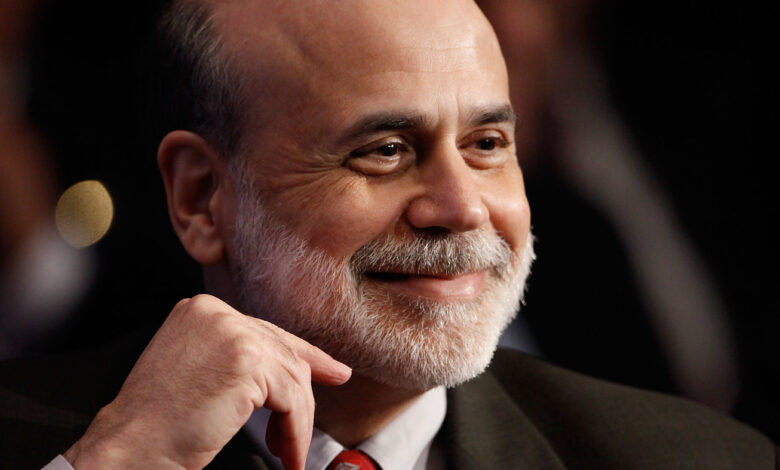

Former Federal Reserve Bank President Ben Bernanke.

Chip Somodevilla / Getty

hide captions

switch captions

Chip Somodevilla / Getty

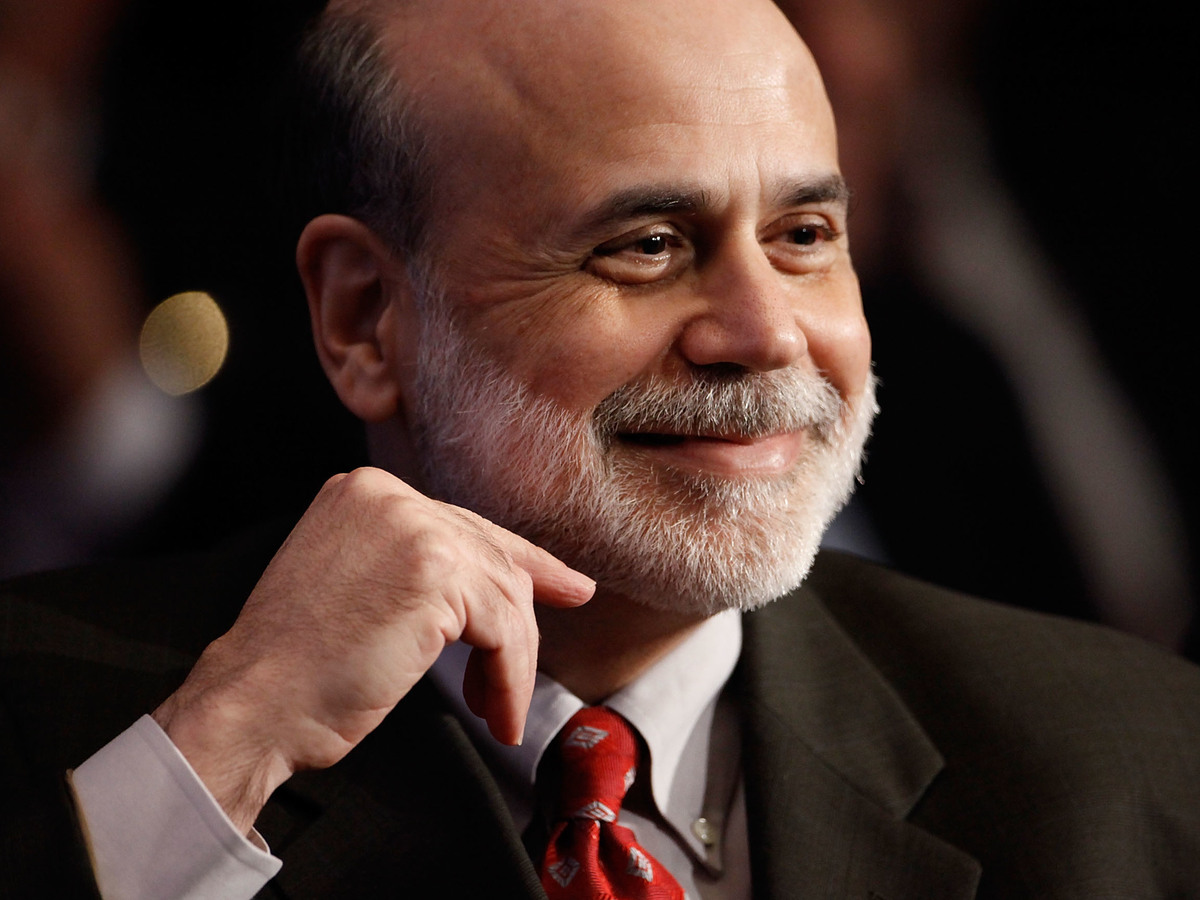

Former Federal Reserve Bank President Ben Bernanke.

Chip Somodevilla / Getty

Former Federal Reserve Chairman Ben Bernanke was awarded the Nobel Prize in Economics on Monday, along with economists Douglas Diamond and Philip Dybvig, for their research into banking practices and containment measures. they.

The three will split the prize money of 10 million Swedish kronor, or $886,000.

Bernanke, now at the Brookings Institution, is recognized for his work on the role banking failures played in deepening and prolonging the Great Depression of the 1930s. He has learned many lessons from the experience. That experience took on the role of Fed chair, a pioneer of the emergency lending programs the central bank used to tackle the 2008-9 financial crisis.

Diamond, now at the University of Chicago and Dybvig, at Washington University in St. Louis, co-authored an influential paper on the vital role banks play as financial intermediaries and how that role can be undermined by timing mismatches.

Banks help foster a more efficient economy by transferring excess cash from depositors to borrowers who need the money to build homes, factories and businesses.

Trouble can arise when depositors want to have their cash available in the short term, but the money is tied up in assets or long-term investments.

John Hassler of the Royal Swedish Academy of Sciences explained in the announcement of the award. “This can create failed banks.”

Governments can stifle banking by providing insurance for deposits, requiring banks to hold a minimum amount of cash, and by using the Federal Reserve as a guarantor. final loan.

Applying those lessons has helped to reduce the severity of recent bank runs.

“The ideas we recognize today have proven invaluable in modern times,” said Hassler, nodding to Bernanke’s role as Fed chair from 2006 to 2014. “Despite the crisis. The financial crisis has taken its toll, but neither the COVID pandemic has led to a recession like it did in the 30s.”

Speaking to reporters during the Nobel press conference, Diamond said that commercial banks are now better prepared to weather the financial downturn. However, he cautions that the timing mismatch between savers and borrowers will always imply a certain amount of risk that can emerge in less regulated corners of the financial system.

“I think we will probably always face unexpected, low-potential crises,” Diamond said. “The problem is that these vulnerabilities of fear of race and disorder and crisis can appear anywhere in the financial sector. It doesn’t have to be commercial banks.”